Irs Form 8508

What is the IRS Form 8508

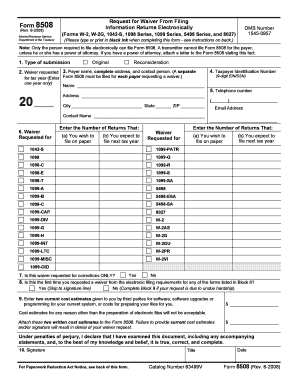

The IRS Form 8508 is a request for a waiver of the electronic filing requirement for certain tax forms. Specifically, it allows filers to apply for a waiver if they are unable to file electronically due to specific circumstances. This form is essential for taxpayers who may face challenges in meeting the electronic filing mandate imposed by the IRS.

How to use the IRS Form 8508

To use the IRS Form 8508, individuals must complete the form accurately, providing all necessary information regarding their situation. This includes details such as the type of tax forms for which the waiver is being requested and the reasons for the inability to file electronically. Once completed, the form must be submitted to the IRS for consideration.

Steps to complete the IRS Form 8508

Completing the IRS Form 8508 involves several key steps:

- Download the form from the IRS website or obtain a physical copy.

- Fill in the required information, including your name, address, and taxpayer identification number.

- Specify the tax forms for which you are requesting a waiver.

- Provide a detailed explanation of why you cannot file electronically.

- Review the form for accuracy and completeness.

- Submit the completed form to the IRS via the appropriate method.

Legal use of the IRS Form 8508

The legal use of the IRS Form 8508 is governed by IRS regulations. It is crucial that the information provided on the form is truthful and accurate, as any false statements could result in penalties. The form serves as a formal request for a waiver, and its acceptance is subject to IRS review.

Filing Deadlines / Important Dates

Filing deadlines for the IRS Form 8508 are critical to ensure timely processing. Generally, the form should be submitted before the due date of the tax forms for which the waiver is requested. It is advisable to check the IRS website for specific deadlines related to the current tax year.

Eligibility Criteria

Eligibility to file the IRS Form 8508 is typically based on specific circumstances that prevent electronic filing. Common reasons include lack of access to the necessary technology or software, or situations where electronic filing is not feasible due to personal or business constraints. Each request is evaluated on a case-by-case basis by the IRS.

Form Submission Methods

The IRS Form 8508 can be submitted through various methods. Taxpayers may choose to file the form electronically using IRS e-file systems or send it via traditional mail. It is essential to follow the submission guidelines provided by the IRS to ensure proper processing of the waiver request.

Quick guide on how to complete irs form 8508

Easily Prepare Irs Form 8508 on Any Device

Managing documents online has gained popularity among businesses and individuals alike. It serves as an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow provides all the tools necessary for you to create, edit, and eSign your documents swiftly and without delays. Handle Irs Form 8508 on any device with the airSlate SignNow Android or iOS applications and enhance any document-related process today.

The Easiest Way to Edit and eSign Irs Form 8508 Effortlessly

- Find Irs Form 8508 and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of the documents or redact sensitive information using the tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Select how you want to send your form, whether by email, SMS, invitation link, or download it to your PC.

Say goodbye to lost or misplaced files, tedious form searching, or errors that require new document copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you prefer. Edit and eSign Irs Form 8508 and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the irs form 8508

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is IRS Form 8508 and why is it important?

IRS Form 8508 is used to request a waiver from the IRS for e-filing requirements for certain tax forms. It is important because it helps organizations manage their filing responsibilities effectively, ensuring compliance with IRS guidelines and avoiding penalties.

-

How can airSlate SignNow assist with completing IRS Form 8508?

airSlate SignNow provides a user-friendly platform that streamlines the process of completing IRS Form 8508. Users can easily fill out the form electronically, sign it, and submit it, ensuring quick and efficient compliance with IRS e-filing requirements.

-

What are the pricing options for using airSlate SignNow for IRS Form 8508?

airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes. Whether you need basic document signing or more advanced features for managing IRS Form 8508, there’s a plan that fits your budget and business needs.

-

Can airSlate SignNow integrate with other software for managing IRS Form 8508?

Yes, airSlate SignNow offers integrations with popular accounting and tax software. This makes it easier for users to manage IRS Form 8508 along with other financial documents, improving workflow efficiency and data accuracy.

-

Is airSlate SignNow secure for handling sensitive documents like IRS Form 8508?

Absolutely! airSlate SignNow employs state-of-the-art security measures to protect your documents, including IRS Form 8508. With features like encryption and secure cloud storage, you can have peace of mind knowing your information is safe.

-

What features does airSlate SignNow provide for managing IRS Form 8508?

airSlate SignNow includes features like customizable templates, electronic signatures, and automated reminders that simplify the management of IRS Form 8508. These tools help users keep track of their forms and ensure timely submissions.

-

Can I track the status of my IRS Form 8508 submissions with airSlate SignNow?

Yes, airSlate SignNow allows you to track the status of all document submissions including IRS Form 8508. This feature helps you stay updated on your filing progress, ensuring that you are informed every step of the way.

Get more for Irs Form 8508

Find out other Irs Form 8508

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document