Payroll Deduction Uniforms09 Colorado Caterers

What is the Payroll Deduction Uniforms09 Colorado Caterers

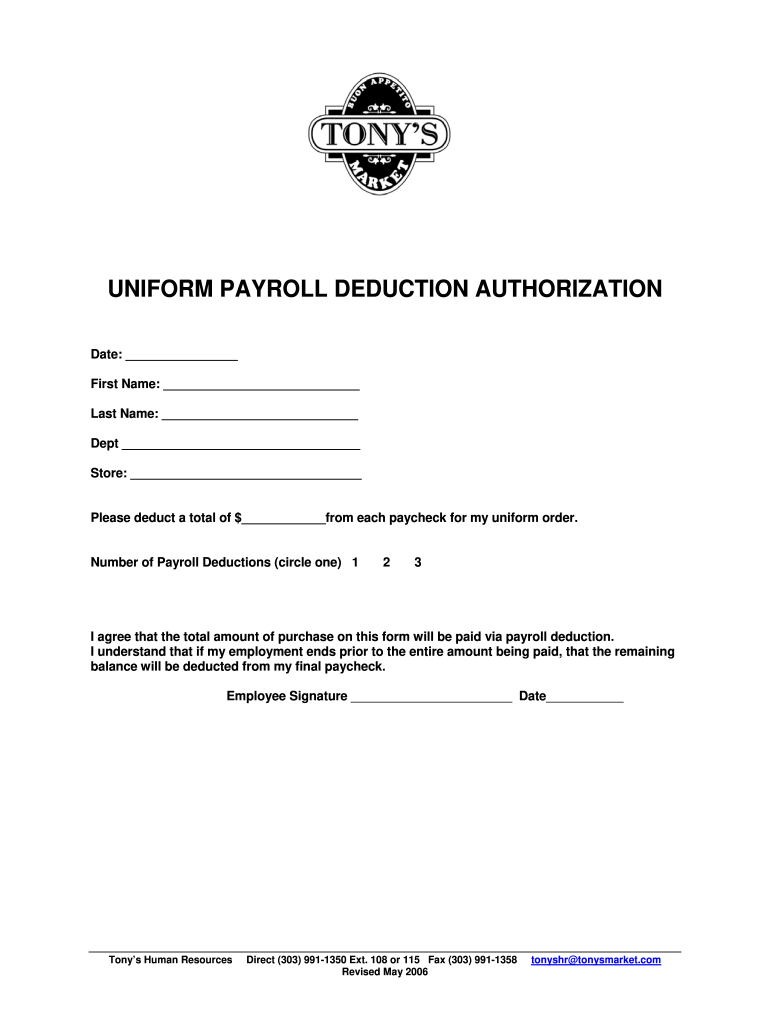

The Payroll Deduction Uniforms09 Colorado Caterers form is a specific document used by catering businesses in Colorado to manage payroll deductions for uniforms. This form allows employers to deduct the cost of uniforms from employees' paychecks, ensuring compliance with state regulations. It streamlines the process of tracking uniform expenses while maintaining accurate payroll records. Understanding this form is essential for both employers and employees to ensure clarity regarding uniform costs and deductions.

How to use the Payroll Deduction Uniforms09 Colorado Caterers

Using the Payroll Deduction Uniforms09 Colorado Caterers form involves a straightforward process. Employers must first complete the form, detailing the uniform costs and the deduction amounts. Employees should review the form to ensure they understand the deductions being made from their pay. Once both parties agree, the form must be signed electronically or in print, depending on the preferred method of record-keeping. This ensures that all deductions are documented and legally binding.

Steps to complete the Payroll Deduction Uniforms09 Colorado Caterers

Completing the Payroll Deduction Uniforms09 Colorado Caterers form requires several key steps:

- Gather necessary information, including employee details and uniform costs.

- Fill out the form accurately, specifying the amount to be deducted from each paycheck.

- Review the completed form with the employee to ensure understanding and agreement.

- Obtain signatures from both the employer and the employee.

- Store the signed form securely for payroll processing and future reference.

Legal use of the Payroll Deduction Uniforms09 Colorado Caterers

The legal use of the Payroll Deduction Uniforms09 Colorado Caterers form is governed by state and federal laws. It is crucial that employers comply with the Fair Labor Standards Act (FLSA) and Colorado labor laws when implementing payroll deductions. The form must clearly outline the terms of the deduction, ensuring that employees are fully informed. Proper execution of the form protects both the employer and the employee from potential disputes regarding uniform costs.

Key elements of the Payroll Deduction Uniforms09 Colorado Caterers

Several key elements must be included in the Payroll Deduction Uniforms09 Colorado Caterers form to ensure its effectiveness:

- Employee name and identification number.

- Details of the uniforms being purchased.

- Amount to be deducted from each paycheck.

- Signature lines for both the employer and employee.

- Date of the agreement.

State-specific rules for the Payroll Deduction Uniforms09 Colorado Caterers

In Colorado, specific rules govern payroll deductions for uniforms. Employers must ensure that deductions do not reduce an employee's pay below the minimum wage. Additionally, employees must provide written consent for any deductions. It is important for employers to stay informed about state labor laws to avoid potential legal issues related to payroll deductions.

Quick guide on how to complete payroll deduction uniforms09 colorado caterers

Complete Payroll Deduction Uniforms09 Colorado Caterers seamlessly on any device

Web-based document management has become increasingly popular among businesses and individuals. It offers an excellent environmentally friendly substitute for traditional printed and signed documents, as you can easily locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools needed to generate, modify, and electronically sign your documents swiftly without any hold-ups. Handle Payroll Deduction Uniforms09 Colorado Caterers on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and electronically sign Payroll Deduction Uniforms09 Colorado Caterers effortlessly

- Obtain Payroll Deduction Uniforms09 Colorado Caterers and click on Get Form to initiate.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or conceal sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Choose how you prefer to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form hunting, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Alter and eSign Payroll Deduction Uniforms09 Colorado Caterers and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the payroll deduction uniforms09 colorado caterers

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are Payroll Deduction Uniforms09 Colorado Caterers?

Payroll Deduction Uniforms09 Colorado Caterers refers to a system that allows employees to purchase uniforms through automatic payroll deductions. This convenient option helps employees manage uniform costs while ensuring they are always dressed professionally. By using this method, businesses can enhance their brand image and foster a sense of unity among staff.

-

How can Payroll Deduction Uniforms09 Colorado Caterers benefit my catering business?

Implementing Payroll Deduction Uniforms09 Colorado Caterers can streamline your uniform acquisition process by allowing employees to pay through payroll deductions. This minimizes upfront costs for employees and ensures you maintain a consistent and professional appearance for your catering team. Ultimately, this approach can enhance employee satisfaction and brand representation.

-

What are the costs associated with Payroll Deduction Uniforms09 Colorado Caterers?

Costs for Payroll Deduction Uniforms09 Colorado Caterers can vary based on the uniform supplier and specific needs of your business. Typically, there are initial costs for the uniforms, which may be recouped through payroll deductions over time. It's crucial to evaluate different suppliers to find a cost-effective solution that meets your catering business's needs.

-

Are there any minimum order requirements for Payroll Deduction Uniforms09 Colorado Caterers?

Many suppliers of Payroll Deduction Uniforms09 Colorado Caterers may have minimum order requirements; it's best to check with individual vendors. Minimums ensure suppliers can maintain efficiency in processing and fulfilling orders. However, some suppliers may offer flexibility for smaller teams, so it's worth exploring various options.

-

Can I customize the uniforms in the Payroll Deduction Uniforms09 Colorado Caterers program?

Yes, most programs for Payroll Deduction Uniforms09 Colorado Caterers offer customization options. You could choose color schemes, styles, and even add your company logo to promote your brand. Custom uniforms can create a more professional image and foster team spirit among your catering staff.

-

Is there any financing option available for Payroll Deduction Uniforms09 Colorado Caterers?

Payroll Deduction Uniforms09 Colorado Caterers typically don't require upfront payment from employees since costs are deducted from their paychecks. This makes it a financing solution in itself, as employees can gradually pay for their uniforms without financial strain. For employers, this system can enhance cash flow management by spreading out uniform-related expenses.

-

How do I implement Payroll Deduction Uniforms09 Colorado Caterers in my business?

To implement Payroll Deduction Uniforms09 Colorado Caterers in your business, start by selecting a uniform supplier that offers this service. Next, communicate the program details to your employees, including sizing and payment deduction options. Finally, establish a system to track deductions and uniform distribution to ensure a smooth process.

Get more for Payroll Deduction Uniforms09 Colorado Caterers

- Download expungement forms

- Nemisa certificate download form

- Boncap specialist referral form

- Mathematics form 2 exercise with answers pdf

- Transnet database online registration form

- Form arel the pennsylvania association of realtors

- Sseb screening form

- Property tax homestead exemptions georgia department of revenue form

Find out other Payroll Deduction Uniforms09 Colorado Caterers

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast

- How To Sign Georgia Car Dealer Lease Agreement Form

- How To Sign Iowa Car Dealer Resignation Letter

- Sign Iowa Car Dealer Contract Safe

- Sign Iowa Car Dealer Limited Power Of Attorney Computer

- Help Me With Sign Iowa Car Dealer Limited Power Of Attorney

- Sign Kansas Car Dealer Contract Fast

- Sign Kansas Car Dealer Agreement Secure

- Sign Louisiana Car Dealer Resignation Letter Mobile

- Help Me With Sign Kansas Car Dealer POA

- How Do I Sign Massachusetts Car Dealer Warranty Deed

- How To Sign Nebraska Car Dealer Resignation Letter

- How Can I Sign New Jersey Car Dealer Arbitration Agreement

- How Can I Sign Ohio Car Dealer Cease And Desist Letter

- How To Sign Ohio Car Dealer Arbitration Agreement

- How To Sign Oregon Car Dealer Limited Power Of Attorney