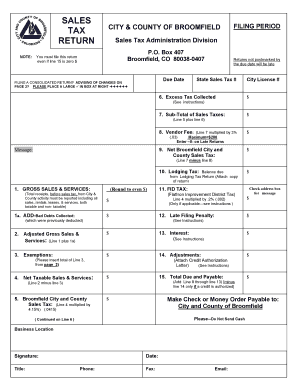

Sales Tax for Broomfield Co Form

What is the Sales Tax for Broomfield, CO?

The sales tax for Broomfield, Colorado, is a tax imposed on the sale of goods and services within the city. This tax is collected by the city government and is used to fund various public services and infrastructure projects. The current sales tax rate in Broomfield includes both state and local components, making it essential for businesses and consumers to understand the total rate applicable to their transactions. The sales tax is calculated as a percentage of the sale price and is typically added at the point of sale.

How to Use the Sales Tax for Broomfield, CO

Using the sales tax for Broomfield involves understanding how it applies to your purchases or sales. For consumers, this means being aware of the total cost of items, including sales tax, when making a purchase. For businesses, it requires accurate calculation and collection of sales tax from customers. Businesses must ensure they are registered with the state and local authorities to collect sales tax legally. Additionally, they should maintain accurate records of sales and taxes collected to comply with reporting requirements.

Steps to Complete the Sales Tax for Broomfield, CO

Completing the sales tax for Broomfield involves several key steps:

- Determine the applicable sales tax rate based on the type of goods or services sold.

- Calculate the sales tax by multiplying the sale price by the sales tax rate.

- Collect the sales tax from the customer at the point of sale.

- Maintain accurate records of all sales and taxes collected.

- File sales tax returns with the appropriate authorities, typically on a monthly or quarterly basis.

Legal Use of the Sales Tax for Broomfield, CO

The legal use of the sales tax in Broomfield is governed by state and local laws. Businesses must be registered to collect sales tax and must comply with all reporting and remittance requirements. Failure to collect or remit sales tax can result in penalties and interest. It is important for businesses to stay informed about any changes in tax laws or rates that may affect their obligations.

Filing Deadlines / Important Dates

Filing deadlines for sales tax in Broomfield vary depending on the frequency of reporting. Businesses are typically required to file returns monthly, quarterly, or annually. Important dates include:

- Monthly filers must submit their returns by the 20th of the following month.

- Quarterly filers are due on the 20th of the month following the end of the quarter.

- Annual filers must submit their returns by January 20th of the following year.

Required Documents

To complete the sales tax process in Broomfield, certain documents are necessary. These include:

- Sales tax registration certificate.

- Records of sales transactions, including receipts and invoices.

- Completed sales tax return forms.

Quick guide on how to complete sales tax for broomfield co

Effortlessly Prepare Sales Tax For Broomfield Co on Any Device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the right form and store it securely online. airSlate SignNow provides you with all the necessary tools to create, edit, and eSign your documents quickly without delays. Manage Sales Tax For Broomfield Co on any platform using the airSlate SignNow apps for Android or iOS, and enhance any document-centric process today.

How to Edit and eSign Sales Tax For Broomfield Co with Ease

- Locate Sales Tax For Broomfield Co and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight pertinent sections of the documents or blackout confidential information with tools specifically offered by airSlate SignNow for that purpose.

- Create your eSignature using the Sign feature, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select your preferred method for sending your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns over lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign Sales Tax For Broomfield Co and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sales tax for broomfield co

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the broomfield sales tax login and how does it work?

The broomfield sales tax login is an online portal that allows businesses in Broomfield to manage their sales tax obligations. By logging in, users can file sales tax returns, check their account status, and make payments easily. This streamlined process helps businesses stay compliant with local tax regulations.

-

How can airSlate SignNow assist with the broomfield sales tax login?

airSlate SignNow offers a simple and efficient way to prepare and eSign sales tax documents required for the broomfield sales tax login. Our platform allows businesses to securely sign important tax documents online, ensuring timely submissions and adherence to local laws. This helps save valuable time and resources for your business.

-

Is there a cost associated with the broomfield sales tax login?

The broomfield sales tax login itself is free to access, but businesses may incur fees for tax filings or payment processing. Utilizing airSlate SignNow can simplify the preparation of necessary documents, making it a cost-effective solution compared to traditional methods. Our platform's pricing is transparent, allowing you to understand costs related to eSigning and document management.

-

What features does airSlate SignNow provide for the broomfield sales tax login?

AirSlate SignNow provides features such as document templates, secure storage, and eSignature capabilities specifically for the broomfield sales tax login. These features help ensure your tax-related documents are efficiently managed and securely signed. With our intuitive interface, you can navigate and manage all your essential documentation with ease.

-

How does airSlate SignNow ensure the security of documents related to the broomfield sales tax login?

Security is a top priority at airSlate SignNow when it comes to the broomfield sales tax login. Our platform employs advanced encryption and secure access to handle sensitive tax documents, ensuring that your information remains private and protected. Regular audits and compliance with industry standards further enhance our security measures.

-

Can airSlate SignNow integrate with other accounting software when using the broomfield sales tax login?

Yes, airSlate SignNow is designed to integrate seamlessly with various accounting software, making the broomfield sales tax login process even more efficient. These integrations help automate data transfer and minimize manual entry errors. This leads to a more streamlined workflow for managing sales tax and other financial transactions.

-

What benefits can businesses expect from using airSlate SignNow for their broomfield sales tax login?

Using airSlate SignNow for the broomfield sales tax login offers numerous benefits, including time savings, improved accuracy, and enhanced compliance. Our platform allows users to eSign and manage documents faster than traditional methods, reducing potential delays in filing. Additionally, our user-friendly interface makes it easy for teams to collaborate on tax-related tasks.

Get more for Sales Tax For Broomfield Co

Find out other Sales Tax For Broomfield Co

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease

- Electronic signature Nebraska Healthcare / Medical RFP Secure

- Electronic signature Nevada Healthcare / Medical Emergency Contact Form Later

- Electronic signature New Hampshire Healthcare / Medical Credit Memo Easy

- Electronic signature New Hampshire Healthcare / Medical Lease Agreement Form Free

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure

- Help Me With Electronic signature Ohio Healthcare / Medical Moving Checklist

- Electronic signature Education PPT Ohio Secure

- Electronic signature Tennessee Healthcare / Medical NDA Now

- Electronic signature Tennessee Healthcare / Medical Lease Termination Letter Online

- Electronic signature Oklahoma Education LLC Operating Agreement Fast

- How To Electronic signature Virginia Healthcare / Medical Contract

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile