IL 1023 CES Tax Illinois Form

What is the IL 1023 CES Tax Illinois

The IL 1023 CES Tax Illinois form is a crucial document for businesses and organizations applying for an exemption from certain taxes in the state of Illinois. This form is specifically designed for entities seeking to establish their eligibility for a Charitable Exemption Status. By completing this form, organizations can demonstrate their commitment to charitable activities and potentially reduce their tax liabilities. The IL 1023 CES is essential for non-profit organizations, educational institutions, and other qualifying entities that operate for charitable purposes.

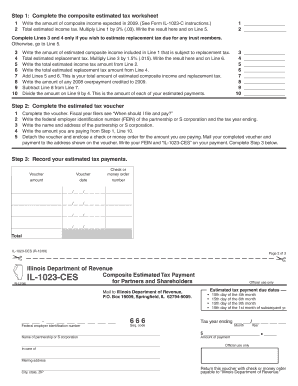

Steps to complete the IL 1023 CES Tax Illinois

Completing the IL 1023 CES Tax Illinois form involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation that supports your organization's charitable status, including financial statements and proof of activities. Next, fill out the form with precise information regarding your organization’s mission, activities, and financial details. It is important to review the form thoroughly to avoid errors. Once completed, submit the form along with any required attachments to the Illinois Department of Revenue. Ensure you keep copies of all submitted documents for your records.

Legal use of the IL 1023 CES Tax Illinois

The legal use of the IL 1023 CES Tax Illinois form is governed by state laws that outline the eligibility criteria for tax exemptions. Organizations must comply with the stipulations set forth by the Illinois Department of Revenue to maintain their exempt status. This includes adhering to regulations regarding the use of funds, reporting requirements, and operational guidelines. Failure to comply with these legal requirements can result in the revocation of tax-exempt status, making it essential for organizations to understand their obligations under Illinois law.

Filing Deadlines / Important Dates

Filing deadlines for the IL 1023 CES Tax Illinois form are critical for organizations seeking timely approval of their tax-exempt status. Generally, the form should be submitted within a specific timeframe following the establishment of the organization or the commencement of operations. It is advisable to check the Illinois Department of Revenue's official guidelines for the most current deadlines and any updates that may affect the filing process. Missing deadlines can lead to delays in receiving tax-exempt status and may incur additional penalties.

Required Documents

When submitting the IL 1023 CES Tax Illinois form, organizations must include a set of required documents that substantiate their eligibility for tax exemption. These typically include articles of incorporation, bylaws, financial statements, and a detailed description of the organization's activities. Additional documentation may be necessary depending on the specific nature of the organization and its operations. Ensuring that all required documents are complete and accurate is vital for a smooth review process by the Illinois Department of Revenue.

Examples of using the IL 1023 CES Tax Illinois

Organizations can utilize the IL 1023 CES Tax Illinois form in various scenarios to secure tax exemptions. For instance, a non-profit organization focused on community service can apply for an exemption to reduce its operational costs. Similarly, educational institutions may use this form to exempt themselves from certain taxes, allowing them to allocate more resources toward educational programs. By successfully obtaining tax-exempt status, these organizations can enhance their financial sustainability and better serve their communities.

Quick guide on how to complete il 1023 ces tax illinois

Complete IL 1023 CES Tax Illinois seamlessly on any device

Digital document management has become increasingly favored by companies and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely retain it online. airSlate SignNow equips you with all the resources necessary to generate, modify, and eSign your documents rapidly without delays. Manage IL 1023 CES Tax Illinois on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and eSign IL 1023 CES Tax Illinois effortlessly

- Locate IL 1023 CES Tax Illinois and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or redacted sensitive information using tools that airSlate SignNow provides specifically for those tasks.

- Create your eSignature with the Sign function, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose your preferred method to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Edit and eSign IL 1023 CES Tax Illinois while ensuring outstanding communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the il 1023 ces tax illinois

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the IL 1023 CES Tax Illinois?

The IL 1023 CES Tax Illinois is a tax form used by businesses to claim an exemption from certain state sales and use taxes. It allows companies to operate efficiently while benefiting from tax advantages specified by the state. Understanding this form is crucial for any business in Illinois looking to streamline their tax processes.

-

How can airSlate SignNow help with IL 1023 CES Tax Illinois documentation?

airSlate SignNow simplifies the process of preparing and signing the IL 1023 CES Tax Illinois form. Our platform enables users to easily create, edit, and electronically sign tax documents without the need for paper or manual processing. This enhances productivity and ensures compliance with state requirements.

-

What are the pricing options for airSlate SignNow when dealing with IL 1023 CES Tax Illinois?

We offer competitive pricing plans tailored to meet the needs of businesses handling the IL 1023 CES Tax Illinois and other documents. Our subscription plans provide unlimited access to features that assist in managing tax forms seamlessly. Review our website for the latest pricing details and choose a plan that fits your business requirements.

-

What features does airSlate SignNow provide for IL 1023 CES Tax Illinois users?

Our platform includes features such as document templates, real-time collaboration, and secure eSigning capabilities specifically designed for IL 1023 CES Tax Illinois and similar forms. Users can customize their documents, track approval processes, and ensure all necessary compliance measures are met. This streamlines operations, making tax filing easier than ever.

-

Are there integration options with airSlate SignNow for managing IL 1023 CES Tax Illinois?

Yes, airSlate SignNow offers various integration options that allow you to connect with other tools and software you may already be using. This flexibility ensures that managing your IL 1023 CES Tax Illinois documentation is more efficient. Popular integrations include CRM systems, cloud storage, and other business applications.

-

What are the benefits of using airSlate SignNow for IL 1023 CES Tax Illinois?

Using airSlate SignNow streamlines your workflow for IL 1023 CES Tax Illinois, resulting in faster processing times and reduced paperwork. With our secure eSigning and digital document management features, businesses can enhance their compliance and productivity. The user-friendly interface also ensures that anyone can navigate the platform with ease.

-

How secure is airSlate SignNow for handling IL 1023 CES Tax Illinois documents?

Security is a top priority at airSlate SignNow, especially when managing sensitive documents like IL 1023 CES Tax Illinois. We employ advanced encryption protocols and follow best practices to protect your information. Users can trust that their tax documents are safe and secure on our platform.

Get more for IL 1023 CES Tax Illinois

Find out other IL 1023 CES Tax Illinois

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer

- eSign North Dakota Lawers Separation Agreement Online

- How To eSign North Dakota Lawers Separation Agreement

- eSign Kansas Insurance Moving Checklist Free

- eSign Louisiana Insurance Promissory Note Template Simple

- eSign Texas Lawers Contract Fast

- eSign Texas Lawers Lease Agreement Free

- eSign Maine Insurance Rental Application Free

- How Can I eSign Maryland Insurance IOU