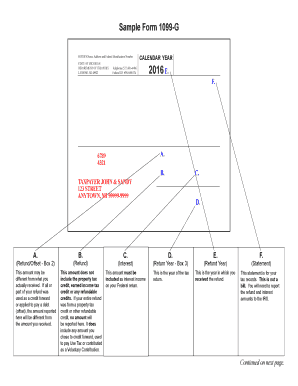

Michigan Unemployment 1099 G State ID Number Form

What is the Michigan Unemployment 1099 G State Id Number

The Michigan Unemployment 1099 G State Id Number is a unique identifier assigned to individuals who receive unemployment benefits in Michigan. This number is essential for accurately reporting unemployment income to the Internal Revenue Service (IRS) during tax filing. The 1099 G tax form details the total amount of unemployment compensation received, which can impact an individual’s tax obligations. Understanding this identifier helps ensure that recipients report their income correctly and comply with federal tax regulations.

How to obtain the Michigan Unemployment 1099 G State Id Number

To obtain the Michigan Unemployment 1099 G State Id Number, individuals can access their unemployment account through the Michigan Unemployment Insurance Agency (UIA) website. After logging in, recipients can navigate to the tax documents section where the 1099 G form is available for download. If an individual does not have online access, they may contact the UIA directly for assistance in obtaining their State Id Number. It is important to keep this number secure, as it is used for tax reporting purposes.

Steps to complete the Michigan Unemployment 1099 G State Id Number

Completing the Michigan Unemployment 1099 G State Id Number involves several key steps:

- Access your unemployment account on the Michigan UIA website.

- Locate the 1099 G tax form under the tax documents section.

- Review the information provided, ensuring that your personal details and unemployment compensation amounts are accurate.

- Use the State Id Number as needed when filing your taxes.

Following these steps ensures that you accurately report your unemployment income and comply with IRS requirements.

Legal use of the Michigan Unemployment 1099 G State Id Number

The Michigan Unemployment 1099 G State Id Number is legally required for individuals receiving unemployment benefits to report their income accurately. This number must be included on tax returns to ensure compliance with IRS regulations. Failure to report this income can lead to penalties or audits. Therefore, it is crucial for recipients to understand the legal implications of using their State Id Number when filing taxes.

IRS Guidelines

According to IRS guidelines, the 1099 G tax form must be used by individuals who receive unemployment benefits. The IRS requires that all unemployment compensation be reported as income, which can affect tax liabilities. Recipients should retain their 1099 G forms for at least three years, as the IRS may request documentation during audits. It is advisable to consult the IRS website or a tax professional for specific guidance related to unemployment income reporting.

Filing Deadlines / Important Dates

Filing deadlines for the Michigan Unemployment 1099 G State Id Number typically align with federal tax deadlines. Generally, individuals must file their tax returns by April fifteenth of each year. However, it is essential to check for any updates or changes in deadlines, especially if they fall on a weekend or holiday. Recipients should also be aware of the date by which the 1099 G forms are issued, usually by January thirty-first, to ensure timely filing of their tax returns.

Quick guide on how to complete michigan unemployment 1099 g state id number

Complete Michigan Unemployment 1099 G State Id Number effortlessly on any device

Online document management has gained signNow traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely preserve it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents quickly and without delays. Manage Michigan Unemployment 1099 G State Id Number on any platform using airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

How to alter and eSign Michigan Unemployment 1099 G State Id Number with ease

- Find Michigan Unemployment 1099 G State Id Number and click on Get Form to begin.

- Employ the tools we offer to complete your document.

- Highlight important parts of the documents or redact sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Alter and eSign Michigan Unemployment 1099 G State Id Number and guarantee excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the michigan unemployment 1099 g state id number

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ides 1099 g, and how does it relate to airSlate SignNow?

The ides 1099 g is a tax form used by state governments to report certain government payments. With airSlate SignNow, you can easily send and eSign your ides 1099 g forms to ensure accurate and timely filing. Our platform simplifies the process, making it convenient for businesses to manage their tax documentation.

-

How can I use airSlate SignNow to manage my ides 1099 g forms?

You can upload your ides 1099 g forms to airSlate SignNow, where you can securely eSign and share them with relevant parties. The platform allows you to track the signing status, ensuring that your documents are efficiently processed. This way, you can keep your compliance stress-free.

-

Does airSlate SignNow offer any integrations for handling ides 1099 g documents?

Yes, airSlate SignNow integrates with various accounting software that enables seamless management of ides 1099 g documents. By connecting with tools like QuickBooks or Xero, you can automate your document workflow and reduce manual entry errors. This integration simplifies keeping your financial records up to date.

-

What pricing options are available for airSlate SignNow concerning ides 1099 g needs?

AirSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. Whether you're a freelancer dealing with a few ides 1099 g forms or a large organization managing multiple accounts, there's a plan that suits your needs. Check our website for detailed pricing information tailored to your document management needs.

-

How secure is airSlate SignNow for managing sensitive ides 1099 g documents?

Security is a priority at airSlate SignNow, especially for sensitive documents like the ides 1099 g forms. Our platform employs bank-level encryption and complies with industry regulations to protect your data. You can trust that your information remains confidential and secure throughout the signing process.

-

What are the benefits of using airSlate SignNow for ides 1099 g forms?

Using airSlate SignNow for your ides 1099 g forms streamlines the signing process, reduces paper usage, and enhances compliance. The ease of sending and receiving electronic signatures helps you save time and effort, allowing you to focus on your core activities. Plus, it provides a reliable audit trail for all your signed documents.

-

Can multiple people eSign an ides 1099 g document using airSlate SignNow?

Absolutely! AirSlate SignNow allows multiple signers to eSign your ides 1099 g documents. You can set the signing order and define who needs to sign, ensuring everyone involved can contribute seamlessly. This feature enhances collaboration and accelerates the completion of your forms.

Get more for Michigan Unemployment 1099 G State Id Number

Find out other Michigan Unemployment 1099 G State Id Number

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement