SPT Tahunan PPh Orang Pribadi 1770 S Direktorat Form

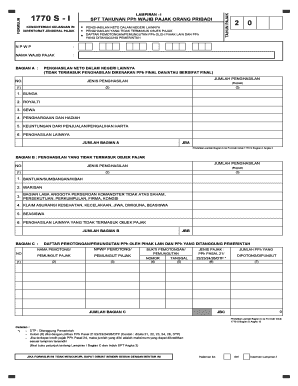

What is the SPT Tahunan PPh Orang Pribadi 1770 S?

The SPT Tahunan PPh Orang Pribadi 1770 S is an annual tax return form for individual taxpayers in Indonesia. This form is specifically designed for those who have income from various sources, including employment, business, and investments. It is essential for reporting income and calculating the annual tax obligation. Understanding the purpose and requirements of this form is crucial for compliance with tax regulations.

Steps to Complete the SPT Tahunan PPh Orang Pribadi 1770 S

Completing the SPT Tahunan PPh Orang Pribadi 1770 S involves several key steps. First, gather all necessary documents, such as income statements, tax receipts, and any applicable deductions. Next, fill out the form accurately, ensuring that all income sources are reported. It is important to double-check the calculations to avoid errors. Once completed, the form can be submitted either online or via mail, depending on the preferences of the taxpayer.

Required Documents for the SPT Tahunan PPh Orang Pribadi 1770 S

To successfully complete the SPT Tahunan PPh Orang Pribadi 1770 S, specific documents are required. These typically include:

- Income statements from employers or business activities.

- Receipts for deductible expenses.

- Previous year’s tax return for reference.

- Any other financial documents that support income claims.

Having these documents readily available will facilitate a smoother filing process.

Legal Use of the SPT Tahunan PPh Orang Pribadi 1770 S

The SPT Tahunan PPh Orang Pribadi 1770 S is legally binding and must be filed annually to comply with tax laws. Failing to submit this form can result in penalties, including fines or additional taxes owed. It is important to understand the legal implications of this form and ensure that it is completed accurately and submitted on time to avoid complications with tax authorities.

Form Submission Methods for the SPT Tahunan PPh Orang Pribadi 1770 S

Taxpayers have several options for submitting the SPT Tahunan PPh Orang Pribadi 1770 S. The form can be filed online through the official tax authority's website, which is often the most efficient method. Alternatively, it can be submitted via mail or in person at designated tax offices. Each method has its own requirements and processing times, so it is advisable to choose the one that best suits individual circumstances.

Filing Deadlines for the SPT Tahunan PPh Orang Pribadi 1770 S

Timely filing of the SPT Tahunan PPh Orang Pribadi 1770 S is crucial to avoid penalties. The deadline for submission typically falls on March 31 of the following year after the income year. It is important for taxpayers to be aware of this deadline and plan accordingly to ensure compliance with tax regulations.

Quick guide on how to complete spt tahunan pph orang pribadi 1770 s direktorat

Complete SPT Tahunan PPh Orang Pribadi 1770 S Direktorat effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed papers, allowing you to locate the right form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents quickly without delays. Handle SPT Tahunan PPh Orang Pribadi 1770 S Direktorat on any platform with airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest way to edit and eSign SPT Tahunan PPh Orang Pribadi 1770 S Direktorat without hassle

- Obtain SPT Tahunan PPh Orang Pribadi 1770 S Direktorat and click Get Form to initiate the process.

- Utilize the tools we provide to complete your document.

- Highlight important sections of your documents or redact sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to preserve your modifications.

- Select how you wish to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious document searches, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Edit and eSign SPT Tahunan PPh Orang Pribadi 1770 S Direktorat and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the spt tahunan pph orang pribadi 1770 s direktorat

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 'formulir spt tahunan orang pribadi pdf' and why is it important?

The 'formulir spt tahunan orang pribadi pdf' is an annual tax return form for individuals in Indonesia. It is important as it is required by the Directorate General of Taxes for reporting income and calculating tax obligations. Submitting this form correctly ensures compliance and avoids penalties.

-

How can airSlate SignNow help with the 'formulir spt tahunan orang pribadi pdf'?

airSlate SignNow offers an efficient way to prepare, send, and eSign your 'formulir spt tahunan orang pribadi pdf'. With our user-friendly interface, you can easily fill out the form, collect signatures, and securely store your documents, all in one place.

-

Is there a cost associated with using airSlate SignNow for 'formulir spt tahunan orang pribadi pdf'?

Yes, airSlate SignNow operates on a subscription-based model. We provide various pricing plans that cater to different business needs, ensuring you find a cost-effective solution for managing your 'formulir spt tahunan orang pribadi pdf' and other documents.

-

Can I integrate airSlate SignNow with other software to manage my 'formulir spt tahunan orang pribadi pdf'?

Absolutely! airSlate SignNow integrates seamlessly with a variety of popular software applications, helping streamline your workflow. This allows you to automatically manage your 'formulir spt tahunan orang pribadi pdf' alongside other essential tools you already use.

-

What features does airSlate SignNow provide for handling 'formulir spt tahunan orang pribadi pdf'?

Our platform includes features like templates, automated workflows, and real-time tracking, which simplify the management of your 'formulir spt tahunan orang pribadi pdf'. Additionally, you benefit from security measures that protect your sensitive information throughout the signing process.

-

How secure is the data when using airSlate SignNow for 'formulir spt tahunan orang pribadi pdf'?

airSlate SignNow prioritizes your security, employing industry-leading encryption and compliance protocols. This ensures that all data related to your 'formulir spt tahunan orang pribadi pdf' is kept safe and confidential in accordance with regulations.

-

Can I customize the 'formulir spt tahunan orang pribadi pdf' with airSlate SignNow?

Yes, you can easily customize your 'formulir spt tahunan orang pribadi pdf' using airSlate SignNow's editing tools. You can add fields, change layout, and incorporate branding elements to suit your organization’s needs.

Get more for SPT Tahunan PPh Orang Pribadi 1770 S Direktorat

- Shaft alignment report sheet form

- Compassionate appointment application form for andhra pradesh

- Sp 232 form

- Religious accommodation examples form

- Wyoming smiles senior dental program form

- Ready to pass form

- Ol 16 form

- Form l3 application to end a tenancy tribunals ontarioform l3 application to end a tenancy tribunals ontarioform l3 application

Find out other SPT Tahunan PPh Orang Pribadi 1770 S Direktorat

- Can I eSign Hawaii Education PDF

- How To eSign Hawaii Education Document

- Can I eSign Hawaii Education Document

- How Can I eSign South Carolina Doctors PPT

- How Can I eSign Kansas Education Word

- How To eSign Kansas Education Document

- How Do I eSign Maine Education PPT

- Can I eSign Maine Education PPT

- How To eSign Massachusetts Education PDF

- How To eSign Minnesota Education PDF

- Can I eSign New Jersey Education Form

- How Can I eSign Oregon Construction Word

- How Do I eSign Rhode Island Construction PPT

- How Do I eSign Idaho Finance & Tax Accounting Form

- Can I eSign Illinois Finance & Tax Accounting Presentation

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF