Form 2271, Concessionaire's Sales Tax Return and Payment Form 2271, Concessionaire's Sales Tax Return and Payment

What is the Form 2271, Concessionaire's Sales Tax Return And Payment

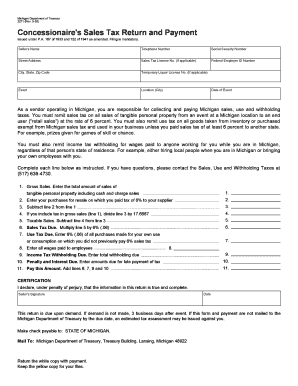

The Form 2271, known as the Concessionaire's Sales Tax Return and Payment, is a crucial document for businesses operating in the concession industry. This form is used to report sales tax collected from customers and to remit that tax to the appropriate state authority. It ensures compliance with state tax regulations and provides a clear record of sales activity. By accurately completing this form, concessionaires can avoid penalties and maintain good standing with tax authorities.

How to use the Form 2271, Concessionaire's Sales Tax Return And Payment

Using the Form 2271 involves several key steps. First, businesses must gather all necessary sales data for the reporting period. This includes total sales, tax collected, and any deductions or exemptions applicable. Next, the form must be filled out accurately, ensuring that all figures are correctly calculated. Once completed, the form can be submitted either electronically or via mail, depending on state requirements. It is essential to keep a copy of the submitted form for your records.

Steps to complete the Form 2271, Concessionaire's Sales Tax Return And Payment

Completing the Form 2271 involves a systematic approach:

- Gather all sales records for the reporting period.

- Calculate the total sales and the sales tax collected.

- Fill in the required fields on the form, including business information and financial figures.

- Review the form for accuracy and completeness.

- Submit the form according to your state’s guidelines.

Legal use of the Form 2271, Concessionaire's Sales Tax Return And Payment

The legal use of Form 2271 is essential for maintaining compliance with state tax laws. This form serves as a formal declaration of sales tax obligations and must be filed within specified deadlines. Failure to submit the form or inaccuracies can lead to fines or legal repercussions. Businesses should ensure they understand the legal implications of their submissions and keep records of all filed forms for potential audits.

Key elements of the Form 2271, Concessionaire's Sales Tax Return And Payment

Key elements of the Form 2271 include:

- Business identification details, such as name and address.

- Total sales amount for the reporting period.

- Sales tax collected from customers.

- Deductions or exemptions claimed.

- Payment amount due, if applicable.

Filing Deadlines / Important Dates

Filing deadlines for the Form 2271 vary by state and are typically set on a monthly or quarterly basis. It is crucial for concessionaires to be aware of these dates to avoid late fees and penalties. Keeping a calendar of important tax dates can help ensure timely submission of the form. Regularly checking with state tax authorities for any changes in deadlines is also advisable.

Quick guide on how to complete form 2271 concessionaires sales tax return and payment form 2271 concessionaires sales tax return and payment

Complete Form 2271, Concessionaire's Sales Tax Return And Payment Form 2271, Concessionaire's Sales Tax Return And Payment with ease on any device

Online document management has become increasingly popular among companies and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to obtain the correct format and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Manage Form 2271, Concessionaire's Sales Tax Return And Payment Form 2271, Concessionaire's Sales Tax Return And Payment on any device with airSlate SignNow's Android or iOS applications and enhance any document-related procedure today.

How to modify and electronically sign Form 2271, Concessionaire's Sales Tax Return And Payment Form 2271, Concessionaire's Sales Tax Return And Payment effortlessly

- Locate Form 2271, Concessionaire's Sales Tax Return And Payment Form 2271, Concessionaire's Sales Tax Return And Payment and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize signNow parts of the documents or redact sensitive information using the tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow manages all your document management needs in just a few clicks from any device you prefer. Edit and eSign Form 2271, Concessionaire's Sales Tax Return And Payment Form 2271, Concessionaire's Sales Tax Return And Payment and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 2271 concessionaires sales tax return and payment form 2271 concessionaires sales tax return and payment

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 2271, Concessionaire's Sales Tax Return And Payment?

The Form 2271, Concessionaire's Sales Tax Return And Payment is a crucial document for concessionaires in reporting and paying sales tax. It simplifies the process of tax compliance, ensuring that all necessary information is captured accurately. Using airSlate SignNow, you can easily fill, sign, and submit the Form 2271, enhancing your efficiency in managing tax obligations.

-

How can airSlate SignNow assist with the Form 2271, Concessionaire's Sales Tax Return And Payment?

airSlate SignNow provides a user-friendly platform that allows businesses to create, send, and eSign the Form 2271, Concessionaire's Sales Tax Return And Payment seamlessly. The software's intuitive features enable quick completion of the form, integration with existing workflows, and secure submission. With airSlate SignNow, managing your concessionaire sales tax returns becomes straightforward and efficient.

-

What are the pricing options for using airSlate SignNow for the Form 2271?

airSlate SignNow offers competitive pricing plans that cater to a variety of business needs when handling the Form 2271, Concessionaire's Sales Tax Return And Payment. Pricing is structured to provide flexibility, ensuring that businesses of all sizes can find a suitable option. Visit our pricing page for detailed information and choose the plan that best fits your requirements.

-

Is airSlate SignNow compliant with regulations for the Form 2271?

Yes, airSlate SignNow is designed to comply with relevant regulations for submitting the Form 2271, Concessionaire's Sales Tax Return And Payment. Our platform adheres to industry standards for document security and eSignature legality, ensuring that your submissions are valid and accepted by tax authorities. You can trust airSlate SignNow to help you meet compliance requirements.

-

Can I integrate airSlate SignNow with other software for managing the Form 2271?

Absolutely! airSlate SignNow seamlessly integrates with various software systems, enabling you to manage the Form 2271, Concessionaire's Sales Tax Return And Payment alongside your existing tools. This integration enhances workflow efficiency, allowing for easy access and management of your documents. Take advantage of our integrations to streamline your tax processes.

-

What are the benefits of using airSlate SignNow for the Form 2271?

Using airSlate SignNow for the Form 2271, Concessionaire's Sales Tax Return And Payment offers numerous benefits, including time savings, improved accuracy, and enhanced security. The platform's intuitive design simplifies the process of completing and signing documents, while advanced security features protect your sensitive information. Experience a hassle-free tax return process with airSlate SignNow.

-

How can I ensure my Form 2271 is processed quickly with airSlate SignNow?

To ensure your Form 2271, Concessionaire's Sales Tax Return And Payment is processed quickly using airSlate SignNow, make sure all required fields are filled accurately and review the document before submission. The platform notifies you of any missing information, minimizing errors and delays. Leverage our real-time tracking features to monitor the status of your submissions.

Get more for Form 2271, Concessionaire's Sales Tax Return And Payment Form 2271, Concessionaire's Sales Tax Return And Payment

Find out other Form 2271, Concessionaire's Sales Tax Return And Payment Form 2271, Concessionaire's Sales Tax Return And Payment

- Sign Maryland Non-Profit Business Plan Template Fast

- How To Sign Nevada Life Sciences LLC Operating Agreement

- Sign Montana Non-Profit Warranty Deed Mobile

- Sign Nebraska Non-Profit Residential Lease Agreement Easy

- Sign Nevada Non-Profit LLC Operating Agreement Free

- Sign Non-Profit Document New Mexico Mobile

- Sign Alaska Orthodontists Business Plan Template Free

- Sign North Carolina Life Sciences Purchase Order Template Computer

- Sign Ohio Non-Profit LLC Operating Agreement Secure

- Can I Sign Ohio Non-Profit LLC Operating Agreement

- Sign South Dakota Non-Profit Business Plan Template Myself

- Sign Rhode Island Non-Profit Residential Lease Agreement Computer

- Sign South Carolina Non-Profit Promissory Note Template Mobile

- Sign South Carolina Non-Profit Lease Agreement Template Online

- Sign Oregon Life Sciences LLC Operating Agreement Online

- Sign Texas Non-Profit LLC Operating Agreement Online

- Can I Sign Colorado Orthodontists Month To Month Lease

- How Do I Sign Utah Non-Profit Warranty Deed

- Help Me With Sign Colorado Orthodontists Purchase Order Template

- Sign Virginia Non-Profit Living Will Fast