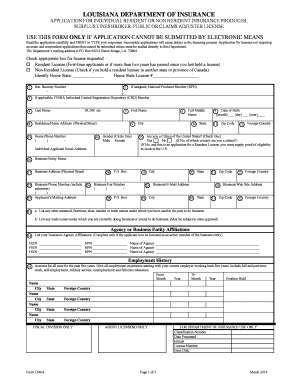

Form 1546a

What is the Form 1546a

The Form 1546a is an official document used primarily for tax purposes in the United States. It is often associated with specific applications or requests that require detailed information from the taxpayer. This form is crucial for individuals and businesses alike, as it facilitates various tax-related processes, ensuring compliance with IRS regulations. Understanding the purpose and requirements of Form 1546a is essential for accurate and timely submissions.

How to use the Form 1546a

Using the Form 1546a involves several straightforward steps. First, ensure you have the correct version of the form, which can typically be obtained from the IRS website or authorized sources. Next, fill out the form with accurate information, including personal details and any relevant financial data. After completing the form, review it carefully to avoid errors that could lead to delays or penalties. Finally, submit the form according to the specified guidelines, whether electronically or by mail.

Steps to complete the Form 1546a

Completing the Form 1546a requires attention to detail. Here are the essential steps:

- Gather necessary information, including your Social Security number, income details, and any applicable deductions.

- Download the Form 1546a from the IRS website or access it through authorized tax software.

- Fill in the required fields accurately, ensuring all information is current and correct.

- Double-check your entries for any mistakes or omissions that could affect your submission.

- Sign and date the form where indicated, ensuring you comply with any additional signature requirements.

- Submit the completed form via the preferred method, either electronically or by mailing it to the appropriate IRS address.

Legal use of the Form 1546a

The legal use of Form 1546a is governed by IRS regulations, which stipulate how and when the form should be utilized. It is essential to ensure that the form is filled out correctly and submitted within the designated timelines to maintain its validity. Failure to comply with these regulations can result in penalties or delays in processing. Utilizing a reliable eSignature solution can enhance the legal standing of your submission, ensuring that it meets all necessary requirements.

Filing Deadlines / Important Dates

Timely submission of the Form 1546a is crucial for compliance with IRS regulations. Specific deadlines may vary based on the type of request or application associated with the form. Generally, it is advisable to file the form as early as possible to avoid last-minute issues. Keeping track of important dates, such as the tax filing deadline, can help ensure that your Form 1546a is submitted on time, preventing potential penalties or complications.

Required Documents

When completing the Form 1546a, certain documents may be required to support your submission. These can include:

- Proof of income, such as W-2 forms or 1099 statements.

- Identification documents, including a driver's license or Social Security card.

- Any relevant financial statements that pertain to the information provided on the form.

Having these documents ready can streamline the completion process and ensure that your submission is thorough and accurate.

Quick guide on how to complete form 1546a

Effortlessly Prepare Form 1546a on Any Device

Managing documents online has become increasingly popular among companies and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the correct form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly without any delays. Handle Form 1546a on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to Modify and Electronically Sign Form 1546a with Ease

- Locate Form 1546a and select Get Form to begin.

- Utilize the tools available to fill out your document.

- Emphasize essential sections of the documents or obscure sensitive details using tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review all the details and click the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Form 1546a and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 1546a

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 1546a and how can airSlate SignNow help with it?

Form 1546a is a tax form that may require signatures for validation. airSlate SignNow simplifies the signing process by allowing users to eSign Form 1546a quickly and securely. With our platform, businesses can send, track, and manage electronic signatures to enhance efficiency.

-

Is there a cost associated with using airSlate SignNow for Form 1546a?

Yes, airSlate SignNow offers a variety of pricing plans to meet the needs of businesses looking to eSign Form 1546a. Our pricing is competitive and provides great value for the features included, such as unlimited document signing and templates. You can choose a plan that fits your budget and signing frequency.

-

What features does airSlate SignNow offer for managing Form 1546a?

airSlate SignNow provides several features designed specifically for managing Form 1546a. You can create templates, add tracking, and automate reminders for signatures. This ensures that Form 1546a is completed efficiently, reducing turnaround time and ensuring compliance.

-

Can I integrate airSlate SignNow with other software to manage Form 1546a?

Absolutely! airSlate SignNow offers seamless integrations with various applications, making it easier to manage Form 1546a alongside your existing tools. Integrate with CRMs, cloud storage, and other platforms to streamline your document workflow and improve productivity.

-

What benefits does airSlate SignNow offer for signing Form 1546a electronically?

Using airSlate SignNow to sign Form 1546a electronically has many benefits. It not only saves time by eliminating the need for printing and scanning, but also enhances security with encrypted signatures. This allows businesses to sign Form 1546a with confidence, knowing their data is protected.

-

Is airSlate SignNow compliant with legal requirements for Form 1546a?

Yes, airSlate SignNow complies with all legal regulations for electronic signatures, making it suitable for signing Form 1546a. Our platform adheres to the eSign Act and UETA regulations, ensuring that your electronic signatures on Form 1546a are legally recognized and valid.

-

How user-friendly is airSlate SignNow for newcomers signing Form 1546a?

airSlate SignNow is designed with user-friendliness in mind, making it easy for newcomers to sign Form 1546a. The intuitive interface guides users through the signing process without requiring technical skills. You'll be able to get started quickly and efficiently.

Get more for Form 1546a

Find out other Form 1546a

- eSign Texas Insurance Affidavit Of Heirship Myself

- Help Me With eSign Kentucky Legal Quitclaim Deed

- eSign Louisiana Legal Limited Power Of Attorney Online

- How Can I eSign Maine Legal NDA

- eSign Maryland Legal LLC Operating Agreement Safe

- Can I eSign Virginia Life Sciences Job Description Template

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP

- eSign Missouri Legal Living Will Computer

- eSign Connecticut Non-Profit Job Description Template Now

- eSign Montana Legal Bill Of Lading Free

- How Can I eSign Hawaii Non-Profit Cease And Desist Letter

- Can I eSign Florida Non-Profit Residential Lease Agreement

- eSign Idaho Non-Profit Business Plan Template Free