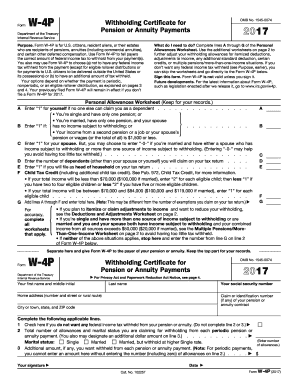

Form W 4P Withholding Certificate for Pension or Annuity Payments

What is the Form W-4P Withholding Certificate For Pension Or Annuity Payments

The Form W-4P is a tax form used in the United States for withholding tax from pension or annuity payments. This form allows recipients to specify the amount of federal income tax they want withheld from their payments. It is essential for individuals receiving pensions or annuities to manage their tax obligations effectively. By completing the W-4P, taxpayers can avoid under-withholding, which may lead to a tax bill at the end of the year.

Steps to Complete the Form W-4P Withholding Certificate For Pension Or Annuity Payments

Completing the Form W-4P involves several straightforward steps:

- Personal Information: Enter your name, address, and Social Security number at the top of the form.

- Filing Status: Indicate your filing status, such as single, married, or head of household.

- Withholding Amount: Specify the amount you want withheld from your pension or annuity payments. You can choose a specific dollar amount or use the IRS withholding tables to determine the appropriate amount.

- Additional Information: If applicable, provide any additional information that may affect your withholding, such as other income or deductions.

- Signature: Sign and date the form to validate your request.

Legal Use of the Form W-4P Withholding Certificate For Pension Or Annuity Payments

The Form W-4P is legally recognized for tax purposes in the United States. It must be completed accurately to ensure compliance with IRS regulations. When filled out correctly, the form serves as a legal document that dictates how much tax will be withheld from pension or annuity payments. It is important to keep a copy of the completed form for your records, as it may be needed for future reference or in case of an audit.

How to Obtain the Form W-4P Withholding Certificate For Pension Or Annuity Payments

The Form W-4P can be obtained through various channels:

- IRS Website: The form is available for download directly from the IRS website in PDF format.

- Financial Institutions: Many banks and financial institutions may provide the form upon request, especially if they manage your pension or annuity.

- Tax Professionals: Certified tax professionals can also provide the form and assist with its completion.

Key Elements of the Form W-4P Withholding Certificate For Pension Or Annuity Payments

Several key elements are essential when filling out the Form W-4P:

- Identification: Accurate personal identification is crucial for processing the form.

- Withholding Options: Understanding the different withholding options helps in making informed decisions about tax payments.

- Signature and Date: A valid signature and date confirm the authenticity of the form.

IRS Guidelines

The IRS provides specific guidelines for completing the Form W-4P. These guidelines outline the necessary information required, the process for submitting the form, and how to adjust withholding amounts as circumstances change. It is important to review these guidelines to ensure compliance and to understand how changes in income or tax laws may affect your withholding choices.

Quick guide on how to complete form w 4p withholding certificate for pension or annuity payments

Effortlessly Prepare Form W 4P Withholding Certificate For Pension Or Annuity Payments on Any Device

Managing documents online has gained signNow traction among businesses and individuals. It serves as an ideal environmentally-friendly alternative to conventional printed and signed documents, allowing you to access the appropriate form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, edit, and electronically sign your documents swiftly without delays. Handle Form W 4P Withholding Certificate For Pension Or Annuity Payments on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to Edit and Electronically Sign Form W 4P Withholding Certificate For Pension Or Annuity Payments with Ease

- Locate Form W 4P Withholding Certificate For Pension Or Annuity Payments and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight relevant portions of your documents or conceal sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal weight as a traditional handwritten signature.

- Review all the information and click on the Done button to save your changes.

- Choose your preferred method for sending your form, whether by email, SMS, invitation link, or downloading it to your computer.

No more worrying about lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Edit and electronically sign Form W 4P Withholding Certificate For Pension Or Annuity Payments to ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form w 4p withholding certificate for pension or annuity payments

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form W 4P Withholding Certificate For Pension Or Annuity Payments?

The Form W 4P Withholding Certificate For Pension Or Annuity Payments is a document used by retirees to specify the amount of federal income tax that should be withheld from their pension or annuity payments. This form helps ensure that the right amount of taxes is withheld, preventing underpayment issues during tax season.

-

How do I complete the Form W 4P Withholding Certificate For Pension Or Annuity Payments?

To complete the Form W 4P Withholding Certificate For Pension Or Annuity Payments, fill out your personal information, including your name, address, and Social Security number. You will also need to indicate your withholding preferences by selecting the appropriate options based on your financial situation before submitting the form to your pension administrator.

-

Why should I use airSlate SignNow for submitting the Form W 4P Withholding Certificate For Pension Or Annuity Payments?

Using airSlate SignNow for submitting the Form W 4P Withholding Certificate For Pension Or Annuity Payments allows for a streamlined and secure document process. You can easily eSign your documents and manage them from anywhere, ensuring timely submission without the hassles of physical paperwork.

-

Is there a cost associated with using airSlate SignNow for the Form W 4P Withholding Certificate For Pension Or Annuity Payments?

airSlate SignNow offers various pricing plans to suit different needs, including a free trial option. This allows you to experience the benefits of eSigning and document management for the Form W 4P Withholding Certificate For Pension Or Annuity Payments at no cost before deciding on a plan.

-

Can I customize the Form W 4P Withholding Certificate For Pension Or Annuity Payments with airSlate SignNow?

Yes, airSlate SignNow enables users to customize the Form W 4P Withholding Certificate For Pension Or Annuity Payments as needed. You can add fields, text, and even branding, ensuring that the completed forms align with your personal or organizational standards.

-

What integrations does airSlate SignNow provide for managing the Form W 4P Withholding Certificate For Pension Or Annuity Payments?

airSlate SignNow offers numerous integrations with popular applications and platforms, allowing for seamless management of documents, including the Form W 4P Withholding Certificate For Pension Or Annuity Payments. Integrations with services like Google Drive, Dropbox, and CRMs enhance your workflow, making document handling easier.

-

What are the benefits of using airSlate SignNow for eSigning the Form W 4P Withholding Certificate For Pension Or Annuity Payments?

The benefits of using airSlate SignNow for eSigning the Form W 4P Withholding Certificate For Pension Or Annuity Payments include enhanced security, compliance with legal standards, and a user-friendly interface. This platform ensures that your documents are signed quickly and safely, providing peace of mind.

Get more for Form W 4P Withholding Certificate For Pension Or Annuity Payments

- Ldss 486t 16832725 form

- Literature worksheets form

- Blank death certificate pdf form

- Lic boc full form

- Recovering couples anonymous book pdf form

- Philip morris coupon redemption form 387062561

- Fire truck visit request form mississauga ca

- The home renovations that will increase your property value form

Find out other Form W 4P Withholding Certificate For Pension Or Annuity Payments

- eSign Texas Renter's contract Mobile

- How Do I eSign Texas Renter's contract

- eSign Hawaii Sales contract template Myself

- How Can I eSign Washington Real estate sales contract template

- How To eSignature California Stock Certificate

- How Can I eSignature Texas Stock Certificate

- Help Me With eSign Florida New employee checklist

- How To eSign Illinois Rental application

- How To eSignature Maryland Affidavit of Identity

- eSignature New York Affidavit of Service Easy

- How To eSignature Idaho Affidavit of Title

- eSign Wisconsin Real estate forms Secure

- How To eSign California Real estate investment proposal template

- eSignature Oregon Affidavit of Title Free

- eSign Colorado Real estate investment proposal template Simple

- eSign Louisiana Real estate investment proposal template Fast

- eSign Wyoming Real estate investment proposal template Free

- How Can I eSign New York Residential lease

- eSignature Colorado Cease and Desist Letter Later

- How Do I eSignature Maine Cease and Desist Letter