Schedule Ca 540 Form

What is the Schedule Ca 540 Form

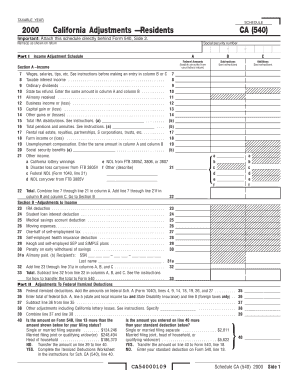

The Schedule Ca 540 Form is a tax document used by California residents to report adjustments to their taxable income. This form is specifically designed for individual income tax returns, allowing taxpayers to make necessary modifications to their federal adjusted gross income. It ensures that taxpayers accurately reflect their financial situation and comply with state tax regulations.

How to use the Schedule Ca 540 Form

Using the Schedule Ca 540 Form involves a few straightforward steps. First, gather all relevant financial documents, including your federal tax return. Next, identify any adjustments that need to be made, such as state-specific deductions or credits. Fill out the form by entering the required information, ensuring accuracy to avoid delays. Finally, submit the completed form along with your California tax return to the appropriate state agency.

Steps to complete the Schedule Ca 540 Form

Completing the Schedule Ca 540 Form requires careful attention to detail. Follow these steps:

- Review your federal adjusted gross income from your IRS Form 1040.

- Identify any California-specific adjustments, such as state tax refunds or non-taxable income.

- Fill in the relevant sections of the Schedule Ca 540 Form, ensuring all figures are accurate.

- Double-check your calculations and ensure all necessary documentation is attached.

- Submit the form with your California tax return by the designated deadline.

Legal use of the Schedule Ca 540 Form

The Schedule Ca 540 Form is legally binding when completed and submitted according to California tax laws. It must be filled out accurately to reflect your financial situation, and any discrepancies may lead to penalties or audits. The form adheres to the legal requirements set forth by the California Franchise Tax Board, ensuring that it is recognized as a legitimate document for tax reporting purposes.

Key elements of the Schedule Ca 540 Form

Several key elements are crucial when filling out the Schedule Ca 540 Form. These include:

- Personal Information: Your name, address, and Social Security number.

- Federal Adjusted Gross Income: The total income reported on your federal tax return.

- California Adjustments: Any specific additions or subtractions required by state tax laws.

- Signature: Your signature certifying the accuracy of the information provided.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule Ca 540 Form align with the overall California tax return deadlines. Typically, individual tax returns are due on April 15 each year. If this date falls on a weekend or holiday, the deadline may be extended. It is essential to stay informed about any changes to these dates to avoid penalties for late submission.

Quick guide on how to complete schedule ca 540 form

Prepare Schedule Ca 540 Form effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, as you can obtain the appropriate form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage Schedule Ca 540 Form on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to edit and eSign Schedule Ca 540 Form seamlessly

- Locate Schedule Ca 540 Form and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight key sections of the documents or obscure sensitive details with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign feature, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and then click the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced documents, time-consuming form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your choice. Modify and eSign Schedule Ca 540 Form and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the schedule ca 540 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Schedule Ca 540 Form?

The Schedule Ca 540 Form is a tax document used by California residents to report their income and deductions. It helps to calculate state income tax liability accurately. Understanding how to complete the Schedule Ca 540 Form is essential for ensuring compliance with California tax laws.

-

How can I conveniently eSign my Schedule Ca 540 Form?

With airSlate SignNow, you can easily eSign your Schedule Ca 540 Form online. Our platform allows you to upload your form, add your signature, and send it securely without any hassle. This streamlines the process, making it quicker and more efficient.

-

Is there a cost associated with using airSlate SignNow for the Schedule Ca 540 Form?

Yes, airSlate SignNow offers various pricing plans tailored to meet the needs of different users. Whether you are an individual or a business, you can choose a package that enables efficient management of your documents, including the Schedule Ca 540 Form.

-

What features does airSlate SignNow offer for completing the Schedule Ca 540 Form?

airSlate SignNow provides a user-friendly interface for filling out your Schedule Ca 540 Form. Key features include customizable templates, real-time collaboration, and secure document storage to keep your sensitive tax information safe.

-

Can I save my Schedule Ca 540 Form in airSlate SignNow for future use?

Absolutely! airSlate SignNow allows you to save your completed and partially finished Schedule Ca 540 Form securely. This lets you access the form later, making it convenient for annual tax filing or modifications as needed.

-

Does airSlate SignNow integrate with other applications for managing the Schedule Ca 540 Form?

Yes, airSlate SignNow integrates seamlessly with various applications such as cloud storage services and CRM systems. This integration facilitates easy access and management of your Schedule Ca 540 Form and related documents from a centralized platform.

-

What are the benefits of using airSlate SignNow for tax documents like the Schedule Ca 540 Form?

Using airSlate SignNow for your Schedule Ca 540 Form offers numerous benefits, including enhanced convenience, time savings, and reduced errors. The platform’s automated features simplify the signing and submission process, ensuring you stay organized and compliant with tax requirements.

Get more for Schedule Ca 540 Form

Find out other Schedule Ca 540 Form

- Electronic signature South Carolina Amendment to an LLC Operating Agreement Safe

- Can I Electronic signature Delaware Stock Certificate

- Electronic signature Massachusetts Stock Certificate Simple

- eSignature West Virginia Sale of Shares Agreement Later

- Electronic signature Kentucky Affidavit of Service Mobile

- How To Electronic signature Connecticut Affidavit of Identity

- Can I Electronic signature Florida Affidavit of Title

- How Can I Electronic signature Ohio Affidavit of Service

- Can I Electronic signature New Jersey Affidavit of Identity

- How Can I Electronic signature Rhode Island Affidavit of Service

- Electronic signature Tennessee Affidavit of Service Myself

- Electronic signature Indiana Cease and Desist Letter Free

- Electronic signature Arkansas Hold Harmless (Indemnity) Agreement Fast

- Electronic signature Kentucky Hold Harmless (Indemnity) Agreement Online

- How To Electronic signature Arkansas End User License Agreement (EULA)

- Help Me With Electronic signature Connecticut End User License Agreement (EULA)

- Electronic signature Massachusetts Hold Harmless (Indemnity) Agreement Myself

- Electronic signature Oklahoma Hold Harmless (Indemnity) Agreement Free

- Electronic signature Rhode Island Hold Harmless (Indemnity) Agreement Myself

- Electronic signature California Toll Manufacturing Agreement Now