Withholding Certificate Form

What is the Withholding Certificate Form

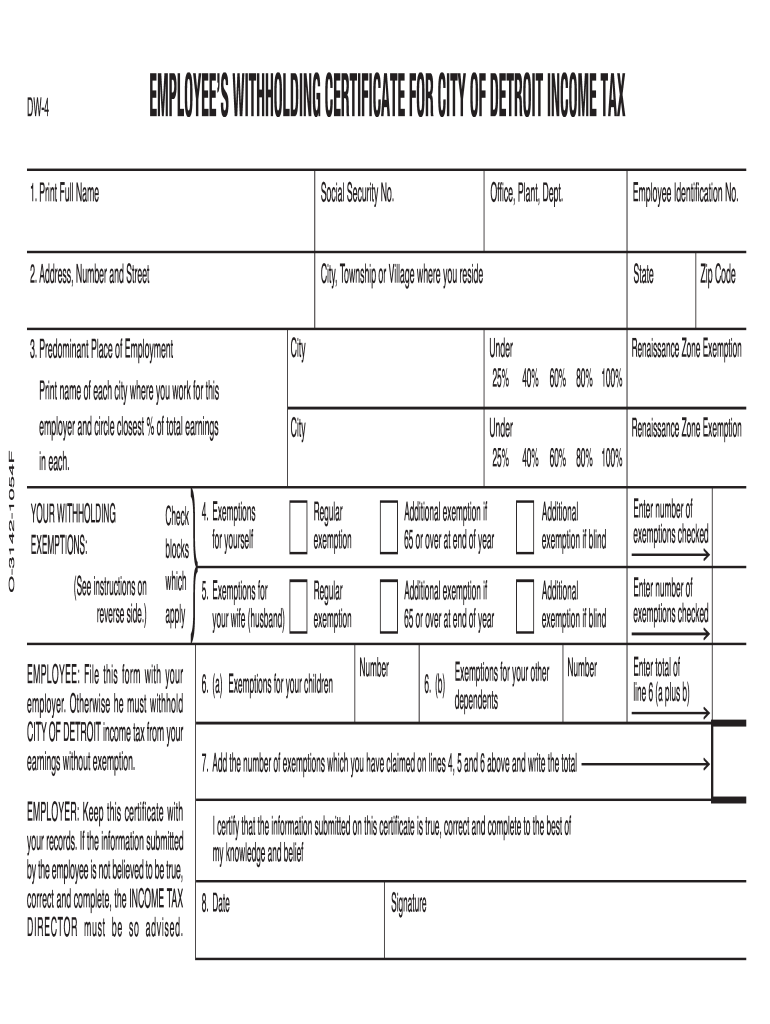

The Withholding Certificate Form is a crucial document used by taxpayers in the United States to claim exemption from withholding or to reduce the amount of tax withheld from their income. This form is particularly relevant for individuals who may not owe any federal income tax or those who qualify for a reduced withholding rate based on their tax situation. By accurately completing this form, taxpayers can ensure that their withholding aligns with their actual tax liability, preventing overpayment or underpayment of taxes.

How to use the Withholding Certificate Form

Using the Withholding Certificate Form involves several key steps. First, taxpayers need to gather necessary information, including their Social Security number, filing status, and any applicable deductions or credits. Next, they should fill out the form, ensuring that all information is accurate and complete. Once the form is completed, it must be submitted to the employer or withholding agent to adjust the withholding amount. It is essential to keep a copy of the submitted form for personal records.

Steps to complete the Withholding Certificate Form

Completing the Withholding Certificate Form requires careful attention to detail. Here are the steps to follow:

- Gather personal information, including your name, address, and Social Security number.

- Determine your filing status (single, married, etc.) and any exemptions you may qualify for.

- Fill out the form accurately, ensuring that all sections are completed as required.

- Review the form for any errors or omissions before submission.

- Submit the completed form to your employer or withholding agent.

Legal use of the Withholding Certificate Form

The legal use of the Withholding Certificate Form is governed by IRS regulations. When completed correctly, this form serves as a legal declaration of your withholding preferences and can impact your tax obligations. It is important to ensure that the information provided is truthful and accurate, as false statements may lead to penalties or legal consequences. Compliance with IRS guidelines is essential to maintain the validity of the form.

IRS Guidelines

The Internal Revenue Service (IRS) provides specific guidelines for completing and submitting the Withholding Certificate Form. Taxpayers should refer to the IRS instructions to understand eligibility criteria, exemptions, and any changes in tax law that may affect their withholding. Staying informed about IRS updates ensures that the form is used correctly and in accordance with current tax regulations.

Filing Deadlines / Important Dates

Filing deadlines for the Withholding Certificate Form are typically aligned with the tax year. It is crucial for taxpayers to submit the form in a timely manner to avoid any issues with withholding. Generally, the form should be submitted at the beginning of the tax year or whenever there is a change in your tax situation. Keeping track of important dates, such as the start of the tax season and deadlines for submitting forms, can help ensure compliance.

Penalties for Non-Compliance

Failure to comply with the requirements associated with the Withholding Certificate Form can result in penalties. If the form is not submitted when required, or if false information is provided, taxpayers may face fines or increased withholding. It is essential to understand the implications of non-compliance and to take steps to ensure that all information is accurate and submitted on time.

Quick guide on how to complete withholding certificate form

Easily Prepare Withholding Certificate Form on Any Device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the required forms and securely store them online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents swiftly and without holdups. Manage Withholding Certificate Form on any device using the airSlate SignNow apps for Android or iOS, and streamline your document-related tasks today.

How to Edit and eSign Withholding Certificate Form Effortlessly

- Locate Withholding Certificate Form and click on Get Form to begin.

- Use the tools we provide to fill out your form.

- Select important sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign feature, which takes seconds and possesses the same legal standing as a traditional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you would like to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs with just a few clicks from your selected device. Edit and eSign Withholding Certificate Form to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the withholding certificate form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Withholding Certificate Form?

A Withholding Certificate Form is a document used by individuals to signNow their tax status, helping to determine the correct amount of tax withholding. By filling out this form accurately, you can ensure that you do not overpay or underpay your taxes. airSlate SignNow simplifies the process of submitting your Withholding Certificate Form electronically, ensuring quick processing and compliance.

-

How do I complete a Withholding Certificate Form using airSlate SignNow?

To complete a Withholding Certificate Form with airSlate SignNow, simply upload the document to our platform, fill in the required fields, and sign electronically. Our user-friendly interface guides you through the process, making it easy to submit your form without any hassles. Once finalized, you can send the Withholding Certificate Form directly to the relevant authorities.

-

Is there a cost associated with using airSlate SignNow for my Withholding Certificate Form?

Yes, airSlate SignNow offers several pricing plans tailored to fit different business needs. Each plan includes features that make it easy to manage documents, including the Withholding Certificate Form. You can choose the plan that best suits your budget and requirements, ensuring an effective eSigning solution without overspending.

-

What features does airSlate SignNow offer for handling Withholding Certificate Forms?

airSlate SignNow provides a variety of features that enhance the handling of Withholding Certificate Forms, including customizable templates, real-time tracking, and automated reminders. Our platform also offers advanced security measures to protect your sensitive information. With these tools, you can streamline the entire process of managing your forms efficiently.

-

Can I integrate airSlate SignNow with other software to manage my Withholding Certificate Forms?

Absolutely! airSlate SignNow offers integrations with various popular applications to enhance your workflow. You can connect our platform with CRM systems, document management tools, and accounting software to easily manage your Withholding Certificate Forms and ensure seamless operation across platforms.

-

How does airSlate SignNow ensure the security of my Withholding Certificate Form?

airSlate SignNow prioritizes the security of your documents, including your Withholding Certificate Form. We employ advanced encryption techniques and secure cloud storage to protect sensitive data. Our compliance with industry standards ensures that your information remains confidential and secure throughout the signing process.

-

What are the benefits of using airSlate SignNow for my Withholding Certificate Form?

Using airSlate SignNow for your Withholding Certificate Form offers numerous benefits, including faster processing times, reduced paperwork, and enhanced organization. Our digital platform allows for quick and efficient signing, enabling you to complete your tax documentation hassle-free. Moreover, eSigning helps save time and resources compared to traditional methods.

Get more for Withholding Certificate Form

Find out other Withholding Certificate Form

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF

- How To Sign Pennsylvania Legal Word

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT