Michigan Refund Certification and Spousal Waiver 2013

What is the Michigan Refund Certification and Spousal Waiver

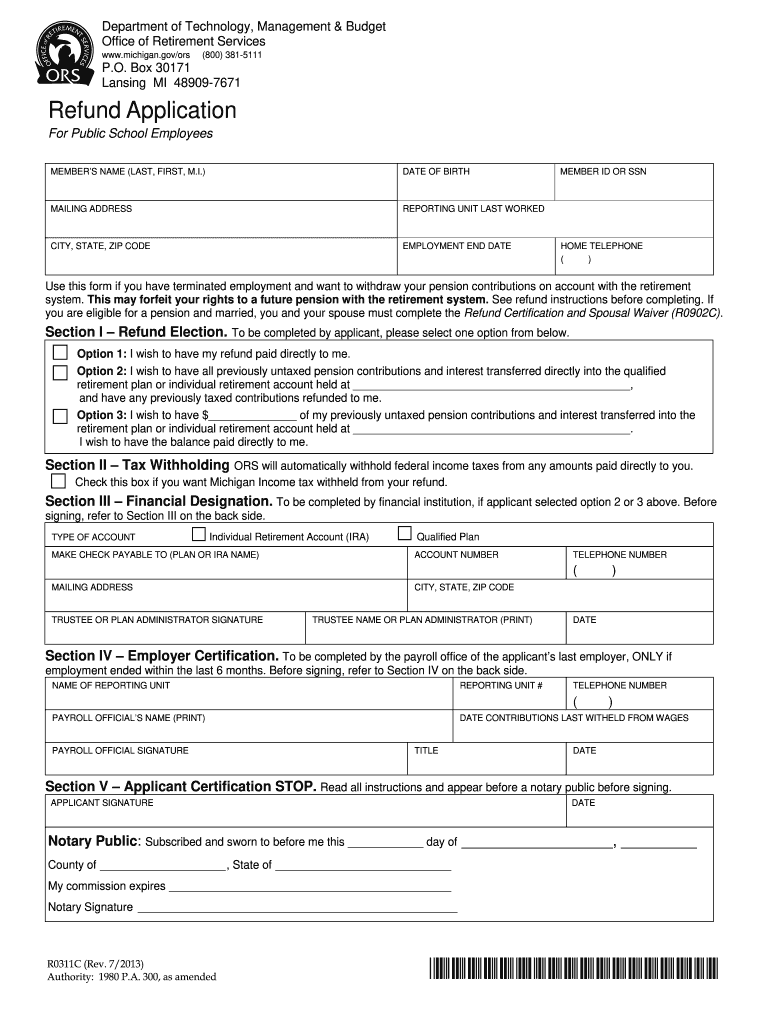

The Michigan Refund Certification and Spousal Waiver, commonly referred to as form R0902C, is a document used primarily in the context of tax refunds and spousal claims. This form allows individuals to certify their eligibility for refunds while also addressing any spousal claims that may arise. It serves as a crucial tool for ensuring that both parties are in agreement regarding the distribution of any potential refunds, thereby preventing disputes and ensuring compliance with state regulations.

Steps to Complete the Michigan Refund Certification and Spousal Waiver

Completing the Michigan Refund Certification and Spousal Waiver involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary information, including personal identification details, tax information, and any relevant documentation regarding spousal claims. Next, follow these steps:

- Fill out the personal information section carefully, ensuring all names and addresses are accurate.

- Provide details regarding the tax refund being claimed, including amounts and relevant tax years.

- Include any spousal information required, confirming that both parties agree to the terms outlined in the waiver.

- Review the completed form for accuracy before submission.

Finally, submit the form according to the instructions provided, which may include online submission options or mailing it to the appropriate tax authority.

Legal Use of the Michigan Refund Certification and Spousal Waiver

The legal use of the Michigan Refund Certification and Spousal Waiver is governed by state tax laws and regulations. This form must be completed accurately to ensure that it is recognized as valid by tax authorities. It is essential that both parties involved in the waiver understand their rights and obligations. The form is designed to protect the interests of both individuals, ensuring that refunds are distributed fairly and legally. Failure to comply with the legal requirements may result in penalties or disputes over the refund.

Eligibility Criteria for the Michigan Refund Certification and Spousal Waiver

Eligibility for the Michigan Refund Certification and Spousal Waiver typically includes individuals who are married and jointly filing their taxes. Both spouses must agree to the terms set forth in the waiver, which includes certifying their understanding of the refund process. Additionally, individuals must meet specific income and tax filing requirements as outlined by Michigan state tax regulations. It is important to verify eligibility before completing the form to avoid complications during the refund process.

Form Submission Methods

The Michigan Refund Certification and Spousal Waiver can be submitted through various methods, depending on the preferences of the filers. Common submission methods include:

- Online Submission: Many taxpayers can submit the form electronically through the Michigan Department of Treasury's online portal.

- Mail: The form can be printed and mailed to the appropriate tax authority, ensuring that it is sent to the correct address for processing.

- In-Person: Some individuals may choose to deliver the form in person at local tax offices, allowing for immediate confirmation of receipt.

Each method has its own processing times and requirements, so it is advisable to check the latest guidelines from the Michigan Department of Treasury.

Required Documents for the Michigan Refund Certification and Spousal Waiver

When completing the Michigan Refund Certification and Spousal Waiver, several documents may be required to support the claims made on the form. These documents typically include:

- Proof of identity for both spouses, such as driver's licenses or Social Security cards.

- Tax returns for the relevant years, which provide context for the refund claim.

- Any additional documentation that supports the spousal waiver, such as marriage certificates or prior correspondence with tax authorities.

Having these documents ready will facilitate a smoother completion and submission process, reducing the risk of delays or complications.

Quick guide on how to complete michigan refund certification and spousal waiver

Effortlessly Prepare Michigan Refund Certification And Spousal Waiver on Any Device

The management of online documents has become increasingly popular among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed papers, allowing easy access to the correct form and secure online storage. airSlate SignNow equips you with all the necessary tools to swiftly create, modify, and eSign your documents without any delays. Manage Michigan Refund Certification And Spousal Waiver on any platform using the airSlate SignNow apps for Android or iOS and streamline any document-related process today.

How to Easily Modify and eSign Michigan Refund Certification And Spousal Waiver

- Locate Michigan Refund Certification And Spousal Waiver and click on Get Form to begin.

- Utilize the available tools to complete your form.

- Emphasize relevant sections of your documents or conceal sensitive information with tools specifically designed by airSlate SignNow for this purpose.

- Generate your signature using the Sign feature, which takes seconds and holds the same legal standing as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method for submitting your form, whether by email, SMS, invitation link, or download it to your computer.

No more worries about lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow addresses your document management needs with just a few clicks from any device you choose. Edit and eSign Michigan Refund Certification And Spousal Waiver to ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct michigan refund certification and spousal waiver

Create this form in 5 minutes!

How to create an eSignature for the michigan refund certification and spousal waiver

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form r0902c and how can it be used?

Form r0902c is a specialized document used to streamline compliance in various business processes. By utilizing the airSlate SignNow platform, users can easily fill out, sign, and manage this form digitally, enhancing efficiency and accuracy in submission.

-

How does airSlate SignNow support completing form r0902c?

AirSlate SignNow provides an intuitive interface for filling out form r0902c, allowing users to input necessary information effortlessly. The platform also supports eSignatures, ensuring that your form r0902c is legally binding and secure once completed.

-

Is there a cost associated with using airSlate SignNow for form r0902c?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. Each plan includes features for managing form r0902c, ensuring that you can choose an option that suits your budget while benefitting from robust document management capabilities.

-

What features does airSlate SignNow offer for form r0902c?

AirSlate SignNow includes features like templates, automated workflows, and real-time tracking specifically designed for handling form r0902c. These tools help streamline the process, making it easier to manage multiple submissions efficiently.

-

Can I integrate other apps with airSlate SignNow when working with form r0902c?

Absolutely! airSlate SignNow offers integrations with a variety of popular applications, allowing users to sync data and automate tasks while handling form r0902c. This flexibility enhances productivity and keeps your workflow seamless.

-

What are the benefits of using airSlate SignNow for form r0902c?

Utilizing airSlate SignNow for form r0902c improves efficiency, reduces paper usage, and accelerates the signing process. The platform also ensures compliance and security, making it an advantageous choice for businesses looking to optimize their document management.

-

How secure is my data when using airSlate SignNow with form r0902c?

AirSlate SignNow prioritizes data security, employing encryption and advanced security protocols when handling form r0902c. You can trust that your documents are protected, ensuring compliance with industry standards and regulations.

Get more for Michigan Refund Certification And Spousal Waiver

Find out other Michigan Refund Certification And Spousal Waiver

- Can I eSign Alabama Non disclosure agreement sample

- eSign California Non disclosure agreement sample Now

- eSign Pennsylvania Mutual non-disclosure agreement Now

- Help Me With eSign Utah Non disclosure agreement sample

- How Can I eSign Minnesota Partnership agreements

- eSign Pennsylvania Property management lease agreement Secure

- eSign Hawaii Rental agreement for house Fast

- Help Me With eSign Virginia Rental agreement contract

- eSign Alaska Rental lease agreement Now

- How To eSign Colorado Rental lease agreement

- How Can I eSign Colorado Rental lease agreement

- Can I eSign Connecticut Rental lease agreement

- eSign New Hampshire Rental lease agreement Later

- Can I eSign North Carolina Rental lease agreement

- How Do I eSign Pennsylvania Rental lease agreement

- How To eSign South Carolina Rental lease agreement

- eSign Texas Rental lease agreement Mobile

- eSign Utah Rental agreement lease Easy

- How Can I eSign North Dakota Rental lease agreement forms

- eSign Rhode Island Rental lease agreement forms Now