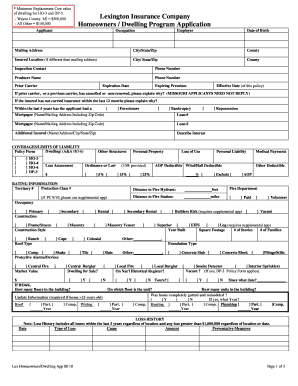

Lexington Insurance Company Homeowners Dwelling Program Form

What is the Lexington Insurance Company Homeowners Dwelling Program

The Lexington Insurance Company Homeowners Dwelling Program is designed to provide comprehensive coverage for homeowners. This program typically includes protection against various risks such as fire, theft, and natural disasters. It aims to safeguard the physical structure of a home, as well as personal belongings within it. Policyholders can customize their coverage options to meet specific needs, ensuring they have adequate protection for their unique circumstances.

How to use the Lexington Insurance Company Homeowners Dwelling Program

Using the Lexington Insurance Company Homeowners Dwelling Program involves several straightforward steps. First, homeowners should assess their coverage needs, taking into account the value of their property and belongings. Next, they can consult with an insurance agent to explore policy options and select the best coverage. Once the policy is in place, homeowners should keep it updated, especially after significant changes such as renovations or acquiring new valuables.

Steps to complete the Lexington Insurance Company Homeowners Dwelling Program

Completing the Lexington Insurance Company Homeowners Dwelling Program typically involves the following steps:

- Evaluate your home and personal property to determine the necessary coverage.

- Contact a Lexington Insurance Company representative to discuss available options.

- Fill out the application form accurately, providing all required information.

- Review the policy terms and conditions before finalizing the purchase.

- Make your first premium payment to activate the policy.

Key elements of the Lexington Insurance Company Homeowners Dwelling Program

Key elements of the Lexington Insurance Company Homeowners Dwelling Program include dwelling coverage, personal property coverage, liability protection, and additional living expenses coverage. Dwelling coverage protects the physical structure of the home, while personal property coverage safeguards belongings inside. Liability protection covers legal expenses in case of accidents on the property, and additional living expenses coverage helps with costs incurred if the home becomes uninhabitable due to a covered loss.

Eligibility Criteria

Eligibility for the Lexington Insurance Company Homeowners Dwelling Program generally depends on several factors, including the type of home, its location, and the homeowner's claims history. Typically, single-family homes, townhouses, and certain condos may qualify. Homeowners should also maintain a good credit score and have a history of responsible home maintenance to improve their chances of obtaining coverage.

Application Process & Approval Time

The application process for the Lexington Insurance Company Homeowners Dwelling Program is relatively straightforward. Homeowners can begin by gathering necessary documentation, such as property details and previous insurance information. After submitting the application, approval times can vary based on the complexity of the application and the insurer's workload. Generally, homeowners can expect a response within a few days to a couple of weeks.

Quick guide on how to complete lexington insurance company homeowners dwelling program

Finish Lexington Insurance Company Homeowners Dwelling Program effortlessly on any gadget

Digital document management has gained traction among companies and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily find the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to generate, modify, and eSign your documents swiftly without delays. Handle Lexington Insurance Company Homeowners Dwelling Program on any gadget with airSlate SignNow Android or iOS applications and enhance any document-related procedure today.

The easiest way to alter and eSign Lexington Insurance Company Homeowners Dwelling Program with ease

- Find Lexington Insurance Company Homeowners Dwelling Program and click Obtain Form to begin.

- Use the tools we provide to complete your form.

- Highlight pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes seconds and holds the same legal significance as a conventional wet ink signature.

- Review all the details and click the Finish button to save your changes.

- Select how you wish to share your form, via email, text message (SMS), or invite link, or download it to your computer.

Forget about lost or misplaced files, tedious form searches, or errors that require the printing of new document copies. airSlate SignNow addresses all your needs in document management in just a few clicks from any device you choose. Alter and eSign Lexington Insurance Company Homeowners Dwelling Program and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the lexington insurance company homeowners dwelling program

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Lexington Insurance Company Homeowners Dwelling Program?

The Lexington Insurance Company Homeowners Dwelling Program is designed to provide comprehensive coverage for homeowners. It offers a range of policies that protect your dwelling and personal property against various risks. With this program, you can ensure your home and belongings are safeguarded effectively.

-

How much does the Lexington Insurance Company Homeowners Dwelling Program cost?

Pricing for the Lexington Insurance Company Homeowners Dwelling Program varies based on coverage levels and property characteristics. Factors such as location, home value, and coverage limits will affect your premium. It's advisable to request a quote to get an accurate estimate tailored to your specific needs.

-

What features are included in the Lexington Insurance Company Homeowners Dwelling Program?

The Lexington Insurance Company Homeowners Dwelling Program includes essential features such as dwelling coverage, personal property protection, and liability coverage. Additionally, it may offer optional endorsements for enhanced protection. These features work together to provide a robust safety net for your home.

-

What are the benefits of choosing the Lexington Insurance Company Homeowners Dwelling Program?

Choosing the Lexington Insurance Company Homeowners Dwelling Program offers numerous benefits, including customizable coverage options and competitive pricing. This program is designed to meet diverse homeowner needs, ensuring adequate protection against financial loss. Furthermore, reliable customer service and claims support enhance the overall experience.

-

Are there any discounts available with the Lexington Insurance Company Homeowners Dwelling Program?

Yes, there are various discounts available with the Lexington Insurance Company Homeowners Dwelling Program. Eligible homeowners may qualify for discounts based on their claims history, security features, or bundling policies. These discounts help lower your overall premium costs, making it a more affordable option.

-

How can I file a claim with the Lexington Insurance Company Homeowners Dwelling Program?

Filing a claim with the Lexington Insurance Company Homeowners Dwelling Program is straightforward. You can initiate the process through their online portal or by contacting customer service directly. The efficient claims process ensures that you receive prompt assistance and support during your time of need.

-

Can I customize my coverage with the Lexington Insurance Company Homeowners Dwelling Program?

Absolutely, the Lexington Insurance Company Homeowners Dwelling Program allows for signNow customization of coverage. You can tailor your policy to fit your specific needs by adding endorsements or adjusting coverage limits. This flexibility ensures that you have the right protection in place for your unique situation.

Get more for Lexington Insurance Company Homeowners Dwelling Program

Find out other Lexington Insurance Company Homeowners Dwelling Program

- How Do I Sign Oregon Legal PDF

- How To Sign Pennsylvania Legal Word

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF