Original Surety Bond Form

What is the Original Surety Bond Form

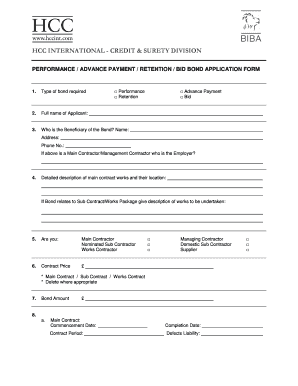

The original surety bond form is a legal document that guarantees the obligations of one party to another. It typically involves three parties: the principal, who is required to fulfill a duty; the obligee, who is the party that requires the bond; and the surety, which is the company that issues the bond. This form is essential in various industries, including construction, finance, and licensing, ensuring that the principal meets their contractual obligations. The surety bond format varies by state and purpose, but it generally includes details about the parties involved, the amount of the bond, and the specific obligations being guaranteed.

Steps to Complete the Original Surety Bond Form

Filling out the original surety bond form involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including the names and addresses of the principal and obligee, as well as the bond amount. Next, carefully read the instructions provided with the form to understand the specific requirements. Then, fill in the form with the required details, ensuring that all information is accurate and complete. After completing the form, review it for any errors or omissions before signing. Finally, submit the form to the surety company for approval, along with any required documentation.

Legal Use of the Original Surety Bond Form

The legal use of the original surety bond form is crucial for its validity. To be legally binding, the form must comply with state regulations and include all necessary signatures. The surety company must also be licensed to issue bonds in the state where the bond is being used. Additionally, the bond must be executed in a manner that meets the requirements of the governing laws, which may include notarization. Understanding these legal aspects helps ensure that the surety bond form is enforceable in a court of law.

Key Elements of the Original Surety Bond Form

Several key elements must be included in the original surety bond form to ensure its effectiveness. These elements typically include:

- Principal Information: Name and address of the individual or business responsible for fulfilling the obligation.

- Obligee Information: Name and address of the party requiring the bond.

- Bond Amount: The monetary value of the bond, which serves as a guarantee.

- Scope of Obligation: A clear description of the duties or obligations the principal must fulfill.

- Signatures: Signatures of all parties involved, including the principal, obligee, and surety representative.

How to Obtain the Original Surety Bond Form

The original surety bond form can be obtained through various channels. Typically, surety companies provide the form directly on their websites or upon request. Additionally, legal and financial advisors may have access to the necessary forms. It is important to ensure that the version of the form obtained is current and compliant with state regulations. Some states may also have official websites where standardized forms can be downloaded.

Form Submission Methods

Submitting the original surety bond form can be done through several methods, depending on the requirements of the surety company and the obligee. Common submission methods include:

- Online Submission: Many surety companies allow electronic submission of the form through their portals, providing a quick and efficient way to complete the process.

- Mail: The form can be printed and mailed to the surety company, ensuring that all signatures are included.

- In-Person Submission: Some individuals may prefer to deliver the form in person, allowing for immediate confirmation of receipt.

Quick guide on how to complete original surety bond form

Complete Original Surety Bond Form effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to locate the necessary form and securely keep it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents swiftly without delays. Manage Original Surety Bond Form on any device using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to modify and eSign Original Surety Bond Form with ease

- Locate Original Surety Bond Form and click Get Form to begin.

- Use the tools we provide to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign feature, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Choose your preferred method to send your form, via email, SMS, or an invitation link, or download it to your computer.

Forget about lost or misplaced documents, laborious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management requirements in just a few clicks from any device you prefer. Edit and eSign Original Surety Bond Form to ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the original surety bond form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a surety bond form?

A surety bond form is a legal document that guarantees the performance or obligation of a party in a contractual agreement. These forms are crucial in various industries, ensuring that businesses meet their financial commitments. Using airSlate SignNow, you can easily create, send, and eSign your surety bond forms efficiently.

-

How can I create a surety bond form with airSlate SignNow?

Creating a surety bond form with airSlate SignNow is straightforward. Simply select a template or create a new document from scratch, fill in your details, and customize it as needed. Once your form is ready, you can send it out for eSignature to ensure a quick turnaround.

-

Are there any costs associated with using the surety bond form feature?

airSlate SignNow offers competitive pricing plans that include access to the surety bond form feature. You can choose a plan that best suits your needs, whether you are a small business or a large enterprise. There are also free trials available, allowing you to test the features before committing.

-

What are the benefits of using airSlate SignNow for surety bond forms?

Using airSlate SignNow for surety bond forms provides numerous benefits, including time savings, enhanced security, and improved compliance. The platform allows for quick eSigning, reducing the time spent on paperwork, while also ensuring your documents are legally binding and secure.

-

Can I integrate airSlate SignNow with other applications for managing surety bond forms?

Yes, airSlate SignNow seamlessly integrates with various applications such as CRM systems, project management tools, and cloud storage solutions. This allows for efficient document management and streamlined workflows when handling surety bond forms.

-

Is it safe to eSign a surety bond form with airSlate SignNow?

Absolutely! airSlate SignNow utilizes industry-leading security measures to protect your data and ensure the integrity of your surety bond forms. With encryption, secure storage, and compliance with electronic signature regulations, your eSigned documents are safe and legally valid.

-

What types of businesses commonly use surety bond forms?

Surety bond forms are commonly used by construction companies, real estate professionals, and service providers that require licensing or permits. Many businesses that engage in contractual agreements rely on surety bonds to protect their interests and guarantee performance.

Get more for Original Surety Bond Form

- Company form 22 reg 272 the republic of uganda the ursb go

- License application form 393299878

- An echinoderm with elongated body shape form

- Student residency questionnaire lausd form

- Oracle flexcube core banking installation user guide branchwinserver form

- Ehss phos forms abrasive blasting appendix b quarterly enclosure inspection docx

- Epcc financial aid form

- Trgmdm 397080699 form

Find out other Original Surety Bond Form

- Electronic signature Montana Courts Promissory Note Template Now

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe

- Electronic signature Oklahoma Sports RFP Fast

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- Can I Sign Colorado Banking PPT