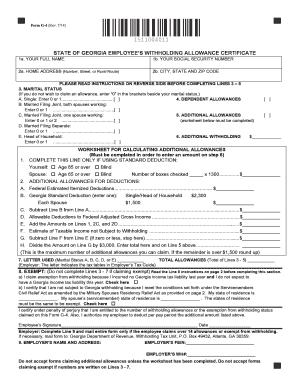

State of Georgia Employee's Withholding Allowance Certificate Form

What is the State Of Georgia Employee's Withholding Allowance Certificate

The State Of Georgia Employee's Withholding Allowance Certificate, commonly referred to as the G-4 form, is a document that allows employees in Georgia to determine the amount of state income tax to withhold from their paychecks. This form is essential for both employees and employers, as it helps ensure that the correct amount of tax is withheld based on the employee's personal circumstances, such as marital status and number of dependents. Proper completion of this form can prevent over-withholding or under-withholding, which can affect an individual's financial situation during tax season.

Steps to complete the State Of Georgia Employee's Withholding Allowance Certificate

Completing the State Of Georgia Employee's Withholding Allowance Certificate involves several straightforward steps:

- Obtain the G-4 form from your employer or download it from the Georgia Department of Revenue website.

- Fill in your personal information, including your name, address, and Social Security number.

- Indicate your filing status, which can be single, married, or head of household.

- Calculate the number of allowances you are claiming based on your personal and financial situation.

- Sign and date the form to certify that the information provided is accurate.

Once completed, submit the form to your employer, who will use it to adjust your withholding accordingly.

How to obtain the State Of Georgia Employee's Withholding Allowance Certificate

The State Of Georgia Employee's Withholding Allowance Certificate can be obtained in a few ways. Employees can request the form directly from their employer, as many businesses provide it during the onboarding process. Alternatively, the G-4 form is available for download on the Georgia Department of Revenue's official website. This accessibility ensures that all employees can easily acquire the necessary documentation to manage their tax withholdings effectively.

Legal use of the State Of Georgia Employee's Withholding Allowance Certificate

The legal use of the State Of Georgia Employee's Withholding Allowance Certificate is governed by state tax laws. Employees must provide accurate information on the form to ensure compliance with Georgia's withholding requirements. Misrepresentation or failure to submit the form may result in incorrect tax withholdings, leading to potential penalties or fines. It is crucial for both employees and employers to understand their responsibilities regarding this form to maintain compliance with state regulations.

Key elements of the State Of Georgia Employee's Withholding Allowance Certificate

Several key elements are essential when filling out the State Of Georgia Employee's Withholding Allowance Certificate:

- Personal Information: Includes the employee's name, address, and Social Security number.

- Filing Status: Indicates whether the employee is single, married, or head of household.

- Allowances Claimed: The number of allowances that the employee is eligible to claim based on their tax situation.

- Signature: The employee must sign and date the form to validate the information provided.

Examples of using the State Of Georgia Employee's Withholding Allowance Certificate

Employees may use the State Of Georgia Employee's Withholding Allowance Certificate in various scenarios:

- A newly hired employee completing the form to establish their withholding preferences.

- An employee experiencing a change in marital status, leading them to update their withholding allowances.

- A parent claiming additional allowances due to dependent children, which may reduce their overall tax burden.

These examples illustrate how the G-4 form plays a vital role in managing state income tax withholdings effectively.

Quick guide on how to complete state of georgia employees withholding allowance certificate

Complete State Of Georgia Employee's Withholding Allowance Certificate effortlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to generate, revise, and electronically sign your files swiftly without delays. Manage State Of Georgia Employee's Withholding Allowance Certificate on any device using airSlate SignNow's Android or iOS applications and simplify any document-focused process today.

How to modify and eSign State Of Georgia Employee's Withholding Allowance Certificate effortlessly

- Find State Of Georgia Employee's Withholding Allowance Certificate and click Get Form to initiate the process.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the details and click the Done button to save your changes.

- Select your preferred method for sharing your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns over lost or mislaid documents, tiring searches for forms, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Alter and eSign State Of Georgia Employee's Withholding Allowance Certificate to ensure outstanding communication at any stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the state of georgia employees withholding allowance certificate

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the State Of Georgia Employee's Withholding Allowance Certificate?

The State Of Georgia Employee's Withholding Allowance Certificate is a form used by employees to determine the amount of state income tax to withhold from their paychecks. This certificate allows employees to claim allowances based on their personal tax situations, which can lower their taxable income. Completing the form accurately is essential for ensuring that the correct withholding amount is applied, avoiding potential tax issues later.

-

How can airSlate SignNow assist in completing the State Of Georgia Employee's Withholding Allowance Certificate?

airSlate SignNow streamlines the process of filling out the State Of Georgia Employee's Withholding Allowance Certificate by providing easy-to-use templates. Users can fill in their information quickly, ensuring accuracy and compliance with state laws. Additionally, the eSigning feature allows employees to submit their forms securely and efficiently.

-

Are there any costs associated with using airSlate SignNow for the State Of Georgia Employee's Withholding Allowance Certificate?

airSlate SignNow offers cost-effective plans that provide access to all features needed for managing the State Of Georgia Employee's Withholding Allowance Certificate. Pricing varies depending on the plan chosen, which can accommodate businesses of all sizes. It's a valuable investment for companies looking to simplify document management and tax-related processes.

-

What features does airSlate SignNow offer for managing the State Of Georgia Employee's Withholding Allowance Certificate?

With airSlate SignNow, users benefit from features like customizable templates, secure eSigning, and cloud storage, all tailored for the State Of Georgia Employee's Withholding Allowance Certificate. The platform also includes real-time tracking of documents, which ensures that every step is monitored and completed efficiently. These features enhance productivity and simplify tax-related tasks.

-

Can I integrate airSlate SignNow with other tools for the State Of Georgia Employee's Withholding Allowance Certificate?

Yes, airSlate SignNow offers integrations with various tools and applications, which can be beneficial when managing the State Of Georgia Employee's Withholding Allowance Certificate. These integrations help streamline workflows, allowing users to connect their HR software or accounting systems for seamless data transfer. This enhances efficiency and reduces the likelihood of errors.

-

How secure is airSlate SignNow for handling the State Of Georgia Employee's Withholding Allowance Certificate?

airSlate SignNow prioritizes security and employs industry-standard encryption protocols to protect sensitive information related to the State Of Georgia Employee's Withholding Allowance Certificate. The platform ensures that all documents are securely stored and transmitted, giving users peace of mind regarding their tax forms. Compliance with various regulations further solidifies its reliability.

-

What benefits does airSlate SignNow provide when handling the State Of Georgia Employee's Withholding Allowance Certificate?

Using airSlate SignNow for the State Of Georgia Employee's Withholding Allowance Certificate provides numerous benefits, including time savings and reduced paperwork. The platform's user-friendly interface makes it easy for employees to complete and submit their forms accurately. Additionally, it enhances collaboration between HR and employees, leading to improved compliance and satisfaction across the board.

Get more for State Of Georgia Employee's Withholding Allowance Certificate

- Kamloops blazers education amp scholarship society award form

- De 165 form

- Canadian foreign air operator certificate amendment application form

- Sc form tc 43

- Load tally sheet form

- Protons neutrons and electrons practice worksheet form

- Texas vaccines for children program tvfc provider enrollment initial enrollment reenrollment contact the health services region form

- Division of medical servicesarkansas medicaid pri form

Find out other State Of Georgia Employee's Withholding Allowance Certificate

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF

- How To Electronic signature Alaska Legal Document

- Help Me With Electronic signature Arkansas Legal PDF

- How Can I Electronic signature Arkansas Legal Document

- How Can I Electronic signature California Legal PDF

- Can I Electronic signature Utah High Tech PDF

- How Do I Electronic signature Connecticut Legal Document

- How To Electronic signature Delaware Legal Document

- How Can I Electronic signature Georgia Legal Word

- How Do I Electronic signature Alaska Life Sciences Word

- How Can I Electronic signature Alabama Life Sciences Document

- How Do I Electronic signature Idaho Legal Form

- Help Me With Electronic signature Arizona Life Sciences PDF

- Can I Electronic signature Colorado Non-Profit Form

- How To Electronic signature Indiana Legal Form

- How To Electronic signature Illinois Non-Profit Document