Georgia Unsecured Installment Payment Promissory Note for Fixed Rate Form

What is the Georgia Unsecured Installment Payment Promissory Note For Fixed Rate

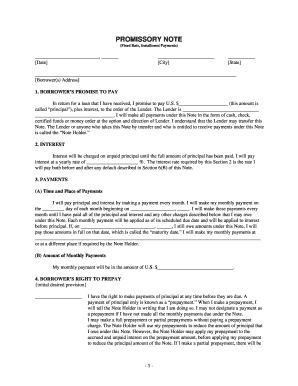

The Georgia Unsecured Installment Payment Promissory Note For Fixed Rate is a legal document that outlines the terms of a loan agreement between a borrower and a lender. This note specifies the amount borrowed, the interest rate, the repayment schedule, and the consequences of default. Unlike secured loans, this type of promissory note does not require collateral, making it essential for borrowers who may not have assets to pledge. It serves as a formal acknowledgment of the debt and is enforceable in a court of law, provided it meets the necessary legal requirements.

How to use the Georgia Unsecured Installment Payment Promissory Note For Fixed Rate

Using the Georgia Unsecured Installment Payment Promissory Note For Fixed Rate involves several straightforward steps. First, both parties should agree on the terms of the loan, including the principal amount, interest rate, and repayment schedule. Once these details are settled, the borrower and lender can fill out the promissory note, ensuring all relevant information is accurately included. After completing the document, both parties should sign it to validate the agreement. It is advisable to keep a copy for personal records and provide one to the other party for their reference.

Key elements of the Georgia Unsecured Installment Payment Promissory Note For Fixed Rate

Several key elements must be included in the Georgia Unsecured Installment Payment Promissory Note For Fixed Rate to ensure its validity. These elements include:

- Borrower and Lender Information: Full names and contact details of both parties.

- Loan Amount: The total amount being borrowed.

- Interest Rate: The fixed rate of interest applied to the loan.

- Repayment Schedule: Specific dates and amounts for repayment installments.

- Default Terms: Conditions under which the borrower may be considered in default.

- Governing Law: A statement indicating that the agreement is governed by Georgia law.

Steps to complete the Georgia Unsecured Installment Payment Promissory Note For Fixed Rate

Completing the Georgia Unsecured Installment Payment Promissory Note For Fixed Rate involves a series of methodical steps:

- Gather Information: Collect all necessary details about the borrower and lender.

- Determine Loan Terms: Agree on the loan amount, interest rate, and repayment schedule.

- Draft the Note: Fill out the promissory note template with the agreed-upon terms.

- Review the Document: Both parties should carefully review the note for accuracy.

- Sign the Note: Both the borrower and lender must sign the document to make it legally binding.

- Distribute Copies: Provide copies of the signed note to both parties for their records.

Legal use of the Georgia Unsecured Installment Payment Promissory Note For Fixed Rate

The legal use of the Georgia Unsecured Installment Payment Promissory Note For Fixed Rate is crucial for both borrowers and lenders. This document serves as a binding agreement that can be enforced in a court of law if necessary. It is important to ensure that the note complies with Georgia state laws regarding lending and borrowing. Proper execution, including signatures and date stamps, is essential for the note to be considered valid. Additionally, both parties should be aware of their rights and obligations under the terms outlined in the note.

State-specific rules for the Georgia Unsecured Installment Payment Promissory Note For Fixed Rate

In Georgia, specific rules govern the creation and enforcement of the Unsecured Installment Payment Promissory Note For Fixed Rate. These rules include:

- Written Agreement: The note must be in writing to be enforceable.

- Interest Rate Limits: Georgia law imposes limits on the interest rates that can be charged, which must be adhered to.

- Signatures Required: Both parties must sign the document for it to be legally binding.

- Record Keeping: It is advisable for both parties to maintain accurate records of all transactions related to the note.

Quick guide on how to complete georgia unsecured installment payment promissory note for fixed rate

Complete Georgia Unsecured Installment Payment Promissory Note For Fixed Rate effortlessly on any device

Online document management has gained popularity among organizations and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents quickly without delays. Manage Georgia Unsecured Installment Payment Promissory Note For Fixed Rate on any platform with the airSlate SignNow Android or iOS applications and ease any document-related tasks today.

How to modify and eSign Georgia Unsecured Installment Payment Promissory Note For Fixed Rate effortlessly

- Find Georgia Unsecured Installment Payment Promissory Note For Fixed Rate and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Mark important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or errors that require printing fresh document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and eSign Georgia Unsecured Installment Payment Promissory Note For Fixed Rate and ensure exceptional communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the georgia unsecured installment payment promissory note for fixed rate

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Georgia Unsecured Installment Payment Promissory Note For Fixed Rate?

A Georgia Unsecured Installment Payment Promissory Note For Fixed Rate is a legal document that outlines the terms under which a borrower repays a loan at a fixed interest rate. This type of note is unsecured, meaning it does not require collateral. It is commonly used for personal loans or financing agreements where both parties want a clear understanding of repayment expectations.

-

How do I create a Georgia Unsecured Installment Payment Promissory Note For Fixed Rate using airSlate SignNow?

Creating a Georgia Unsecured Installment Payment Promissory Note For Fixed Rate with airSlate SignNow is straightforward. Simply use our customizable templates and fill in the relevant information regarding the borrower, lender, and repayment terms. Once your document is complete, you can easily send it for electronic signatures.

-

What are the benefits of using airSlate SignNow for a Georgia Unsecured Installment Payment Promissory Note For Fixed Rate?

Using airSlate SignNow for your Georgia Unsecured Installment Payment Promissory Note For Fixed Rate provides several advantages, including cost-effectiveness and ease of use. The platform allows for quick electronic signing, ensuring that documents are executed efficiently. Additionally, you can store and manage your signed documents securely in the cloud.

-

Is there a cost associated with creating a Georgia Unsecured Installment Payment Promissory Note For Fixed Rate on airSlate SignNow?

Yes, there are pricing plans available for airSlate SignNow that cater to different business needs. These plans are designed to be budget-friendly, providing access to features like template creation and eSigning, which are essential for managing a Georgia Unsecured Installment Payment Promissory Note For Fixed Rate.

-

Can I customize the terms of the Georgia Unsecured Installment Payment Promissory Note For Fixed Rate?

Absolutely! When using airSlate SignNow, you have the flexibility to customize the terms of your Georgia Unsecured Installment Payment Promissory Note For Fixed Rate. You can modify repayment schedules, interest rates, and other specific conditions to fit your requirements.

-

Does airSlate SignNow integrate with other applications for managing Georgia Unsecured Installment Payment Promissory Notes?

Yes, airSlate SignNow offers various integrations with popular applications to enhance your workflow. You can integrate it with tools for accounting, project management, and more, making it easier to manage your Georgia Unsecured Installment Payment Promissory Note For Fixed Rate in conjunction with other business processes.

-

What security measures does airSlate SignNow have for my Georgia Unsecured Installment Payment Promissory Note For Fixed Rate?

airSlate SignNow prioritizes the security of your documents, including the Georgia Unsecured Installment Payment Promissory Note For Fixed Rate. Our platform employs encryption protocols and complies with industry standards to ensure that your information remains confidential and protected.

Get more for Georgia Unsecured Installment Payment Promissory Note For Fixed Rate

Find out other Georgia Unsecured Installment Payment Promissory Note For Fixed Rate

- Electronic signature Maine Car Dealer Promissory Note Template Later

- Electronic signature Maryland Car Dealer POA Now

- Electronic signature Oklahoma Banking Affidavit Of Heirship Mobile

- Electronic signature Oklahoma Banking Separation Agreement Myself

- Electronic signature Hawaii Business Operations Permission Slip Free

- How Do I Electronic signature Hawaii Business Operations Forbearance Agreement

- Electronic signature Massachusetts Car Dealer Operating Agreement Free

- How To Electronic signature Minnesota Car Dealer Credit Memo

- Electronic signature Mississippi Car Dealer IOU Now

- Electronic signature New Hampshire Car Dealer NDA Now

- Help Me With Electronic signature New Hampshire Car Dealer Warranty Deed

- Electronic signature New Hampshire Car Dealer IOU Simple

- Electronic signature Indiana Business Operations Limited Power Of Attorney Online

- Electronic signature Iowa Business Operations Resignation Letter Online

- Electronic signature North Carolina Car Dealer Purchase Order Template Safe

- Electronic signature Kentucky Business Operations Quitclaim Deed Mobile

- Electronic signature Pennsylvania Car Dealer POA Later

- Electronic signature Louisiana Business Operations Last Will And Testament Myself

- Electronic signature South Dakota Car Dealer Quitclaim Deed Myself

- Help Me With Electronic signature South Dakota Car Dealer Quitclaim Deed