FINTRAC Suspicious Transaction Report Form CANAFE 2008-2026

What is the FINTRAC Suspicious Transaction Report Form?

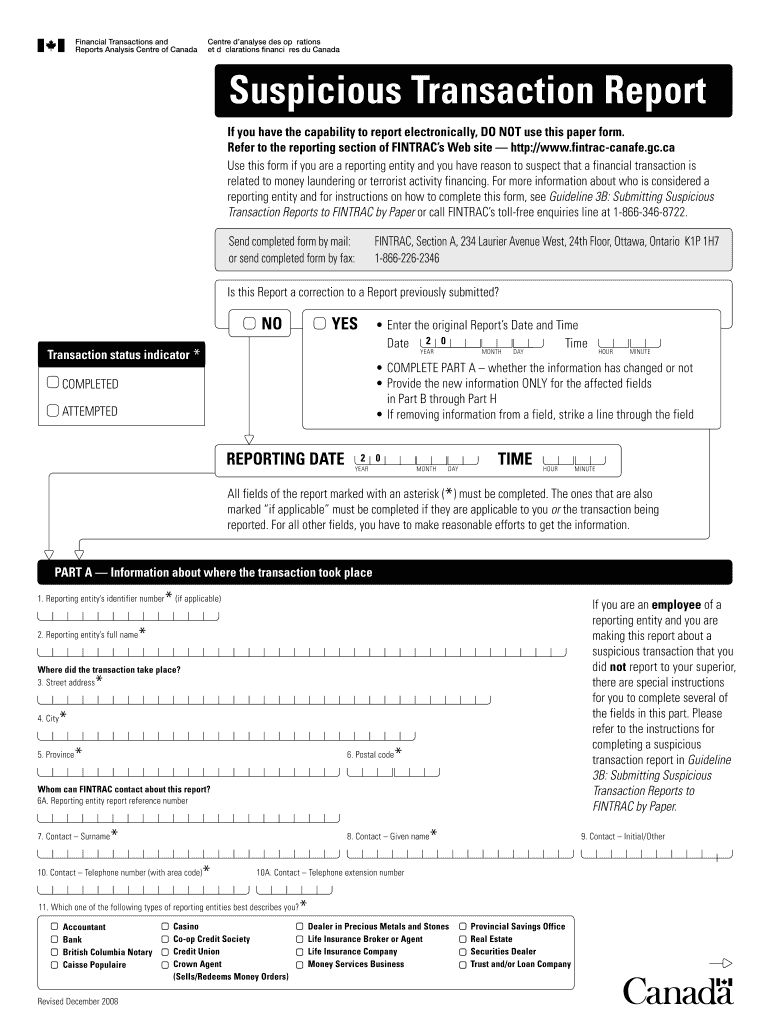

The FINTRAC Suspicious Transaction Report Form, often referred to as the CANAFE form, is a critical document used in Canada for reporting suspicious financial activities. It is designed to assist financial institutions and other reporting entities in complying with the Proceeds of Crime (Money Laundering) and Terrorist Financing Act. By submitting this form, organizations can report transactions that they suspect may be linked to money laundering or terrorist financing, thereby contributing to national security and the integrity of the financial system.

Steps to Complete the FINTRAC Suspicious Transaction Report Form

Completing the FINTRAC Suspicious Transaction Report Form involves several key steps to ensure accuracy and compliance. First, gather all relevant information regarding the suspicious transaction, including the date, amount, and parties involved. Next, fill out the form with detailed descriptions of the transaction and the reasons for suspicion. It is essential to provide clear and concise information to facilitate the review process. After completing the form, review it for any errors or omissions before submission. Finally, ensure that the form is submitted through the appropriate channels, whether electronically or via mail, in accordance with regulatory requirements.

Key Elements of the FINTRAC Suspicious Transaction Report Form

The FINTRAC Suspicious Transaction Report Form contains several key elements that must be accurately completed. These include:

- Identification of the Reporting Entity: This section requires the name and contact information of the entity submitting the report.

- Details of the Suspicious Transaction: Report the specifics of the transaction, including date, amount, and nature of the transaction.

- Reason for Suspicion: Clearly articulate the reasons for suspecting the transaction is linked to criminal activity.

- Client Information: Provide details about the individuals or entities involved in the transaction.

Legal Use of the FINTRAC Suspicious Transaction Report Form

The legal use of the FINTRAC Suspicious Transaction Report Form is governed by Canadian laws aimed at preventing money laundering and terrorist financing. Financial institutions and other obligated entities are required to submit this form when they detect suspicious activities. Failure to report can result in significant penalties, including fines and legal repercussions. It is essential for organizations to understand their obligations under the law and ensure that they are compliant with all reporting requirements.

How to Obtain the FINTRAC Suspicious Transaction Report Form

The FINTRAC Suspicious Transaction Report Form can be obtained through the official FINTRAC website or directly from regulatory bodies overseeing financial transactions. Organizations can access the form in various formats, including electronic versions for online submission. It is important for reporting entities to ensure they are using the most current version of the form to comply with regulatory standards.

Examples of Using the FINTRAC Suspicious Transaction Report Form

Examples of using the FINTRAC Suspicious Transaction Report Form include situations where a bank notices unusual patterns in a client’s transactions, such as large cash deposits followed by immediate withdrawals. Another example is when a real estate company identifies a buyer making an unusually high purchase without a clear source of funds. In both cases, completing and submitting the CANAFE form is crucial for reporting these suspicious activities to the appropriate authorities.

Quick guide on how to complete fintrac suspicious transaction report form canafe

Complete FINTRAC Suspicious Transaction Report Form CANAFE seamlessly on any device

Digital document management has become favored by enterprises and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your files quickly without delays. Manage FINTRAC Suspicious Transaction Report Form CANAFE on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to edit and eSign FINTRAC Suspicious Transaction Report Form CANAFE effortlessly

- Obtain FINTRAC Suspicious Transaction Report Form CANAFE and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight pertinent parts of the documents or redact sensitive information using tools that airSlate SignNow specifically offers for this purpose.

- Generate your eSignature with the Sign tool, which only takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your updates.

- Choose your preferred method to send your form—via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choosing. Edit and eSign FINTRAC Suspicious Transaction Report Form CANAFE and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fintrac suspicious transaction report form canafe

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a FINTRAC form and why is it important?

A FINTRAC form is a document required by the Financial Transactions and Reports Analysis Centre of Canada for reporting certain financial transactions. It's essential for compliance with regulations that help prevent money laundering and terrorist financing. By using airSlate SignNow, you can easily complete and eSign your FINTRAC forms, ensuring that your business remains compliant.

-

How does airSlate SignNow simplify the process of completing a FINTRAC form?

airSlate SignNow simplifies the FINTRAC form process by providing an intuitive interface that allows users to fill out and sign documents electronically. With easy document sharing and tracking features, you can streamline your compliance workflow. This reduces the risk of errors and speeds up the submission process.

-

Is the airSlate SignNow solution cost-effective for businesses needing to file FINTRAC forms?

Yes, airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes needing to file FINTRAC forms. With various subscription options, you can find a plan that fits your budget while still receiving a robust eSigning solution. The time and cost savings associated with electronic signatures can signNowly benefit your overall operations.

-

What features does airSlate SignNow offer for managing FINTRAC forms?

airSlate SignNow includes features such as customizable templates, workflows, and secure eSignature capabilities that are ideal for managing FINTRAC forms. You can create reusable templates, ensuring compliance with regulatory requirements every time. Additionally, the platform allows for document tracking and audit trails to enhance security and accountability.

-

Can airSlate SignNow integrate with other software for handling FINTRAC forms?

Yes, airSlate SignNow can integrate with various third-party applications, making it easier to handle FINTRAC forms alongside your existing software solutions. These integrations streamline workflows by allowing you to import data from your CRM or export completed documents to accounting systems. This ensures efficiency and a seamless experience for users.

-

How secure is the process of signing and storing FINTRAC forms with airSlate SignNow?

The security of your FINTRAC forms is a top priority for airSlate SignNow, which employs industry-leading encryption and security protocols. Your signed documents are securely stored in the cloud, preventing unauthorized access. Compliance with privacy regulations further enhances the protection of sensitive financial information.

-

What are the benefits of using airSlate SignNow for eSigning FINTRAC forms?

Using airSlate SignNow for eSigning FINTRAC forms offers numerous benefits, including efficiency, cost savings, and improved compliance. The platform's easy-to-use interface allows users to complete forms quickly and securely. Moreover, your team can collaborate in real-time, ensuring that all necessary parties can review and sign documents promptly.

Get more for FINTRAC Suspicious Transaction Report Form CANAFE

- Tr 321 form

- Form 15c consent motion to change ontario court services

- Transport document for lithium batteries form

- Harris teeter educational leave form

- Qaf no authorization required form medicaid clear health alliance

- Property lossdamage claim form garrun group

- Outlaw quadruped nutria amp beaver night take qnbnt permit form

- License application form kentucky

Find out other FINTRAC Suspicious Transaction Report Form CANAFE

- Help Me With eSign Hawaii Healthcare / Medical PDF

- How To eSign Arizona High Tech Document

- How Can I eSign Illinois Healthcare / Medical Presentation

- Can I eSign Hawaii High Tech Document

- How Can I eSign Hawaii High Tech Document

- How Do I eSign Hawaii High Tech Document

- Can I eSign Hawaii High Tech Word

- How Can I eSign Hawaii High Tech Form

- How Do I eSign New Mexico Healthcare / Medical Word

- How To eSign Washington High Tech Presentation

- Help Me With eSign Vermont Healthcare / Medical PPT

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form