Form 4562 Depreciation and Amortization Irs

What is the Form 4562 Depreciation and Amortization IRS

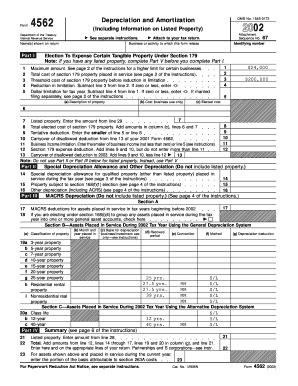

The Form 4562 is a crucial document used by businesses and individuals to report depreciation and amortization on their tax returns. This form allows taxpayers to claim deductions for the depreciation of property used in a trade or business, as well as for the amortization of certain intangible assets. Understanding the purpose of this form is essential for accurate tax reporting and maximizing potential deductions.

Steps to Complete the Form 4562 Depreciation and Amortization IRS

Completing the Form 4562 involves several steps to ensure accuracy and compliance with IRS guidelines. Here is a simplified process:

- Gather all necessary documentation related to the assets you are claiming depreciation or amortization for.

- Determine the type of property and its applicable depreciation method, such as straight-line or declining balance.

- Fill out the form by entering the required information, including the date the property was placed in service and the cost basis.

- Calculate the depreciation or amortization for the current tax year using the appropriate tables provided by the IRS.

- Review the completed form for accuracy before submission.

Legal Use of the Form 4562 Depreciation and Amortization IRS

The legal use of Form 4562 is governed by IRS regulations, which dictate how and when it should be filed. This form is legally binding when completed accurately and submitted on time. It is essential for taxpayers to follow IRS guidelines to avoid penalties and ensure that all claimed deductions are valid. Proper documentation and adherence to the rules surrounding depreciation and amortization are critical for compliance.

IRS Guidelines for Form 4562 Depreciation and Amortization

The IRS provides specific guidelines for completing and filing Form 4562. These guidelines include instructions on the types of property eligible for depreciation, the methods of calculating depreciation, and the timelines for filing the form. Taxpayers should refer to the latest IRS publications to stay updated on any changes to the rules or procedures associated with this form.

Examples of Using the Form 4562 Depreciation and Amortization IRS

Examples of using Form 4562 can help clarify its application in real-world scenarios. For instance, a business that purchases new machinery can use this form to report the depreciation over its useful life. Similarly, an individual who invests in a patent can claim amortization on the intangible asset. These examples illustrate how the form facilitates tax deductions for various types of property and investments.

Filing Deadlines for Form 4562 Depreciation and Amortization IRS

Filing deadlines for Form 4562 align with the overall tax filing deadlines for individuals and businesses. Typically, this form must be submitted by the tax return due date, including any extensions. It is important for taxpayers to be aware of these deadlines to ensure timely filing and avoid potential penalties.

Quick guide on how to complete form 4562 depreciation and amortization irs

Complete Form 4562 Depreciation And Amortization Irs effortlessly on any device

Managing documents online has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can obtain the necessary form and securely keep it online. airSlate SignNow equips you with all the tools needed to create, edit, and eSign your documents rapidly without delays. Handle Form 4562 Depreciation And Amortization Irs on any device using the airSlate SignNow apps for Android or iOS and streamline any document-related task today.

How to edit and eSign Form 4562 Depreciation And Amortization Irs with ease

- Obtain Form 4562 Depreciation And Amortization Irs and click Get Form to initiate.

- Utilize the tools we provide to complete your form.

- Mark pertinent sections of the documents or conceal sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet signature.

- Review the details and click the Done button to save your changes.

- Choose your preferred method for delivering your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you select. Edit and eSign Form 4562 Depreciation And Amortization Irs and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 4562 depreciation and amortization irs

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a form 4562 example used for?

A form 4562 example is primarily used to report depreciation and amortization on your tax return. This form helps businesses claim deductions for their asset purchases, which can signNowly affect your overall tax liability. Utilizing a form 4562 example in your tax preparations ensures compliance and maximizes your benefits.

-

How can airSlate SignNow assist with form 4562 example submissions?

airSlate SignNow allows you to easily create, send, and eSign documents such as a form 4562 example. With its user-friendly interface, you can quickly tailor your forms and ensure they are delivered promptly, simplifying your submission process. This enhances efficiency and reduces potential errors in your paperwork.

-

What features does airSlate SignNow offer for managing form 4562 example?

airSlate SignNow offers features that enable users to create customizable templates, including a form 4562 example. You can utilize eSignature capabilities, automated reminders, and real-time tracking. These features help streamline your documentation process and ensure timely responses.

-

Is there a cost associated with using airSlate SignNow for form 4562 example?

Yes, there is a cost associated with using airSlate SignNow, but it is designed to be a cost-effective solution for managing your documentation needs, including a form 4562 example. Pricing plans are flexible, catering to the varying needs of businesses, whether small or large. You can choose a plan that fits your budget and requirements.

-

Can I integrate airSlate SignNow with other accounting software to manage form 4562 example?

Absolutely! airSlate SignNow offers seamless integrations with various accounting software, making the management of a form 4562 example easier. This means you can connect your eSignature processes with tools you already use, enhancing productivity and streamlining your workflows.

-

What are the benefits of using airSlate SignNow for a form 4562 example?

Using airSlate SignNow for a form 4562 example enhances efficiency by allowing quick document generation, eSigning, and tracking. You can reduce the time spent on paperwork and minimize the risk of errors, ensuring accurate submissions. The overall benefit is a streamlined experience that saves time and resources.

-

How secure is airSlate SignNow when handling sensitive documents like form 4562 example?

Security is a top priority for airSlate SignNow. When handling sensitive documents such as a form 4562 example, the platform employs advanced encryption and security protocols to protect your information. Rest assured, your data remains confidential and safe throughout the entire process.

Get more for Form 4562 Depreciation And Amortization Irs

Find out other Form 4562 Depreciation And Amortization Irs

- How Do I Electronic signature New Hampshire Legal LLC Operating Agreement

- How Can I Electronic signature New Mexico Legal Forbearance Agreement

- Electronic signature New Jersey Legal Residential Lease Agreement Fast

- How To Electronic signature New York Legal Lease Agreement

- How Can I Electronic signature New York Legal Stock Certificate

- Electronic signature North Carolina Legal Quitclaim Deed Secure

- How Can I Electronic signature North Carolina Legal Permission Slip

- Electronic signature Legal PDF North Dakota Online

- Electronic signature North Carolina Life Sciences Stock Certificate Fast

- Help Me With Electronic signature North Dakota Legal Warranty Deed

- Electronic signature North Dakota Legal Cease And Desist Letter Online

- Electronic signature North Dakota Legal Cease And Desist Letter Free

- Electronic signature Delaware Orthodontists Permission Slip Free

- How Do I Electronic signature Hawaii Orthodontists Lease Agreement Form

- Electronic signature North Dakota Life Sciences Business Plan Template Now

- Electronic signature Oklahoma Legal Bill Of Lading Fast

- Electronic signature Oklahoma Legal Promissory Note Template Safe

- Electronic signature Oregon Legal Last Will And Testament Online

- Electronic signature Life Sciences Document Pennsylvania Simple

- Electronic signature Legal Document Pennsylvania Online