Bolingbrook Restaurant Tax Form

What is the Bolingbrook Restaurant Tax Form

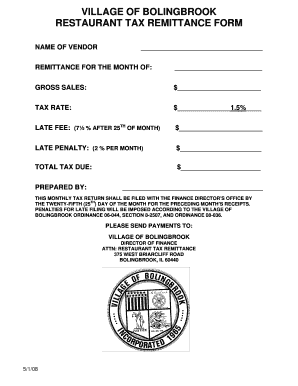

The Bolingbrook Restaurant Tax Form is a specific document required for restaurants operating within Bolingbrook, Illinois. This form is used to report and remit the local restaurant tax imposed on the sales of food and beverages. Understanding the nuances of this form is essential for compliance with local tax regulations. It ensures that restaurants accurately account for their tax liabilities and contribute to local funding initiatives.

How to use the Bolingbrook Restaurant Tax Form

Using the Bolingbrook Restaurant Tax Form involves several key steps. First, businesses must gather all relevant sales data, including total food and beverage sales. Next, they should calculate the applicable tax based on the current local tax rate. Once these figures are determined, the form can be filled out, detailing the sales and tax amounts. Finally, the completed form must be submitted to the appropriate local tax authority, either online or via mail, depending on the submission options available.

Steps to complete the Bolingbrook Restaurant Tax Form

Completing the Bolingbrook Restaurant Tax Form requires careful attention to detail. Here are the main steps:

- Gather sales records for the reporting period.

- Calculate the total sales of food and beverages.

- Determine the applicable restaurant tax rate.

- Fill in the form with accurate sales and tax amounts.

- Review the form for any errors or omissions.

- Submit the form to the local tax authority by the specified deadline.

Legal use of the Bolingbrook Restaurant Tax Form

The legal use of the Bolingbrook Restaurant Tax Form is governed by local tax laws and regulations. To ensure compliance, businesses must accurately report their sales and remit the correct amount of tax. Failure to do so can result in penalties, including fines or interest on unpaid taxes. It is crucial for restaurant owners to stay informed about any changes in tax laws that may affect their reporting obligations.

Filing Deadlines / Important Dates

Filing deadlines for the Bolingbrook Restaurant Tax Form are typically set by the local tax authority. It is important for businesses to be aware of these dates to avoid late fees. Generally, forms may be due on a monthly or quarterly basis, depending on the volume of sales. Keeping a calendar of these important dates can help ensure timely submissions and compliance.

Required Documents

To complete the Bolingbrook Restaurant Tax Form, certain documents are necessary. These may include:

- Sales records for the reporting period.

- Previous tax returns, if applicable.

- Any relevant correspondence from the local tax authority.

Having these documents on hand will facilitate accurate form completion and help ensure compliance with local tax requirements.

Quick guide on how to complete bolingbrook restaurant tax form

Effortlessly Prepare Bolingbrook Restaurant Tax Form on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers a perfect eco-friendly substitute for traditional printed and signed documents, as you can access the required form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your papers swiftly and without delays. Handle Bolingbrook Restaurant Tax Form on any device using airSlate SignNow’s Android or iOS applications and simplify any documentation process today.

How to Edit and eSign Bolingbrook Restaurant Tax Form with Ease

- Locate Bolingbrook Restaurant Tax Form and click on Get Form to begin.

- Leverage the tools we offer to fill out your document.

- Mark important sections of the documents or conceal sensitive information using the tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method of sharing your form, whether it be via email, text message (SMS), invitation link, or download it to your computer.

No more concerns about lost or misplaced documents, cumbersome form searches, or mistakes that require new copies to be printed. airSlate SignNow addresses your document management needs with just a few clicks from your chosen device. Edit and eSign Bolingbrook Restaurant Tax Form while ensuring effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the bolingbrook restaurant tax form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Bolingbrook Restaurant Tax Form and why do I need it?

The Bolingbrook Restaurant Tax Form is a specific document required for restaurants operating in Bolingbrook to report their tax obligations. It helps ensure compliance with local tax regulations, thus avoiding penalties. Accurate and timely submission of this form is vital for any restaurant owner to maintain smooth operations.

-

How can airSlate SignNow help me with the Bolingbrook Restaurant Tax Form?

airSlate SignNow streamlines the process of completing and eSigning the Bolingbrook Restaurant Tax Form. Our platform simplifies document management, allowing restaurant owners to easily fill out, sign, and send forms securely. This saves time and reduces errors in the submission process.

-

What features does airSlate SignNow offer for managing the Bolingbrook Restaurant Tax Form?

airSlate SignNow offers an intuitive interface, robust eSignature capabilities, and document templates specifically designed for the Bolingbrook Restaurant Tax Form. Additional features include automatic reminders for deadlines and a secure storage system for compliance purposes. These tools help maximize efficiency in document handling.

-

Is airSlate SignNow a cost-effective solution for handling Bolingbrook Restaurant Tax Forms?

Yes, airSlate SignNow provides a cost-effective solution for managing Bolingbrook Restaurant Tax Forms. Our pricing plans are designed to cater to businesses of all sizes, ensuring you only pay for the features you need. This helps restaurant owners save on administrative costs while ensuring compliance.

-

Can I integrate airSlate SignNow with my existing accounting software for the Bolingbrook Restaurant Tax Form?

Absolutely! airSlate SignNow offers integrations with various accounting software platforms, making it easier to manage the Bolingbrook Restaurant Tax Form alongside your other financial documents. This seamless integration saves time and helps maintain accurate financial records effortlessly.

-

What are the benefits of using airSlate SignNow for the Bolingbrook Restaurant Tax Form?

Using airSlate SignNow for the Bolingbrook Restaurant Tax Form provides several benefits, such as enhanced efficiency, improved accuracy, and better security. You will reduce the risk of errors in your tax submissions, ensure that forms are submitted on time, and keep sensitive information secure. Our solution modernizes the way restaurants handle their tax forms.

-

How do I get started with airSlate SignNow for my Bolingbrook Restaurant Tax Form?

Getting started with airSlate SignNow is easy! Simply visit our website to sign up for an account, choose a plan that fits your needs, and begin using our platform to prepare and eSign your Bolingbrook Restaurant Tax Form. Our support team is available to assist you through the setup process.

Get more for Bolingbrook Restaurant Tax Form

- Crew medical claim form pantaenius

- Process safety 101 quiz answers form

- Social security office close to ga tech form

- Kaimosi college of research and technology form

- Facetoface form

- Calfpig scramble entry form madison county extension office madison ifas ufl

- Chas referral form 379821136

- Mba test pass tp no nsu north south university school of w3 northsouth form

Find out other Bolingbrook Restaurant Tax Form

- Can I eSign Washington Charity LLC Operating Agreement

- eSign Wyoming Charity Living Will Simple

- eSign Florida Construction Memorandum Of Understanding Easy

- eSign Arkansas Doctors LLC Operating Agreement Free

- eSign Hawaii Construction Lease Agreement Mobile

- Help Me With eSign Hawaii Construction LLC Operating Agreement

- eSign Hawaii Construction Work Order Myself

- eSign Delaware Doctors Quitclaim Deed Free

- eSign Colorado Doctors Operating Agreement Computer

- Help Me With eSign Florida Doctors Lease Termination Letter

- eSign Florida Doctors Lease Termination Letter Myself

- eSign Hawaii Doctors Claim Later

- eSign Idaho Construction Arbitration Agreement Easy

- eSign Iowa Construction Quitclaim Deed Now

- How Do I eSign Iowa Construction Quitclaim Deed

- eSign Louisiana Doctors Letter Of Intent Fast

- eSign Maine Doctors Promissory Note Template Easy

- eSign Kentucky Construction Claim Online

- How Can I eSign Maine Construction Quitclaim Deed

- eSign Colorado Education Promissory Note Template Easy