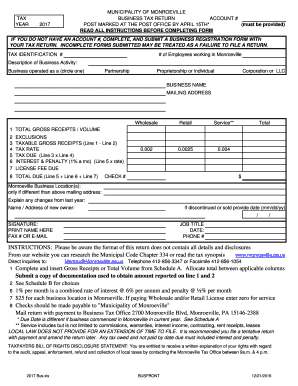

Monroeville Business Tax Return 2017-2026

What is the PA Business Tax Return?

The PA business tax return is a crucial document for businesses operating within Pennsylvania, including Monroeville. This form is used to report income, calculate tax liabilities, and ensure compliance with state tax regulations. It is essential for various business entities, including corporations, partnerships, and sole proprietorships, to accurately complete this return to avoid penalties and maintain good standing with state authorities.

Steps to Complete the PA Business Tax Return

Completing the PA business tax return involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary financial documents, including income statements, expense records, and prior tax returns. Next, fill out the appropriate sections of the form, detailing your business income, deductions, and credits. It is important to double-check all entries for accuracy before submission. Finally, sign and date the return, ensuring that all required signatures are included to validate the document.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the PA business tax return is critical to avoid late fees and penalties. Typically, the deadline for submitting this return aligns with the federal tax filing deadline, which is April 15 for most businesses. However, certain business entities may have different deadlines based on their fiscal year. It is advisable to check for any updates or changes to these dates annually to ensure timely filing.

Required Documents

To complete the PA business tax return, several documents are necessary. These include:

- Profit and loss statements

- Balance sheets

- Receipts for deductible expenses

- Prior year tax returns

- Any relevant schedules or forms specific to your business type

Having these documents readily available will streamline the completion process and help ensure accuracy.

Form Submission Methods

The PA business tax return can be submitted through various methods, providing flexibility for businesses. Options include:

- Online submission through the Pennsylvania Department of Revenue's e-filing system

- Mailing a paper copy to the appropriate tax office

- In-person submission at designated tax offices

Each method has its own advantages, such as immediate confirmation for online submissions or the ability to retain a physical copy when mailed.

Legal Use of the PA Business Tax Return

The PA business tax return serves as a legally binding document when completed and submitted according to state regulations. To ensure its legal standing, businesses must adhere to all applicable tax laws and guidelines. This includes providing accurate information, maintaining proper records, and signing the return. Compliance with these requirements helps protect businesses from legal issues and potential audits.

Penalties for Non-Compliance

Failure to file the PA business tax return on time or inaccuracies in reporting can result in significant penalties. Common consequences include:

- Late filing fees

- Interest on unpaid taxes

- Potential audits by state tax authorities

Businesses should prioritize timely and accurate submissions to avoid these penalties and maintain their operational integrity.

Quick guide on how to complete monroeville business tax return

Complete Monroeville Business Tax Return seamlessly on any device

Digital document management has become increasingly popular among companies and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed papers, enabling you to access the appropriate form and securely store it online. airSlate SignNow provides all the tools required to create, modify, and electronically sign your documents swiftly without delays. Manage Monroeville Business Tax Return on any platform with airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest way to modify and electronically sign Monroeville Business Tax Return effortlessly

- Find Monroeville Business Tax Return and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Mark signNow sections of your documents or obscure sensitive details with features that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign feature, which takes seconds and holds the same legal standing as a traditional ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to submit your form, by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form hunting, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Monroeville Business Tax Return to ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the monroeville business tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a PA business tax return?

A PA business tax return is a document filed with the Pennsylvania Department of Revenue that reports income, deductions, and credits for businesses operating within the state. This return is essential for fulfilling state tax obligations and ensuring compliance. Understanding how to properly complete a PA business tax return can help prevent errors and potential penalties.

-

How can airSlate SignNow help with PA business tax returns?

airSlate SignNow streamlines the process of preparing and submitting PA business tax returns by facilitating electronic signatures and document management. With its user-friendly interface, you can easily gather the necessary signatures, reducing the time spent on paperwork. This efficiency supports timely tax submission and helps you stay organized.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow includes features like customizable templates, automated workflows, and secure document storage, all designed to simplify tax document management. These tools are particularly useful when dealing with complex PA business tax return requirements, allowing you to track progress and ensure all documents are complete. Additionally, the platform provides notifications and reminders to keep you on schedule.

-

Is airSlate SignNow affordable for small businesses handling PA business tax returns?

Yes, airSlate SignNow offers various pricing plans, making it an affordable solution for small businesses handling their PA business tax returns. The cost-effectiveness of the platform is highlighted by its emphasis on eliminating printing and mailing costs associated with traditional document handling. Investing in airSlate SignNow can ultimately save you time and money during tax season.

-

Can I integrate airSlate SignNow with my existing accounting software for filing PA business tax returns?

Absolutely! AirSlate SignNow supports integrations with popular accounting software, which helps streamline the entire tax filing process, including PA business tax returns. By connecting your accounting tools, you can efficiently transfer data and ensure accuracy across all platforms. This integration minimizes manual entry errors, making tax preparation smoother.

-

What are the benefits of using airSlate SignNow for eSignatures on tax documents?

Using airSlate SignNow for eSignatures on tax documents provides several benefits including enhanced security, faster turnaround times, and a more organized workflow. The platform ensures that your PA business tax return is signed and returned quickly, which is crucial as tax deadlines approach. Furthermore, it simplifies the document-tracking process so you can focus more on your business.

-

How do I get started with airSlate SignNow for my PA business tax return needs?

To get started with airSlate SignNow for your PA business tax return needs, simply sign up for an account and explore the platform’s intuitive dashboard. Create templates or upload documents related to your tax return, and begin inviting team members or clients to eSign. The onboarding process is straightforward, and customer support is available should you need assistance.

Get more for Monroeville Business Tax Return

Find out other Monroeville Business Tax Return

- eSign Oregon Doctors LLC Operating Agreement Mobile

- eSign Hawaii Education Claim Myself

- eSign Hawaii Education Claim Simple

- eSign Hawaii Education Contract Simple

- eSign Hawaii Education NDA Later

- How To eSign Hawaii Education NDA

- How Do I eSign Hawaii Education NDA

- eSign Hawaii Education Arbitration Agreement Fast

- eSign Minnesota Construction Purchase Order Template Safe

- Can I eSign South Dakota Doctors Contract

- eSign Mississippi Construction Rental Application Mobile

- How To eSign Missouri Construction Contract

- eSign Missouri Construction Rental Lease Agreement Easy

- How To eSign Washington Doctors Confidentiality Agreement

- Help Me With eSign Kansas Education LLC Operating Agreement

- Help Me With eSign West Virginia Doctors Lease Agreement Template

- eSign Wyoming Doctors Living Will Mobile

- eSign Wyoming Doctors Quitclaim Deed Free

- How To eSign New Hampshire Construction Rental Lease Agreement

- eSign Massachusetts Education Rental Lease Agreement Easy