Ohio Withholding Tax Forms 2017

What is the Ohio Withholding Tax Forms

The Ohio withholding tax forms are documents used by employers to report and remit state income tax withheld from employees' wages. These forms ensure compliance with state tax laws and help maintain accurate records for both employers and employees. The primary form for withholding tax in Ohio is the IT-4, which allows employees to indicate their withholding preferences based on their personal tax situation.

How to use the Ohio Withholding Tax Forms

Using the Ohio withholding tax forms involves several steps. Employers must first obtain the necessary forms, such as the IT-4, from the Ohio Department of Taxation or other authorized sources. Once the forms are acquired, employers should provide them to their employees for completion. Employees fill out the forms to specify their withholding allowances, which will determine the amount of state income tax deducted from their paychecks. Employers then use this information to calculate and remit the correct amount of withholding tax to the state.

Steps to complete the Ohio Withholding Tax Forms

Completing the Ohio withholding tax forms requires careful attention to detail. Here are the steps involved:

- Obtain the appropriate form, typically the IT-4.

- Fill in personal information, including name, address, and Social Security number.

- Indicate the number of allowances claimed based on personal circumstances.

- Sign and date the form to validate the information provided.

- Submit the completed form to the employer for processing.

Legal use of the Ohio Withholding Tax Forms

The legal use of Ohio withholding tax forms is governed by state tax regulations. These forms must be accurately completed and submitted to ensure compliance with Ohio tax laws. Employers are responsible for withholding the correct amount of state income tax from employees' wages and must maintain records of submitted forms. Failure to comply with these regulations can result in penalties and interest charges from the Ohio Department of Taxation.

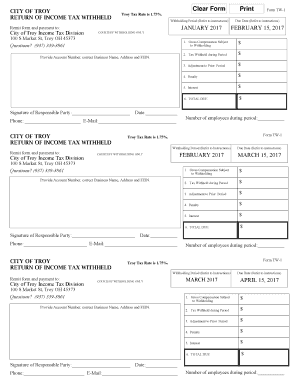

Filing Deadlines / Important Dates

Filing deadlines for Ohio withholding tax forms are crucial for compliance. Employers must submit the withheld taxes on a regular schedule, typically monthly or quarterly, depending on the amount withheld. Additionally, employees should submit their completed IT-4 forms to their employers upon starting employment or when their tax situation changes. It is essential to stay informed about any changes to these deadlines, which can vary from year to year.

Form Submission Methods (Online / Mail / In-Person)

Ohio withholding tax forms can be submitted through various methods. Employers have the option to file electronically through the Ohio Department of Taxation's online portal, which offers a streamlined process for submitting withholding tax payments. Alternatively, forms can be mailed to the appropriate tax office or submitted in person at designated locations. Each submission method has its own processing times and requirements, so employers should choose the method that best suits their needs.

Quick guide on how to complete ohio withholding tax forms

Effortlessly Prepare Ohio Withholding Tax Forms on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, as you can easily access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly and without delays. Manage Ohio Withholding Tax Forms on any device using airSlate SignNow's Android or iOS applications and streamline your document-related processes today.

How to Modify and Electronically Sign Ohio Withholding Tax Forms with Ease

- Locate Ohio Withholding Tax Forms and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Choose your preferred method of sending your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes requiring the printing of new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you choose. Modify and electronically sign Ohio Withholding Tax Forms to ensure effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ohio withholding tax forms

Create this form in 5 minutes!

How to create an eSignature for the ohio withholding tax forms

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are Ohio withholding tax forms?

Ohio withholding tax forms are documents businesses use to report and pay employee withholding taxes to the state of Ohio. These forms ensure compliance with state tax laws and are crucial for both employers and employees. Using a reliable solution like airSlate SignNow makes managing and submitting these forms much easier.

-

How can airSlate SignNow help with Ohio withholding tax forms?

airSlate SignNow simplifies the process of completing and submitting Ohio withholding tax forms by providing a user-friendly platform for document creation and e-signatures. With features designed for efficiency, businesses can quickly fill out, sign, and send these forms digitally, saving time and reducing errors.

-

Are there any fees associated with using airSlate SignNow for Ohio withholding tax forms?

airSlate SignNow offers affordable pricing plans tailored to different business needs, all while providing access to essential features for managing Ohio withholding tax forms. Our cost-effective solution ensures you get the functionality you need without breaking the bank. Check our website for the latest pricing options.

-

Can I integrate airSlate SignNow with other tools for Ohio withholding tax forms?

Yes, airSlate SignNow seamlessly integrates with numerous applications to enhance your workflow when handling Ohio withholding tax forms. Whether you're using accounting software or HR management systems, our platform easily connects to streamline document processing. This saves you time and minimizes potential issues during tax season.

-

What features does airSlate SignNow offer for managing Ohio withholding tax forms?

airSlate SignNow provides a range of features specifically designed for managing Ohio withholding tax forms, including customizable templates, secure e-signature capabilities, and automated reminders. These tools ensure that your forms are completed accurately and submitted on time, reducing the risk of penalties or late fees.

-

Is airSlate SignNow secure for handling sensitive Ohio withholding tax forms?

Absolutely! airSlate SignNow prioritizes the security of your documents, including sensitive Ohio withholding tax forms. We utilize advanced encryption and compliance protocols to protect your data, ensuring that your information remains safe and confidential throughout the signing process.

-

What are the benefits of using airSlate SignNow for Ohio withholding tax forms over traditional methods?

Using airSlate SignNow for Ohio withholding tax forms offers numerous benefits compared to traditional paper methods. It enhances efficiency by allowing for quick completion and digital submission, reduces the risk of errors, and provides a secure way to manage sensitive information—all while saving your business time and resources.

Get more for Ohio Withholding Tax Forms

- Kentwood electrical permit form

- Bank direct deposit authorization form

- Form 100 michigan

- Rice association of pakistan form

- Ge benefits participant vision care benefits claim forms

- Cancel gym membership form wikiform

- Visual acuity worksheets form

- Fleet mpg calculations for this period by fuel type form

Find out other Ohio Withholding Tax Forms

- Sign Nebraska Real Estate Letter Of Intent Online

- Sign Nebraska Real Estate Limited Power Of Attorney Mobile

- How Do I Sign New Mexico Sports Limited Power Of Attorney

- Sign Ohio Sports LLC Operating Agreement Easy

- Sign New Jersey Real Estate Limited Power Of Attorney Computer

- Sign New Mexico Real Estate Contract Safe

- How To Sign South Carolina Sports Lease Termination Letter

- How Can I Sign New York Real Estate Memorandum Of Understanding

- Sign Texas Sports Promissory Note Template Online

- Sign Oregon Orthodontists Last Will And Testament Free

- Sign Washington Sports Last Will And Testament Free

- How Can I Sign Ohio Real Estate LLC Operating Agreement

- Sign Ohio Real Estate Quitclaim Deed Later

- How Do I Sign Wisconsin Sports Forbearance Agreement

- How To Sign Oregon Real Estate Resignation Letter

- Can I Sign Oregon Real Estate Forbearance Agreement

- Sign Pennsylvania Real Estate Quitclaim Deed Computer

- How Do I Sign Pennsylvania Real Estate Quitclaim Deed

- How Can I Sign South Dakota Orthodontists Agreement

- Sign Police PPT Alaska Online