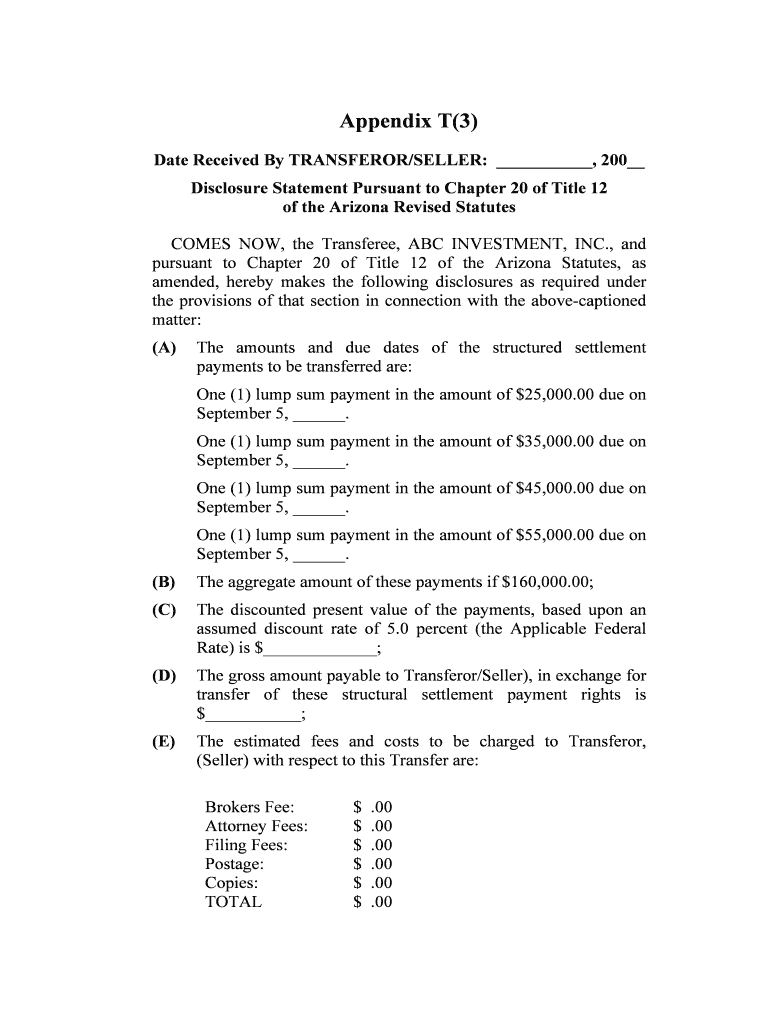

Appendix T3 Form

What is the Appendix T3

The Appendix T3 is a specific form used primarily for tax purposes in the United States. It is often associated with trusts and estates, serving as a means to report income generated by these entities. This form is essential for beneficiaries and trustees alike, ensuring that income is accurately reported to the Internal Revenue Service (IRS). The Appendix T3 allows for the proper allocation of income to beneficiaries, which is crucial for tax reporting and compliance.

How to use the Appendix T3

Using the Appendix T3 involves several steps to ensure accurate completion and submission. First, gather all necessary financial documents related to the trust or estate, including income statements and distribution records. Next, fill out the form with the required information, ensuring that all income sources are reported. It is important to allocate income correctly to each beneficiary, as this affects their individual tax obligations. Once completed, the form must be submitted to the IRS along with any applicable tax returns.

Steps to complete the Appendix T3

Completing the Appendix T3 requires careful attention to detail. Follow these steps:

- Collect all relevant financial documents, including income statements and distribution records.

- Fill out the form, starting with the trust or estate's identifying information.

- Report all income generated by the trust or estate, categorizing it appropriately.

- Allocate income to beneficiaries, ensuring accuracy in reporting their shares.

- Review the completed form for any errors or omissions.

- Submit the form to the IRS along with any required tax returns.

Legal use of the Appendix T3

The legal use of the Appendix T3 is governed by IRS regulations, which stipulate how income from trusts and estates should be reported. It is crucial for the form to be completed accurately to avoid potential legal complications. Trusts and estates must adhere to the rules set forth by the IRS to ensure compliance, especially regarding income allocation to beneficiaries. Failure to properly use the Appendix T3 can result in penalties or audits, making it vital to understand the legal implications of this form.

Filing Deadlines / Important Dates

Filing deadlines for the Appendix T3 are typically aligned with the tax return deadlines for trusts and estates. Generally, the form must be submitted by the fifteenth day of the fourth month following the end of the tax year. For most trusts and estates, this means that the filing deadline falls on April 15. It is important to be aware of any extensions or specific state variations that may apply, as these can affect the timing of submissions.

Required Documents

To complete the Appendix T3, several documents are required to ensure accurate reporting. These include:

- Income statements from all sources related to the trust or estate.

- Distribution records showing how income is allocated to beneficiaries.

- Previous tax returns for the trust or estate, if applicable.

- Any relevant legal documents, such as the trust agreement.

Who Issues the Form

The Appendix T3 is issued by the Internal Revenue Service (IRS). It is specifically designed for use by trusts and estates to report income and distributions to beneficiaries. The IRS provides guidelines and instructions for completing the form, ensuring that users understand their responsibilities when filing. It is essential to refer to the IRS website or official publications for the most current version of the form and any updates to filing procedures.

Quick guide on how to complete appendix t3

Finalize Appendix T3 effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally-friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the tools you require to create, edit, and eSign your documents promptly without delay. Handle Appendix T3 on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The simplest way to modify and eSign Appendix T3 without difficulty

- Obtain Appendix T3 and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Select important sections of the documents or redact sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Review the details and click on the Done button to confirm your changes.

- Decide how you would prefer to share your form, whether through email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or mistakes that necessitate printing additional copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Edit and eSign Appendix T3 while ensuring excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is Appendix T3 and how does it relate to airSlate SignNow?

Appendix T3 is a critical document in the realm of financial disclosures. With airSlate SignNow, you can easily eSign and send your Appendix T3 forms securely, ensuring compliance and accuracy in your business dealings.

-

How does airSlate SignNow simplify the process of signing Appendix T3 forms?

airSlate SignNow streamlines the signing process for Appendix T3 documents by providing an intuitive interface that enables users to fill out and eSign forms in just a few clicks. This reduces the time spent on paperwork, allowing you to focus on what matters most for your business.

-

What features does airSlate SignNow offer for managing Appendix T3 documents?

With airSlate SignNow, you get features like custom templates, automated workflows, and real-time tracking specifically designed for documents like Appendix T3. These features enhance efficiency and ensure that you stay organized and compliant throughout the process.

-

Is airSlate SignNow a cost-effective solution for handling Appendix T3 forms?

Absolutely! airSlate SignNow offers competitive pricing plans tailored to businesses of all sizes, making it a cost-effective solution for managing Appendix T3 forms. With its user-friendly interface and robust features, you can save money on printing and mailing costs.

-

Does airSlate SignNow integrate with other tools for processing Appendix T3 documents?

Yes, airSlate SignNow integrates seamlessly with various business applications, allowing you to automate the workflow of your Appendix T3 documents. This ensures better collaboration and efficiency, as you can connect it with CRMs, cloud storage, and more.

-

How secure is my information when using airSlate SignNow for Appendix T3 forms?

Security is our top priority at airSlate SignNow. When signing Appendix T3 documents, your data is protected with industry-grade encryption and compliance with strict regulations to ensure that your sensitive information remains safe.

-

Can I track the status of my Appendix T3 documents in airSlate SignNow?

Yes, airSlate SignNow provides real-time tracking for all your documents, including Appendix T3. You can monitor who has signed, who needs to sign, and ensure that all actions are completed in a timely manner.

Get more for Appendix T3

- Nb tuition rebate form

- Address assignment county of san bernardino home cms sbcounty form

- Authorization and direction to pay todd039s body shop form

- No trespassing order 46763796 form

- Cuyahoga county transfer on death deed form

- Uncontested divorce in albany ga form

- Ip purchase agreement template form

- Ip transfer agreement template form

Find out other Appendix T3

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer

- eSignature Colorado Charity LLC Operating Agreement Now

- eSignature Missouri Car Dealer Purchase Order Template Easy

- eSignature Indiana Charity Residential Lease Agreement Simple

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy