Wisconsin Real Estate Magazine I Noticed You 2022-2026

Understanding the 2010 WB41 Form

The 2010 WB41 form, officially known as the Wisconsin Business Franchise Tax Return, is essential for businesses operating in Wisconsin. This form is used to report income and calculate the franchise tax owed to the state. Understanding its purpose is crucial for compliance and accurate tax reporting. The form captures various financial details, including gross receipts, deductions, and credits applicable to the business entity.

Steps to Complete the 2010 WB41 Form

Filling out the 2010 WB41 form requires careful attention to detail. Here are the key steps to follow:

- Gather necessary financial documents, including income statements and previous tax returns.

- Fill in the business identification information, such as name, address, and federal employer identification number (EIN).

- Report total gross receipts and any applicable deductions accurately.

- Calculate the franchise tax based on the provided instructions.

- Review the completed form for accuracy before submission.

Legal Use of the 2010 WB41 Form

The 2010 WB41 form must be completed and submitted in accordance with Wisconsin state laws. It serves as a legal document that reports a business's financial activities and tax obligations. Ensuring that all information is accurate and submitted on time helps avoid penalties and legal issues. Businesses should retain copies of the submitted form and any supporting documentation for their records.

Filing Deadlines for the 2010 WB41 Form

Timely submission of the 2010 WB41 form is critical to avoid penalties. The standard deadline for filing is typically the 15th day of the fourth month following the close of the business's fiscal year. For businesses operating on a calendar year, this means the form is due by April 15. Extensions may be available, but they must be requested in advance and are subject to specific conditions.

Form Submission Methods for the 2010 WB41

The 2010 WB41 form can be submitted through various methods, ensuring flexibility for businesses. Options include:

- Online submission through the Wisconsin Department of Revenue's e-file system.

- Mailing a paper copy of the completed form to the appropriate address provided by the state.

- In-person submission at designated state offices for immediate processing.

Required Documents for the 2010 WB41 Form

When preparing to file the 2010 WB41 form, certain documents are necessary to ensure accurate reporting. Required documents typically include:

- Financial statements, including balance sheets and income statements.

- Records of gross receipts and any deductions claimed.

- Previous tax returns for reference and consistency.

Examples of Using the 2010 WB41 Form

Understanding practical applications of the 2010 WB41 form can aid in its completion. For instance, a small business owner may use the form to report income from sales and calculate the franchise tax owed. Similarly, a partnership must file the form to report its collective income and ensure compliance with state tax laws. Each business scenario may require different considerations, but the fundamental use of the form remains consistent across types.

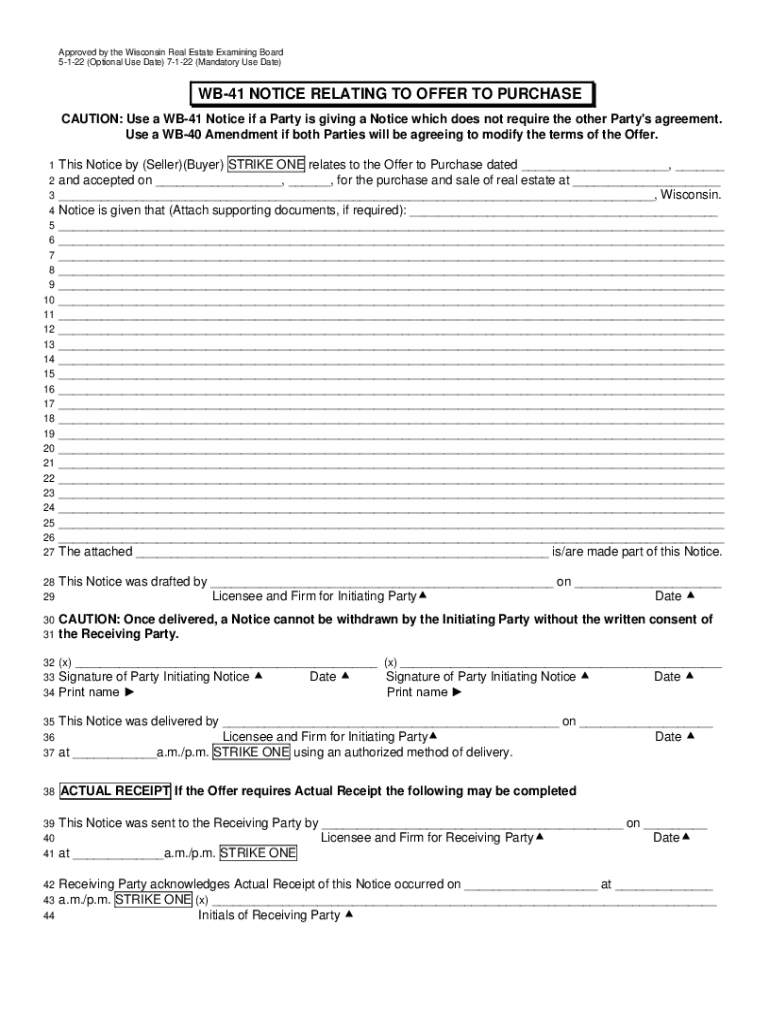

Quick guide on how to complete wisconsin real estate magazine i noticed you

Complete Wisconsin Real Estate Magazine I Noticed You effortlessly on any device

Digital document management has gained traction among organizations and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to obtain the correct form and safely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly and efficiently. Handle Wisconsin Real Estate Magazine I Noticed You on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and eSign Wisconsin Real Estate Magazine I Noticed You without hassle

- Obtain Wisconsin Real Estate Magazine I Noticed You and click Get Form to begin.

- Utilize the tools we provide to finalize your form.

- Emphasize important sections of the documents or redact sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to store your modifications.

- Select how you'd like to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your preference. Edit and eSign Wisconsin Real Estate Magazine I Noticed You and guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct wisconsin real estate magazine i noticed you

Create this form in 5 minutes!

How to create an eSignature for the wisconsin real estate magazine i noticed you

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2010 wb41 fillable form and how can I use it?

The 2010 wb41 fillable form is an essential document for filing your taxes related to business income. With airSlate SignNow, you can easily fill, sign, and eFile this form securely online. Our platform ensures that your information is saved and accessible whenever you need to complete the 2010 wb41 fillable form.

-

How can airSlate SignNow help streamline the completion of the 2010 wb41 fillable form?

airSlate SignNow offers an intuitive interface that makes it easy to fill out the 2010 wb41 fillable form without the hassle of paper documents. You can edit, sign, and send the form within minutes. Additionally, our solution integrates seamlessly with popular cloud storage platforms for easy document management.

-

Is there a cost associated with using the airSlate SignNow platform for the 2010 wb41 fillable form?

Yes, airSlate SignNow offers various pricing plans tailored to meet different business needs. You can access the 2010 wb41 fillable form, along with other document solutions, at an affordable monthly rate. We also provide a free trial, so you can explore our features before making a commitment.

-

Can I save my progress when filling out a 2010 wb41 fillable form on airSlate SignNow?

Absolutely! airSlate SignNow allows users to save their progress when completing the 2010 wb41 fillable form. This feature ensures that you can return later to finalize and submit your document without losing any of the information you've already entered.

-

Are there any integrations available with airSlate SignNow for handling the 2010 wb41 fillable form?

Yes, airSlate SignNow integrates with numerous applications like Google Drive, Dropbox, and Microsoft Office. This allows you to easily manage and access your documents, including the 2010 wb41 fillable form, from various platforms, enhancing your productivity and workflow.

-

What are the key benefits of using airSlate SignNow for the 2010 wb41 fillable form?

The primary benefits of using airSlate SignNow for the 2010 wb41 fillable form include enhanced efficiency, convenience of eSigning, and secure document storage. Our platform also helps reduce paper usage and streamline the entire signing process, making tax filing more straightforward and less time-consuming.

-

Is the 2010 wb41 fillable form compliant with IRS regulations when using airSlate SignNow?

Yes, the 2010 wb41 fillable form completed through airSlate SignNow is designed to comply with IRS regulations. We prioritize the secure handling of your sensitive information, ensuring that all documents adhere to the necessary guidelines for tax submissions.

Get more for Wisconsin Real Estate Magazine I Noticed You

Find out other Wisconsin Real Estate Magazine I Noticed You

- eSign Missouri Work Order Computer

- eSign Hawaii Electrical Services Contract Safe

- eSign Texas Profit Sharing Agreement Template Safe

- eSign Iowa Amendment to an LLC Operating Agreement Myself

- eSign Kentucky Amendment to an LLC Operating Agreement Safe

- eSign Minnesota Affidavit of Identity Now

- eSign North Dakota Affidavit of Identity Free

- Help Me With eSign Illinois Affidavit of Service

- eSign North Dakota Affidavit of Identity Simple

- eSign Maryland Affidavit of Service Now

- How To eSign Hawaii Affidavit of Title

- How Do I eSign New Mexico Affidavit of Service

- How To eSign Texas Affidavit of Title

- How Do I eSign Texas Affidavit of Service

- eSign California Cease and Desist Letter Online

- eSign Colorado Cease and Desist Letter Free

- How Do I eSign Alabama Hold Harmless (Indemnity) Agreement

- eSign Connecticut Hold Harmless (Indemnity) Agreement Mobile

- eSign Hawaii Hold Harmless (Indemnity) Agreement Mobile

- Help Me With eSign Hawaii Hold Harmless (Indemnity) Agreement