Ventura County BOE 571 R CA Assessors Association 2023-2026

What is the Ventura County BOE 571 R CA Assessors Association?

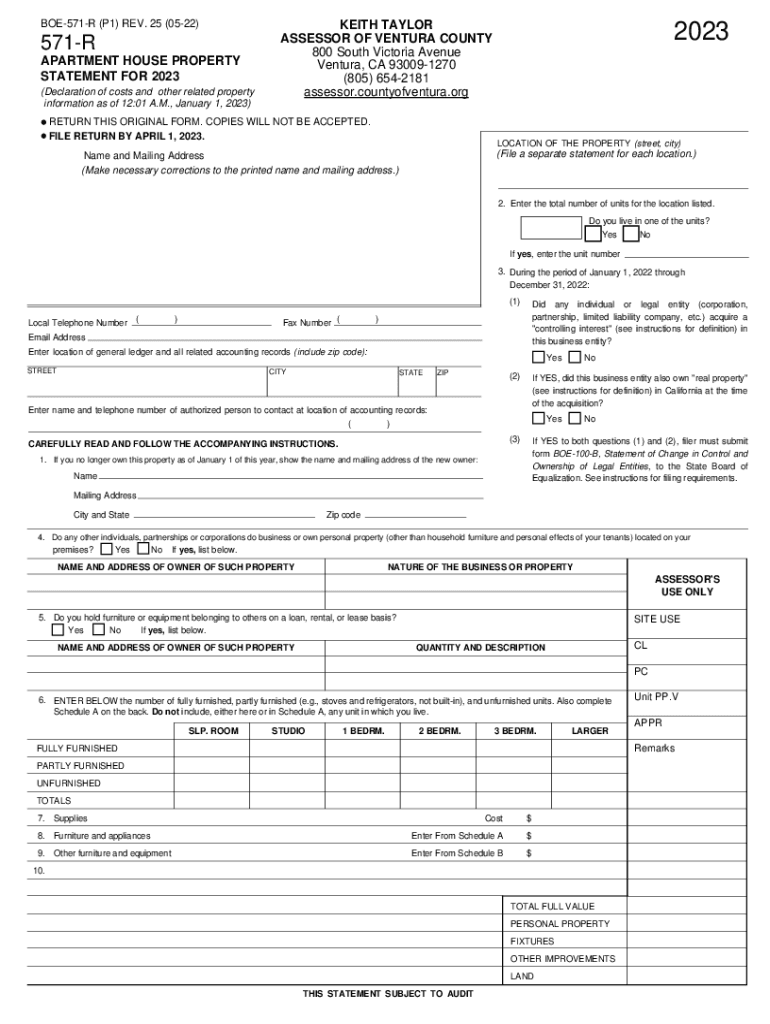

The Ventura County BOE 571 R CA Assessors Association is a specific form used within the realm of property assessment in Ventura County, California. This document is typically utilized by property owners and assessors to communicate essential information regarding property values and assessments. It serves as a crucial tool in ensuring accurate property tax assessments, facilitating transparency between the assessors and property owners. Understanding this form is vital for anyone involved in property ownership or assessment in the region.

Steps to complete the Ventura County BOE 571 R CA Assessors Association

Completing the Ventura County BOE 571 R CA Assessors Association form involves several key steps to ensure accuracy and compliance. First, gather all necessary information regarding the property, including its location, current assessed value, and any relevant ownership details. Next, carefully fill out the form, ensuring that all fields are completed accurately. It is important to review the form for any errors or omissions before submission. Once completed, the form can be submitted electronically or via traditional mail, depending on the preferences of the local assessor's office.

Legal use of the Ventura County BOE 571 R CA Assessors Association

The Ventura County BOE 571 R CA Assessors Association form is legally binding when filled out and submitted in accordance with local and state regulations. To ensure its legal standing, it is essential to comply with all relevant laws governing property assessments and taxation. This includes adhering to guidelines set forth by the California State Board of Equalization and other applicable legal frameworks. Proper execution of this form can help prevent disputes regarding property assessments and ensure that property taxes are assessed fairly and accurately.

How to obtain the Ventura County BOE 571 R CA Assessors Association

Obtaining the Ventura County BOE 571 R CA Assessors Association form is a straightforward process. Property owners can typically find the form on the official website of the Ventura County Assessor's Office. Alternatively, it may be available at local government offices or through direct request from the assessor's office. It is advisable to check for the most current version of the form to ensure compliance with any recent changes in regulations or requirements.

Key elements of the Ventura County BOE 571 R CA Assessors Association

Key elements of the Ventura County BOE 571 R CA Assessors Association form include essential property information such as the property address, owner details, and the assessed value. Additionally, the form may require specific declarations or statements regarding any changes in property status or ownership. Understanding these elements is crucial for accurately completing the form and ensuring that all necessary information is provided to the assessor's office.

Form Submission Methods (Online / Mail / In-Person)

The Ventura County BOE 571 R CA Assessors Association form can be submitted through various methods to accommodate different preferences. Property owners may choose to submit the form online via the Ventura County Assessor's Office website, which often provides a secure platform for electronic submissions. Alternatively, the form can be mailed directly to the assessor's office or submitted in person at designated government locations. It is important to verify the submission method preferred by the local assessor's office to ensure timely processing.

Quick guide on how to complete ventura county boe 571 r ca assessors association

Effortlessly Prepare Ventura County BOE 571 R CA Assessors Association on Any Device

Digital document management has gained traction among both businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed forms, allowing you to obtain the necessary documentation and securely archive it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly and without complications. Manage Ventura County BOE 571 R CA Assessors Association across any platform using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

Efficiently Modify and eSign Ventura County BOE 571 R CA Assessors Association with Ease

- Locate Ventura County BOE 571 R CA Assessors Association and click on Get Form to begin.

- Use the tools we offer to complete your form.

- Highlight important sections of the documents or redact sensitive information with tools specially provided by airSlate SignNow for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your edits.

- Choose how you wish to send your form, whether via email, SMS, or an invitation link, or download it to your computer.

Eliminate concerns of lost or misplaced documents, tedious form navigation, or errors that necessitate reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Ventura County BOE 571 R CA Assessors Association to ensure outstanding communication throughout every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ventura county boe 571 r ca assessors association

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Ventura County BOE 571 R CA Assessors Association?

The Ventura County BOE 571 R CA Assessors Association is an essential resource for assessors in Ventura County, providing vital information on property assessments and tax regulations. This association aims to enhance the professional standards of assessment practices within the area. Understanding its role can help businesses align with the local requirements in property transactions.

-

How can airSlate SignNow assist with Ventura County BOE 571 R CA Assessors Association forms?

AirSlate SignNow simplifies the process of sending and eSigning documents, including those related to the Ventura County BOE 571 R CA Assessors Association. Our platform allows you to quickly prepare, send, and manage these crucial forms digitally. This not only streamlines your workflow but also ensures compliance with local assessment regulations.

-

What are the pricing options for airSlate SignNow that align with Ventura County BOE 571 R CA Assessors Association requirements?

AirSlate SignNow offers various pricing plans to suit your needs, whether you are an individual assessor or part of a larger organization dealing with the Ventura County BOE 571 R CA Assessors Association. Each plan includes essential features for easy document management and electronic signatures, ensuring you stay compliant without breaking the bank. We also provide a trial period to explore the features risk-free.

-

What features does airSlate SignNow offer that benefit users of the Ventura County BOE 571 R CA Assessors Association?

AirSlate SignNow includes features such as customizable templates, automated reminders, and real-time tracking of document status, all tailored for the needs of the Ventura County BOE 571 R CA Assessors Association. These functionalities enhance productivity and ensure that all assessments and related documents are processed efficiently. Your team can easily collaborate and stay organized with these tools.

-

How does airSlate SignNow improve the eSigning process for Ventura County BOE 571 R CA Assessors Association documents?

Our platform streamlines the eSigning process for documents relevant to the Ventura County BOE 571 R CA Assessors Association by providing a user-friendly interface that requires minimal training. With airSlate SignNow, users can quickly review and sign important documents from any device, ensuring timely submissions. This efficiency helps you to meet deadlines related to property assessments with ease.

-

Can airSlate SignNow integrate with other software for Ventura County BOE 571 R CA Assessors Association workflows?

Yes, airSlate SignNow can seamlessly integrate with various tools and software commonly used by the Ventura County BOE 571 R CA Assessors Association. This includes popular CRM systems, cloud storage services, and productivity applications. These integrations enhance your existing workflows, allowing for a more efficient and interconnected document management experience.

-

What security measures does airSlate SignNow implement for Ventura County BOE 571 R CA Assessors Association documents?

AirSlate SignNow prioritizes the security of your documents related to the Ventura County BOE 571 R CA Assessors Association, employing industry-standard encryption and data protection protocols. Our platform ensures that all transactions are secure, and users can control access and permissions to sensitive information. Trust in our secure system to keep your assessment documents safe.

Get more for Ventura County BOE 571 R CA Assessors Association

- Trucking policy and procedures template form

- Vanguard change of name form

- Affidavit of loss passport form

- Food service employee evaluation form

- Unique global imports accounting answer key form

- How do you fill out the c 33 application form

- Acorns beneficiary form

- Equipment demo agreement template 214862148 form

Find out other Ventura County BOE 571 R CA Assessors Association

- Sign Tennessee Government Residential Lease Agreement Fast

- Sign Texas Government Job Offer Free

- Sign Alabama Healthcare / Medical LLC Operating Agreement Online

- Sign Alabama Healthcare / Medical Quitclaim Deed Mobile

- Can I Sign Alabama Healthcare / Medical Quitclaim Deed

- Sign Utah Government Month To Month Lease Myself

- Can I Sign Texas Government Limited Power Of Attorney

- Sign Arkansas Healthcare / Medical Living Will Free

- Sign Arkansas Healthcare / Medical Bill Of Lading Later

- Sign California Healthcare / Medical Arbitration Agreement Free

- Help Me With Sign California Healthcare / Medical Lease Agreement Form

- Sign Connecticut Healthcare / Medical Business Plan Template Free

- Sign Indiana Healthcare / Medical Moving Checklist Safe

- Sign Wisconsin Government Cease And Desist Letter Online

- Sign Louisiana Healthcare / Medical Limited Power Of Attorney Mobile

- Sign Healthcare / Medical PPT Michigan Now

- Sign Massachusetts Healthcare / Medical Permission Slip Now

- Sign Wyoming Government LLC Operating Agreement Mobile

- Sign Wyoming Government Quitclaim Deed Free

- How To Sign Nebraska Healthcare / Medical Living Will