Residence, Remittance Basis Etc Use the SA109 Supplementary Pages to Declare Your Residence and Domicile Status and Claim Person 2023-2026

Understanding the SA109 Form

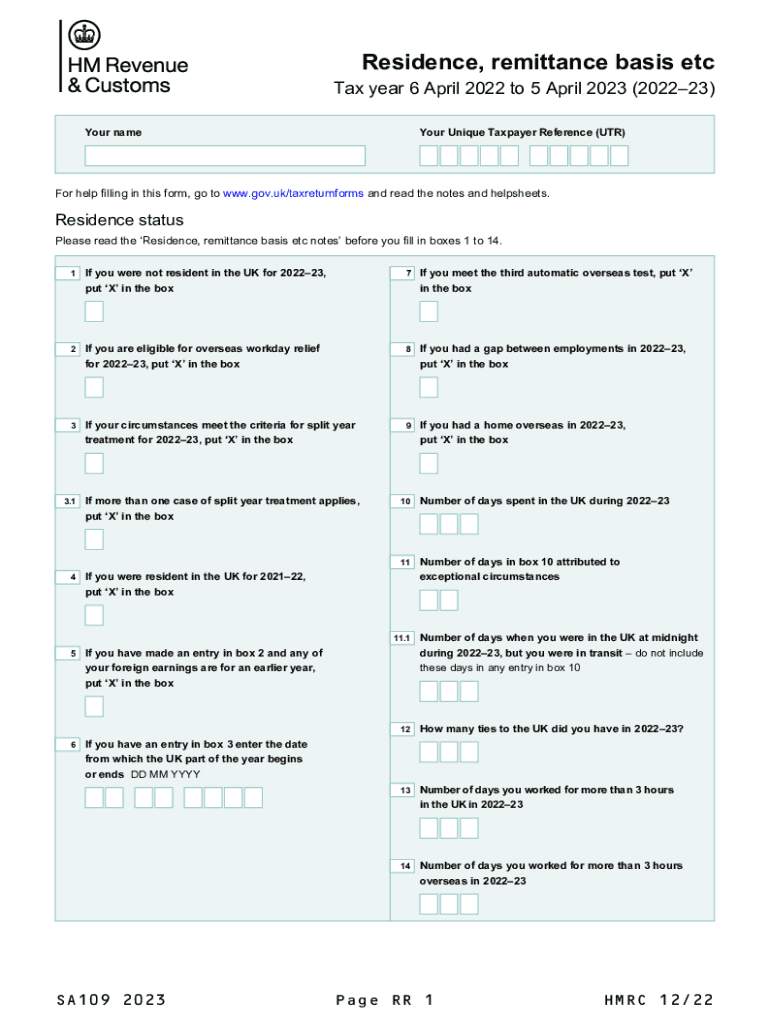

The SA109 form is a supplementary page used for declaring residence and domicile status when filing a tax return in the United Kingdom. It is particularly relevant for non-UK residents who need to claim personal allowances while completing their tax obligations. This form helps clarify an individual's tax position, especially in relation to income earned outside the UK.

Steps to Complete the SA109 Form

Filling out the SA109 form involves several key steps:

- Gather necessary documents, including proof of residence and any income statements.

- Clearly state your domicile status and any relevant personal circumstances.

- Complete each section of the form accurately, ensuring all information is up-to-date.

- Review the form for accuracy before submission to avoid delays or penalties.

Legal Use of the SA109 Form

The SA109 form is legally recognized for tax purposes in the UK. It is essential for non-residents to declare their status correctly to comply with tax laws. Failure to complete the form accurately can lead to complications with tax authorities, including potential fines or audits.

Required Documents for the SA109 Form

When completing the SA109 form, certain documents are necessary to support your claims:

- Proof of residence, such as utility bills or rental agreements.

- Income statements from foreign sources, if applicable.

- Any previous tax returns that may provide context for your current situation.

Filing Deadlines for the SA109 Form

It is important to be aware of the filing deadlines associated with the SA109 form. Typically, the deadline aligns with the overall tax return submission date, which is usually January 31 for online submissions. Late submissions can result in penalties, so timely filing is crucial.

IRS Guidelines for Non-Residents

For U.S. citizens or residents filing taxes while living abroad, understanding IRS guidelines is essential. The IRS requires specific forms and documentation to ensure compliance with U.S. tax laws. Non-residents must be aware of their obligations under both U.S. and UK tax regulations to avoid double taxation.

Quick guide on how to complete residence remittance basis etc use the sa109 supplementary pages to declare your residence and domicile status and claim 659270221

Effortlessly prepare Residence, Remittance Basis Etc Use The SA109 Supplementary Pages To Declare Your Residence And Domicile Status And Claim Person on any device

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly without delays. Manage Residence, Remittance Basis Etc Use The SA109 Supplementary Pages To Declare Your Residence And Domicile Status And Claim Person on any device using airSlate SignNow's Android or iOS applications and enhance any document-oriented process today.

How to edit and electronically sign Residence, Remittance Basis Etc Use The SA109 Supplementary Pages To Declare Your Residence And Domicile Status And Claim Person effortlessly

- Locate Residence, Remittance Basis Etc Use The SA109 Supplementary Pages To Declare Your Residence And Domicile Status And Claim Person and click Get Form to begin.

- Utilize the tools available to fill out your document.

- Indicate important sections of the documents or redact sensitive information using tools that airSlate SignNow provides specifically for this purpose.

- Create your electronic signature using the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate the hassle of lost or misfiled documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow manages all your document requirements in just a few clicks from any device you choose. Edit and electronically sign Residence, Remittance Basis Etc Use The SA109 Supplementary Pages To Declare Your Residence And Domicile Status And Claim Person and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct residence remittance basis etc use the sa109 supplementary pages to declare your residence and domicile status and claim 659270221

Create this form in 5 minutes!

How to create an eSignature for the residence remittance basis etc use the sa109 supplementary pages to declare your residence and domicile status and claim 659270221

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the SA109 form, and why do I need it?

The SA109 form is a supplementary form used in the UK tax system for individuals who are non-resident or have foreign income. You need this form to report your overseas income and gains accurately, which can help you avoid penalties and ensure compliance with HMRC regulations.

-

How can airSlate SignNow help me with the SA109 form?

AirSlate SignNow allows you to easily upload, send, and eSign documents like the SA109 form. With our platform, you can streamline the submission process, ensuring that your form is delivered securely and efficiently.

-

Is there a cost associated with using airSlate SignNow for the SA109 form?

Yes, airSlate SignNow offers various pricing plans tailored to business needs. Our cost-effective solutions ensure that you can manage your document workflows, including the SA109 form, without breaking the bank.

-

What features does airSlate SignNow offer for managing the SA109 form?

AirSlate SignNow includes features like document templates, eSigning, and secure cloud storage, which can be extremely beneficial when handling the SA109 form. These features allow for easy customization and make the filing process faster and more organized.

-

Can I integrate airSlate SignNow with other tools while working on the SA109 form?

Absolutely! AirSlate SignNow integrates seamlessly with various tools and platforms, enhancing your workflow when dealing with the SA109 form. Whether you're using accounting software or project management tools, our integrations simplify your document handling.

-

What are the benefits of using airSlate SignNow for the SA109 form submission?

Using airSlate SignNow for SA109 form submissions offers numerous benefits, such as increased efficiency, reduced errors, and enhanced security. Our easy-to-use platform ensures that your forms are filled out correctly and submitted on time.

-

How secure is my data when using airSlate SignNow for the SA109 form?

Data security is a priority at airSlate SignNow. When working with the SA109 form, your information is protected with advanced encryption and compliance features, ensuring that your sensitive data remains safe and confidential.

Get more for Residence, Remittance Basis Etc Use The SA109 Supplementary Pages To Declare Your Residence And Domicile Status And Claim Person

- Camp rules template form

- Tmb account opening form sample

- Larry goins forms

- Modern database management 13th edition answer key form

- Form 3050

- Suffolk county certification of sewage disposal system abandonment form

- Fillable online vfes 1777 north valley road vfes fax form

- Informed consent for video and audio recording 3

Find out other Residence, Remittance Basis Etc Use The SA109 Supplementary Pages To Declare Your Residence And Domicile Status And Claim Person

- Electronic signature Utah Doctors Promissory Note Template Secure

- Electronic signature West Virginia Doctors Bill Of Lading Online

- Electronic signature West Virginia Construction Quitclaim Deed Computer

- Electronic signature Construction PDF Wisconsin Myself

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement

- Can I Electronic signature California Education Cease And Desist Letter

- Electronic signature Arizona Finance & Tax Accounting Promissory Note Template Computer

- Electronic signature California Finance & Tax Accounting Warranty Deed Fast

- Can I Electronic signature Georgia Education Quitclaim Deed

- Electronic signature California Finance & Tax Accounting LLC Operating Agreement Now

- Electronic signature Connecticut Finance & Tax Accounting Executive Summary Template Myself

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple

- Electronic signature Illinois Education Business Plan Template Secure

- How Do I Electronic signature Colorado Government POA

- Electronic signature Government Word Illinois Now