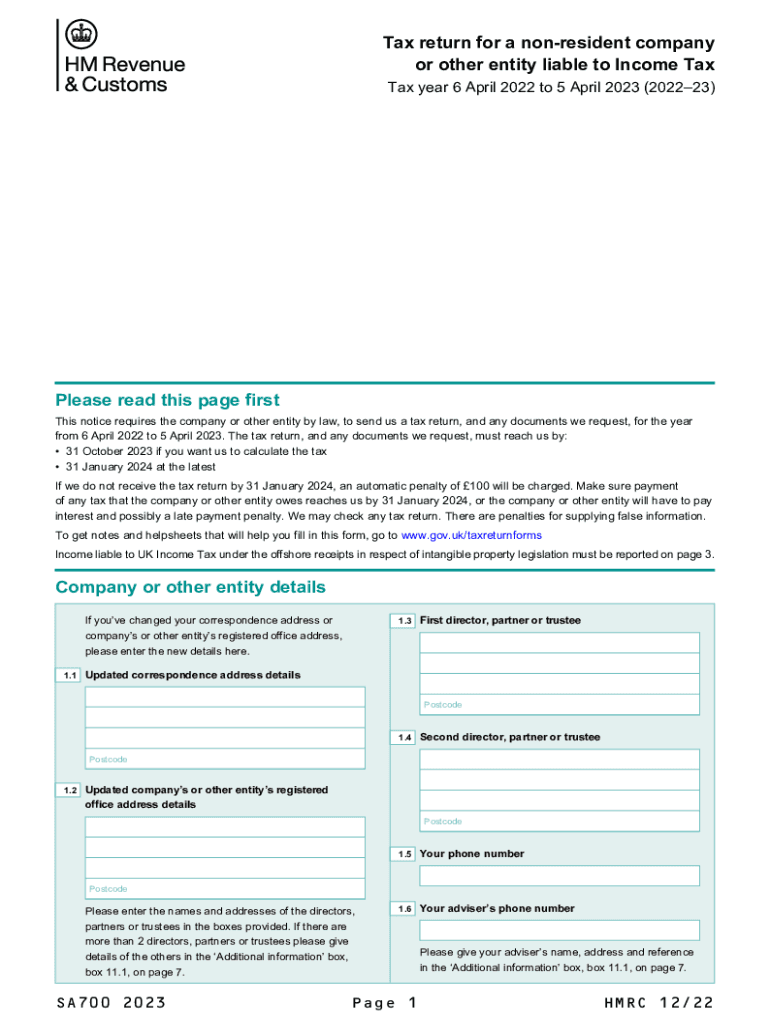

Tax Return for a Non Resident Company Liable to Income Tax Use SA700 to File a Tax Return for a Non Resident Company for the Tax 2023-2026

Understanding the SA200 Tax Return Form

The SA200 form is a short tax return designed for individuals and businesses that meet specific criteria. This form is particularly relevant for non-resident companies liable to income tax in the United States. It simplifies the filing process by allowing eligible taxpayers to report their income and expenses in a more straightforward manner. The SA200 form is essential for ensuring compliance with tax obligations while minimizing the complexity typically associated with tax returns.

Steps to Complete the SA200 Form

Filling out the SA200 form involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements and expense records. Next, download the SA200 form as a PDF from a trusted source. After obtaining the form, carefully fill in the required information, ensuring that all figures are accurate. Once completed, review the form for any errors before submitting it. This careful approach helps prevent delays or issues with your tax return.

Filing Deadlines for the SA200 Form

Timely submission of the SA200 form is crucial to avoid penalties. The IRS typically sets specific deadlines for tax returns, which may vary based on individual circumstances. Generally, for most taxpayers, the deadline falls on April fifteenth of each year. However, non-resident companies may have different deadlines depending on their fiscal year. It is important to stay informed about these dates to ensure compliance and avoid unnecessary fines.

Required Documents for the SA200 Form

When preparing to file the SA200 form, certain documents are essential. These include proof of income, such as pay stubs or bank statements, and documentation of any allowable deductions or credits. Additionally, having previous tax returns on hand can be beneficial for reference. Ensuring that all required documents are ready before starting the form can streamline the filing process and reduce the likelihood of errors.

Legal Use of the SA200 Form

The SA200 form is legally binding when completed and submitted correctly. To ensure that your submission meets legal standards, it is important to follow IRS guidelines closely. This includes providing accurate information and signing the form where required. Utilizing a reliable electronic signature solution can help validate your submission and ensure compliance with eSignature laws, providing added security and legitimacy to your filing.

Digital vs. Paper Version of the SA200 Form

Choosing between a digital or paper version of the SA200 form can impact the filing experience. The digital version, often available as a PDF download, allows for easier editing and quicker submission. In contrast, the paper version may require mailing, which can lead to delays. Digital submissions typically offer enhanced security features, such as encryption and audit trails, ensuring that your information is protected throughout the filing process.

Quick guide on how to complete tax return for a non resident company liable to income tax use sa700 to file a tax return for a non resident company for the

Complete Tax Return For A Non resident Company Liable To Income Tax Use SA700 To File A Tax Return For A Non resident Company For The Tax effortlessly on any device

Web-based document administration has gained traction among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to locate the necessary form and securely keep it online. airSlate SignNow equips you with all the resources needed to create, alter, and electronically sign your documents quickly and without issues. Handle Tax Return For A Non resident Company Liable To Income Tax Use SA700 To File A Tax Return For A Non resident Company For The Tax on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and eSign Tax Return For A Non resident Company Liable To Income Tax Use SA700 To File A Tax Return For A Non resident Company For The Tax without hassle

- Locate Tax Return For A Non resident Company Liable To Income Tax Use SA700 To File A Tax Return For A Non resident Company For The Tax and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize relevant sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign feature, which takes only seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click the Done button to save your changes.

- Choose how you want to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and eSign Tax Return For A Non resident Company Liable To Income Tax Use SA700 To File A Tax Return For A Non resident Company For The Tax and guarantee outstanding communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tax return for a non resident company liable to income tax use sa700 to file a tax return for a non resident company for the

Create this form in 5 minutes!

How to create an eSignature for the tax return for a non resident company liable to income tax use sa700 to file a tax return for a non resident company for the

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the short tax return form sa200 download pdf?

The short tax return form sa200 download pdf is a simplified version of the tax return required for certain individuals. This PDF form allows filers to report their income and claim tax allowances efficiently. By utilizing this form, you can save time and effort when filing your taxes.

-

How can I download the short tax return form sa200?

You can easily download the short tax return form sa200 download pdf directly from our website. Simply visit our resource section, find the document, and click on the download link. It’s user-friendly and efficient, ensuring you have the right form quickly.

-

Is there a cost associated with the short tax return form sa200 download pdf?

No, downloading the short tax return form sa200 download pdf is completely free. We aim to provide accessible resources for individuals to manage their tax filings without incurring any additional costs. Visit our site to get started without any financial commitment.

-

Are there any specific eligibility requirements for using the short tax return form sa200?

Yes, the short tax return form sa200 is intended for individuals with straightforward tax situations. To qualify, your income and tax allowances should meet the criteria defined by the tax authority. Reviewing these requirements before downloading the short tax return form sa200 download pdf is advisable.

-

What are the benefits of using the short tax return form sa200?

Using the short tax return form sa200 download pdf streamlines the tax filing process for eligible individuals. It simplifies the required information, allowing you to complete your taxes quickly and accurately. This efficiency can result in prompt refunds and fewer errors in your tax submission.

-

Can I use the short tax return form sa200 if I have additional income sources?

If you have additional income sources, it's essential to evaluate whether the short tax return form sa200 is suitable for your situation. While this form is designed for straightforward tax filings, more complex financial scenarios might require a standard tax return. Make sure to assess your eligibility before downloading the short tax return form sa200 download pdf.

-

How does airSlate SignNow facilitate the eSigning of tax documents like the sa200 form?

airSlate SignNow allows users to eSign tax documents, including the short tax return form sa200 download pdf, effortlessly. By integrating with various platforms, our solution enables secure and swift eSigning, helping you complete your tax filing efficiently. Experience a seamless process that conforms to legal standards.

Get more for Tax Return For A Non resident Company Liable To Income Tax Use SA700 To File A Tax Return For A Non resident Company For The Tax

Find out other Tax Return For A Non resident Company Liable To Income Tax Use SA700 To File A Tax Return For A Non resident Company For The Tax

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter