Tax Return for a Non Resident Company Liable to Income Tax Use SA700 to File a Tax Return for a Non Resident Company for the Tax 2020

Understanding the SA700 Tax Return for Non-Resident Companies

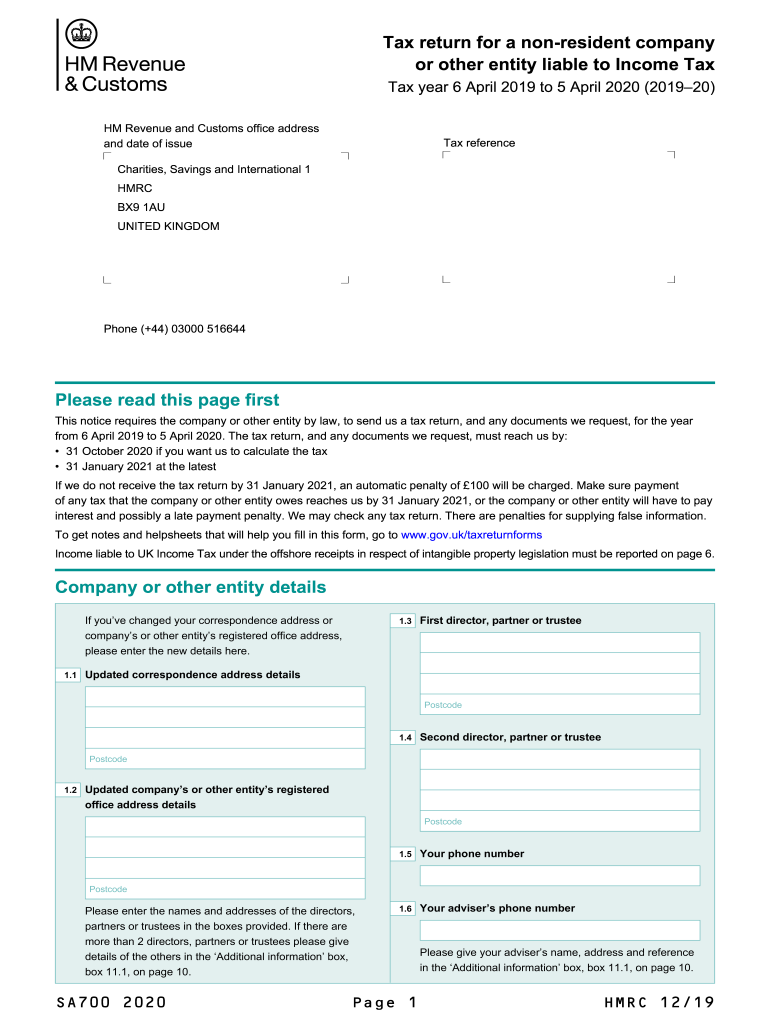

The SA700 tax return is specifically designed for non-resident companies that are liable for income tax in the United Kingdom. This form is essential for reporting income earned in the UK by foreign entities. Non-resident companies must complete the SA700 to ensure compliance with UK tax regulations, particularly for income generated from UK sources.

Steps to Complete the SA700 Tax Return

Filling out the SA700 tax return involves several key steps:

- Gather necessary financial documents, including income statements and expense records.

- Access the SA700 form, which can be downloaded online.

- Fill in the required sections, ensuring accurate reporting of all income and expenses.

- Review the completed form for any errors or omissions.

- Submit the form either online or by mail, following the guidelines provided by HMRC.

Obtaining the SA700 Tax Return Form

The SA700 form can be easily obtained through the official HMRC website. Users can download the form in PDF format, allowing for convenient access and printing. It is advisable to ensure that the latest version of the form is used to comply with current tax regulations.

Key Elements of the SA700 Tax Return

When completing the SA700, it is important to understand its key elements, which include:

- Identification details of the company, including name and registration number.

- Details of income earned from UK sources.

- Allowable expenses that can be deducted from the income.

- Tax calculations based on the reported income and applicable tax rates.

Filing Deadlines for the SA700 Tax Return

Timely submission of the SA700 is crucial to avoid penalties. The filing deadline for the SA700 typically aligns with the end of the tax year, which is April 5 in the UK. Companies should ensure that they submit their tax returns on or before this date to remain compliant with HMRC regulations.

Penalties for Non-Compliance with the SA700

Failure to file the SA700 tax return on time can result in significant penalties. HMRC imposes fines based on the length of delay in submission. Additionally, interest may accrue on any unpaid taxes, further increasing the financial burden on the company. It is essential for non-resident companies to prioritize compliance to avoid these repercussions.

Quick guide on how to complete tax return for a non resident company liable to income tax 2020 use sa7002020 to file a tax return for a non resident company

Complete Tax Return For A Non resident Company Liable To Income Tax Use SA700 To File A Tax Return For A Non resident Company For The Tax effortlessly on any device

Online document management has become increasingly popular among organizations and individuals. It offers an excellent eco-friendly option to traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents quickly without delays. Manage Tax Return For A Non resident Company Liable To Income Tax Use SA700 To File A Tax Return For A Non resident Company For The Tax on any platform with airSlate SignNow Android or iOS applications and enhance any document-centered process today.

The easiest way to edit and eSign Tax Return For A Non resident Company Liable To Income Tax Use SA700 To File A Tax Return For A Non resident Company For The Tax with minimal effort

- Find Tax Return For A Non resident Company Liable To Income Tax Use SA700 To File A Tax Return For A Non resident Company For The Tax and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight pertinent sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal significance as a traditional wet ink signature.

- Review all the information and click the Done button to save your changes.

- Choose how you want to send your form—via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Tax Return For A Non resident Company Liable To Income Tax Use SA700 To File A Tax Return For A Non resident Company For The Tax and guarantee outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tax return for a non resident company liable to income tax 2020 use sa7002020 to file a tax return for a non resident company

Create this form in 5 minutes!

How to create an eSignature for the tax return for a non resident company liable to income tax 2020 use sa7002020 to file a tax return for a non resident company

The way to make an eSignature for your PDF file in the online mode

The way to make an eSignature for your PDF file in Chrome

The way to make an eSignature for putting it on PDFs in Gmail

How to make an electronic signature straight from your smartphone

The way to make an electronic signature for a PDF file on iOS devices

How to make an electronic signature for a PDF document on Android

People also ask

-

What is the short tax return form SA200?

The short tax return form SA200 is a streamlined version of the tax return designed for individuals with simpler financial situations. By using the short tax return form SA200 download, taxpayers can file their returns more efficiently, reducing the time and effort needed for tax filing.

-

How can I download the short tax return form SA200?

You can easily download the short tax return form SA200 from our website. Simply navigate to the tax forms section and select the short tax return form SA200 download link, and it will be saved to your device for your convenience.

-

Is there a cost associated with downloading the short tax return form SA200?

No, downloading the short tax return form SA200 is completely free. AirSlate SignNow provides this service at no cost to ensure that all users have access to essential tax documentation without any financial burden.

-

What features does airSlate SignNow offer for eSigning the short tax return form SA200?

AirSlate SignNow offers a user-friendly platform that allows you to easily eSign your short tax return form SA200. You can add signatures, timestamps, and comments, streamlining the process and ensuring that your documents are legally binding.

-

What are the benefits of using airSlate SignNow for tax documents?

Using airSlate SignNow for your tax documents, including the short tax return form SA200, enhances efficiency and security. It reduces paper waste and automates the signing process, allowing you to focus on other important tasks.

-

Can I integrate airSlate SignNow with other software for tax filing?

Yes, airSlate SignNow can integrate with various accounting and tax software. This integration ensures that you can seamlessly manage your short tax return form SA200 download alongside your other financial documents, improving workflow and productivity.

-

Is airSlate SignNow compliant with data protection regulations?

Absolutely, airSlate SignNow is fully compliant with data protection regulations, ensuring that your personal information is safeguarded while you manage your short tax return form SA200 download and other sensitive documents.

Get more for Tax Return For A Non resident Company Liable To Income Tax Use SA700 To File A Tax Return For A Non resident Company For The Tax

- Suggested affidavit form nonresident purchaser

- Az joint tax application form

- File adjust or review quarterly tax ampamp wage reportdes ncfile adjust or review quarterly tax ampamp wage reportdes ncfile form

- Florida dept of revenue reemployment tax return and payment information

- Reporting agent authorization form

- Form 165 instructions azdorgov

- Exemption certificates for sales taxexemption certificates for sales taxexemption certificates for sales taxexemption form

- International fuel tax agreement ifta texas comptroller of public form

Find out other Tax Return For A Non resident Company Liable To Income Tax Use SA700 To File A Tax Return For A Non resident Company For The Tax

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Oregon Non-Profit Last Will And Testament

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself