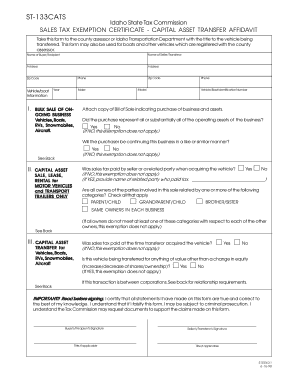

ST 133CATS 1998

What is the ST 133CATS

The ST 133CATS form is a specific document used for various administrative purposes, particularly in the context of state regulations. It is essential for businesses and individuals who need to comply with certain legal requirements. This form may involve declarations, certifications, or other essential information that must be submitted to relevant authorities. Understanding its purpose is crucial for ensuring compliance and avoiding potential legal issues.

How to use the ST 133CATS

Using the ST 133CATS form involves several straightforward steps. First, gather all necessary information and documents required for completion. Next, fill out the form accurately, ensuring that all fields are completed as per the instructions. Once completed, review the form for any errors or omissions. Finally, submit the form according to the specified submission methods, which may include online submission, mailing, or in-person delivery.

Steps to complete the ST 133CATS

Completing the ST 133CATS form involves a systematic approach to ensure accuracy and compliance. Follow these steps:

- Gather required information, including identification details and any supporting documents.

- Carefully read the instructions provided with the form to understand each section.

- Fill in the form, ensuring that all information is clear and legible.

- Double-check all entries for accuracy, including names, dates, and signatures.

- Submit the completed form through the designated method.

Legal use of the ST 133CATS

The legal use of the ST 133CATS form is governed by specific regulations and guidelines that ensure its validity. To be considered legally binding, the form must be completed in accordance with applicable laws. This includes providing accurate information, obtaining necessary signatures, and adhering to submission deadlines. Understanding these legal requirements is essential for individuals and businesses to avoid penalties and ensure compliance.

Key elements of the ST 133CATS

The ST 133CATS form contains several key elements that are vital for its proper completion. These elements typically include:

- Identification information of the individual or entity submitting the form.

- Details related to the specific purpose of the form.

- Signature lines for required parties, ensuring authenticity.

- Any additional documentation or evidence that may be required to support the submission.

Who Issues the Form

The ST 133CATS form is typically issued by a state or local government agency. This agency is responsible for overseeing compliance with the regulations related to the form's purpose. It is important for users to verify the issuing authority to ensure they are following the correct procedures and guidelines associated with the form.

Quick guide on how to complete st 133cats

Prepare ST 133CATS effortlessly on any device

Online document administration has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed papers, enabling you to access the needed form and securely save it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents quickly and without delays. Manage ST 133CATS on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related tasks today.

The simplest way to modify and eSign ST 133CATS with ease

- Locate ST 133CATS and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or obscure sensitive information using the tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or errors that necessitate reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign ST 133CATS and ensure outstanding communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct st 133cats

Create this form in 5 minutes!

How to create an eSignature for the st 133cats

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is ST 133CATS and how does it benefit businesses?

ST 133CATS is an innovative electronic signature solution that streamlines document management for businesses. By enabling quick and secure signing of documents, ST 133CATS enhances productivity and efficiency, saving valuable time and resources. It is designed for easy integration into existing workflows, making it an ideal choice for organizations of all sizes.

-

How much does ST 133CATS cost?

The pricing for ST 133CATS is competitive and varies based on the features and services selected. airSlate SignNow offers flexible subscription plans to cater to the diverse needs of businesses, ensuring that even small enterprises can afford powerful eSigning solutions. You can visit our pricing page for detailed information on the available plans.

-

What features are included in ST 133CATS?

ST 133CATS includes a wide range of features such as customizable templates, in-person signing, and real-time tracking of document statuses. Additionally, it supports various file formats and provides integrations with popular business tools, enhancing overall productivity. The user-friendly interface of ST 133CATS ensures that anyone can quickly adapt to the platform.

-

Can ST 133CATS be integrated with other applications?

Yes, ST 133CATS offers seamless integrations with popular applications like Google Drive, Salesforce, and Microsoft Office. This interoperability allows users to easily access and send documents directly from their preferred tools, improving workflow efficiency. The flexibility of ST 133CATS makes it a versatile choice for businesses reliant on multiple software solutions.

-

How secure is ST 133CATS for handling sensitive documents?

Security is a top priority for ST 133CATS, which employs robust encryption protocols to protect sensitive data. All documents signed through ST 133CATS are securely stored and managed, ensuring compliance with industry standards and regulations. With features such as audit trails and multi-factor authentication, ST 133CATS safeguards your documents against unauthorized access.

-

What types of businesses can benefit from ST 133CATS?

ST 133CATS is designed to benefit businesses of all sizes and industries. From small startups to large enterprises, any organization needing efficient document signing and management can take advantage of the features offered by ST 133CATS. Its scalability ensures that as your business grows, ST 133CATS can adapt to meet your evolving needs.

-

Is there a trial period available for ST 133CATS?

Yes, airSlate SignNow offers a free trial for ST 133CATS, allowing prospective customers to explore its features without any commitment. The trial period provides the opportunity to test out the platform and see how it can simplify your document signing process. Sign up on our website to start your free trial today.

Get more for ST 133CATS

Find out other ST 133CATS

- Electronic signature North Carolina Insurance Profit And Loss Statement Secure

- Help Me With Electronic signature Oklahoma Insurance Contract

- Electronic signature Pennsylvania Insurance Letter Of Intent Later

- Electronic signature Pennsylvania Insurance Quitclaim Deed Now

- Electronic signature Maine High Tech Living Will Later

- Electronic signature Maine High Tech Quitclaim Deed Online

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast

- Electronic signature Vermont Insurance Limited Power Of Attorney Easy

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure

- Electronic signature Wyoming Insurance LLC Operating Agreement Computer

- How To Electronic signature Missouri High Tech Lease Termination Letter

- Electronic signature Montana High Tech Warranty Deed Mobile

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease