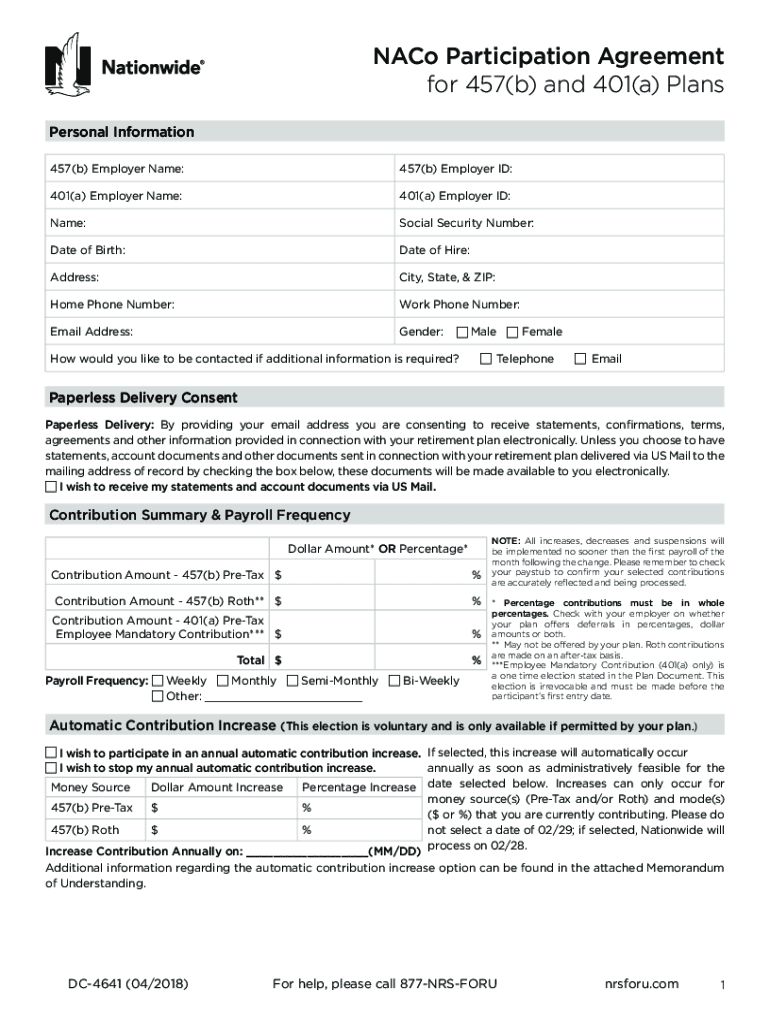

NACo Participation Agreement NRSforU Form

Understanding the Revoke Citizenship Process

The process to revoke citizenship involves several legal steps and considerations. Individuals may seek to revoke their citizenship for various reasons, including personal choice or legal obligations. It is essential to understand that this process is irreversible and can have significant implications on one’s legal status and rights. Before proceeding, individuals should consult legal experts to navigate the complexities involved.

Steps to Complete the Revoke Citizenship Form

Completing the revoke citizenship form requires careful attention to detail. Here are the general steps involved:

- Gather necessary documentation, including proof of identity and any prior citizenship documents.

- Complete the revoke citizenship form accurately, ensuring all required fields are filled.

- Review the form for any errors or omissions, as inaccuracies can delay processing.

- Submit the completed form along with any required fees to the appropriate government agency.

Required Documents for Revoking Citizenship

When submitting a request to revoke citizenship, specific documents are typically required. These may include:

- Proof of identity, such as a government-issued ID or passport.

- Original citizenship certificate or documentation proving citizenship.

- Any legal documents supporting the request for revocation.

It is advisable to check with the relevant authorities for any additional requirements specific to your situation.

Legal Implications of Revoking Citizenship

Revoking citizenship can have serious legal implications. Individuals may lose their rights to reside in the United States, access government services, or travel freely. Additionally, revocation can affect family members and dependents. Understanding these consequences is crucial before initiating the process. Legal counsel can provide guidance on the potential outcomes and help individuals make informed decisions.

Form Submission Methods

The revoke citizenship form can typically be submitted through various methods, including:

- Online submission via the official government website.

- Mailing the completed form to the designated office.

- In-person submission at local government offices.

Each method has its own processing times and requirements, so individuals should choose the one that best suits their needs.

Eligibility Criteria for Revoking Citizenship

Not everyone is eligible to revoke their citizenship. Common eligibility criteria include:

- Being a citizen of another country or having a valid reason for renouncing U.S. citizenship.

- Meeting specific legal requirements set forth by immigration laws.

It is essential to verify eligibility before initiating the revocation process to avoid complications.

Quick guide on how to complete naco participation agreement nrsforu

Effortlessly Prepare NACo Participation Agreement NRSforU on Any Device

Digital document management has gained signNow traction among businesses and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed paperwork, allowing you to find the right template and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly and easily. Manage NACo Participation Agreement NRSforU on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to Modify and eSign NACo Participation Agreement NRSforU with Ease

- Find NACo Participation Agreement NRSforU and select Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight important sections of your documents or obscure sensitive information using tools offered by airSlate SignNow specifically for that purpose.

- Create your eSignature with the Sign tool, which requires just seconds and has the same legal validity as a conventional wet ink signature.

- Review all details and click on the Done button to save your modifications.

- Decide how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow manages all your document administration needs in just a few clicks from any device you prefer. Alter and eSign NACo Participation Agreement NRSforU to ensure excellent communication at every step of the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the naco participation agreement nrsforu

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What steps do I need to follow to revoke citizenship using airSlate SignNow?

To revoke citizenship using airSlate SignNow, begin by gathering the necessary documents that indicate your request. Our platform allows you to easily eSign these documents with legally binding signatures. You can streamline the process by sending the necessary paperwork through our user-friendly interface.

-

Is there a cost associated with revoking citizenship using airSlate SignNow?

While airSlate SignNow provides a cost-effective solution for eSigning documents, the specific costs may depend on your subscription plan. You can choose from various pricing tiers that suit your needs, helping you manage expenses while effectively processing your citizenship revocation.

-

What features does airSlate SignNow offer to help revoke citizenship documentation?

airSlate SignNow offers a range of features including automated workflows, document templates, and secure eSigning capabilities which can simplify the process to revoke citizenship. These features ensure your documents are signed quickly and securely, providing a seamless experience.

-

Can I track the status of my documents when revoking citizenship?

Yes, airSlate SignNow allows you to track the status of your documents in real-time. You can see who has signed and what stage the documents are at in the process, making it easier to manage your paperwork when you decide to revoke citizenship.

-

Are there integrations available for airSlate SignNow that assist in revoking citizenship?

Absolutely! airSlate SignNow integrates with numerous applications such as Google Drive, Dropbox, and more. This allows you to easily access and manage documents needed to revoke citizenship, ensuring a smooth workflow across platforms.

-

How does airSlate SignNow ensure the security of documents related to revoking citizenship?

airSlate SignNow prioritizes security with industry-leading encryption protocols to protect your documents. When you are handling sensitive information such as citizenship revocation, you can trust our platform to keep your data secure throughout the entire eSigning process.

-

What are the benefits of using airSlate SignNow when I need to revoke citizenship?

Using airSlate SignNow to revoke citizenship offers numerous benefits such as increased efficiency, cost savings, and ease of use. Our platform enables you to manage complex paperwork with a few simple clicks, allowing you to focus on the important aspects of your citizenship revocation.

Get more for NACo Participation Agreement NRSforU

- I9 forms

- Private property agreement and waiver form

- 5 paragraph essay rubric form

- Vacant land disclosure form

- Churchs chicken application pdf form

- Construction control requirements town of burlington form

- Cross connection control plan and program for hbampampts utility district form

- Construction traffic management plan ctmp form

Find out other NACo Participation Agreement NRSforU

- How Can I Electronic signature Delaware Car Dealer Purchase Order Template

- How To Electronic signature Delaware Car Dealer Lease Template

- Electronic signature North Carolina Banking Claim Secure

- Electronic signature North Carolina Banking Separation Agreement Online

- How Can I Electronic signature Iowa Car Dealer Promissory Note Template

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Myself

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Fast

- How Do I Electronic signature Iowa Car Dealer Limited Power Of Attorney

- Electronic signature Kentucky Car Dealer LLC Operating Agreement Safe

- Electronic signature Louisiana Car Dealer Lease Template Now

- Electronic signature Maine Car Dealer Promissory Note Template Later

- Electronic signature Maryland Car Dealer POA Now

- Electronic signature Oklahoma Banking Affidavit Of Heirship Mobile

- Electronic signature Oklahoma Banking Separation Agreement Myself

- Electronic signature Hawaii Business Operations Permission Slip Free

- How Do I Electronic signature Hawaii Business Operations Forbearance Agreement

- Electronic signature Massachusetts Car Dealer Operating Agreement Free

- How To Electronic signature Minnesota Car Dealer Credit Memo

- Electronic signature Mississippi Car Dealer IOU Now

- Electronic signature New Hampshire Car Dealer NDA Now