Ct Uc 5a 2004

What is the Ct Uc 5a

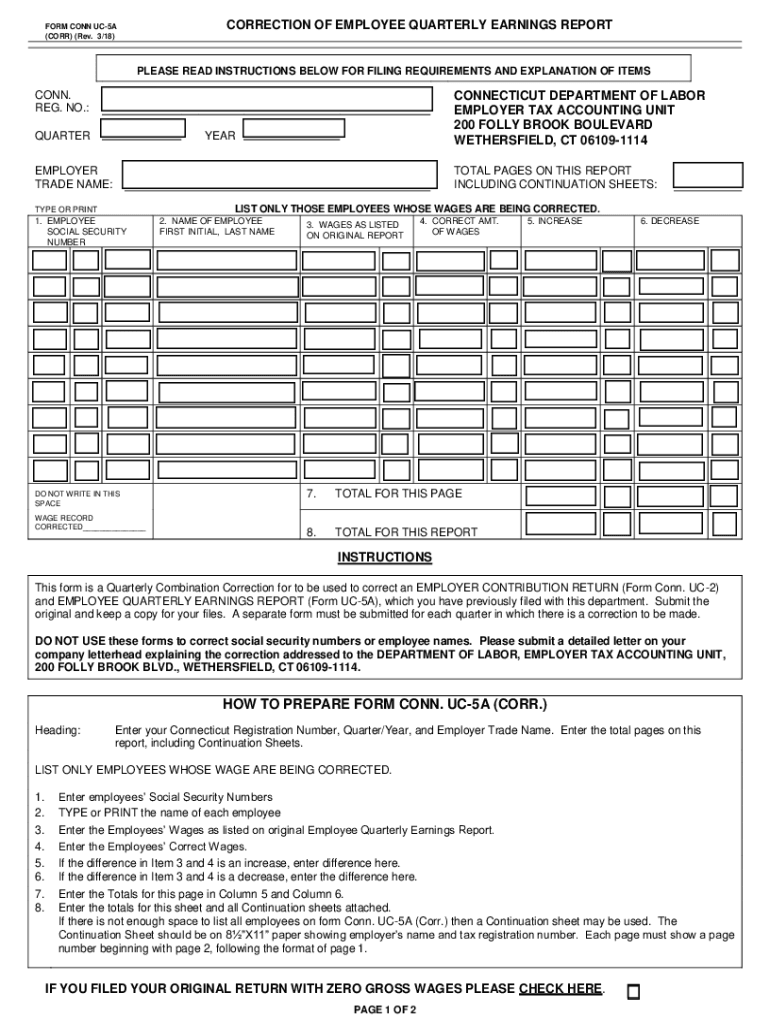

The Ct Uc 5a form, also known as the Connecticut Employee Quarterly Earnings Report, is a crucial document for employers in Connecticut. This form is used to report wages paid to employees and the associated unemployment contributions for each quarter. It is essential for maintaining compliance with state unemployment insurance regulations and ensuring that employees receive the benefits they are entitled to in case of unemployment.

How to use the Ct Uc 5a

Using the Ct Uc 5a involves accurately reporting the total wages paid to employees during the quarter. Employers must gather payroll records and ensure that all information is complete and correct. The form requires details such as the employer's identification number, the total number of employees, and the total wages paid. Once filled out, the form can be submitted electronically or via mail, depending on the employer's preference.

Steps to complete the Ct Uc 5a

Completing the Ct Uc 5a involves several key steps:

- Gather all necessary payroll records for the quarter.

- Fill in the employer identification number and business details.

- Report the total number of employees and total wages paid.

- Review the form for accuracy to avoid penalties.

- Submit the completed form either online or by mail by the specified deadline.

Legal use of the Ct Uc 5a

The Ct Uc 5a serves a legal purpose by ensuring compliance with Connecticut's unemployment insurance laws. Submitting this form accurately and on time is essential to avoid penalties and ensure that employees' unemployment benefits are properly funded. Employers are legally obligated to report wages and contributions to maintain the integrity of the unemployment insurance system.

Filing Deadlines / Important Dates

Employers must be aware of the filing deadlines for the Ct Uc 5a to avoid late fees. The form is typically due on the last day of the month following the end of each quarter. For example, for the first quarter ending March 31, the form is due by April 30. It is important to keep track of these dates to ensure timely submission and compliance with state regulations.

Who Issues the Form

The Ct Uc 5a is issued by the Connecticut Department of Labor. This department oversees the administration of unemployment insurance programs and ensures that employers comply with reporting requirements. Employers can access the form and additional resources through the department's official website.

Quick guide on how to complete ct uc 5a

Complete Ct Uc 5a effortlessly on any device

Online document management has become increasingly popular among organizations and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can locate the necessary form and securely store it online. airSlate SignNow provides you with all the tools needed to create, modify, and eSign your documents quickly without delays. Handle Ct Uc 5a on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The simplest way to alter and eSign Ct Uc 5a with ease

- Locate Ct Uc 5a and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive data with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all information and click on the Done button to save your changes.

- Select how you want to share your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign Ct Uc 5a and ensure exceptional communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ct uc 5a

Create this form in 5 minutes!

How to create an eSignature for the ct uc 5a

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is ct uc 5a and how does it relate to airSlate SignNow?

The ct uc 5a refers to a specific functionality within the airSlate SignNow platform. It streamlines the electronic signing process, making it easier for businesses to manage their document workflows. This feature enhances efficiency and ensures that contracts and agreements are signed promptly.

-

How much does airSlate SignNow cost for using ct uc 5a features?

Pricing for airSlate SignNow varies based on the features you choose, including ct uc 5a capabilities. We offer competitive pricing tiers designed to fit different business needs. For detailed pricing information, it's best to visit our pricing page or contact our sales team.

-

Can I integrate ct uc 5a with other software my business uses?

Yes, airSlate SignNow, including ct uc 5a features, seamlessly integrates with many popular software applications. This allows businesses to streamline their document management processes. Check our integration documentation for a list of compatible platforms.

-

What are the benefits of using ct uc 5a in my business?

Using the ct uc 5a functionality in airSlate SignNow offers several benefits, including increased efficiency in document signing and reduced turnaround times. Additionally, it enhances the user experience, allowing teams to focus on more critical tasks. Overall, this leads to better productivity and time management.

-

Is airSlate SignNow’s ct uc 5a secure for sensitive documents?

Absolutely! airSlate SignNow, including its ct uc 5a features, prioritizes security with advanced encryption protocols. Our commitment to protecting your sensitive documents ensures compliance with industry standards. You can trust that your data is safe and secure when using our platform.

-

How easy is it to use the ct uc 5a feature in airSlate SignNow?

The ct uc 5a feature in airSlate SignNow is designed with user-friendliness in mind, making it accessible for all users regardless of technical expertise. The intuitive interface allows you to quickly send and eSign documents without hassle. You'll find that the learning curve is minimal, enabling immediate productivity.

-

Can I customize documents when using ct uc 5a?

Yes, airSlate SignNow allows extensive customization of documents when utilizing the ct uc 5a feature. This flexibility means you can add your branding, adjust templates, and tailor the signing experience to match your business needs. Customization helps reinforce your brand identity during the signing process.

Get more for Ct Uc 5a

- Clerical medical distribution bond form

- Caregiver evaluation form 25867436

- Price for a sold waste sticker in durham nc form

- Denver homestead exemption form

- Start back tool pdf form

- Affidavit of non ownership colorado form

- Maryland form cra combined registration application

- Mw 508a annual employer withholding reconciliation return mw 508a annual employer withholding reconciliation return form

Find out other Ct Uc 5a

- Electronic signature Alabama Limited Partnership Agreement Online

- Can I Electronic signature Wisconsin Retainer Agreement Template

- Can I Electronic signature Michigan Trademark License Agreement

- Electronic signature Indiana Letter Bankruptcy Inquiry Now

- eSignature Oklahoma Payroll Deduction Authorization Easy

- How To eSignature Texas Payroll Deduction Authorization

- Can I Electronic signature Connecticut Retainer for Attorney

- How Do I Electronic signature Idaho Assignment of License

- Electronic signature New Jersey Lease Renewal Free

- Electronic signature Texas Lease Renewal Fast

- How Can I Electronic signature Colorado Notice of Intent to Vacate

- eSignature Delaware Employee Compliance Survey Later

- eSignature Kansas Employee Compliance Survey Myself

- Can I Electronic signature Colorado Bill of Sale Immovable Property

- How Can I Electronic signature West Virginia Vacation Rental Short Term Lease Agreement

- How Do I Electronic signature New Hampshire Bill of Sale Immovable Property

- Electronic signature North Dakota Bill of Sale Immovable Property Myself

- Can I Electronic signature Oregon Bill of Sale Immovable Property

- How To Electronic signature West Virginia Bill of Sale Immovable Property

- Electronic signature Delaware Equipment Sales Agreement Fast