Borang Pinjaman Maybank 2021-2026

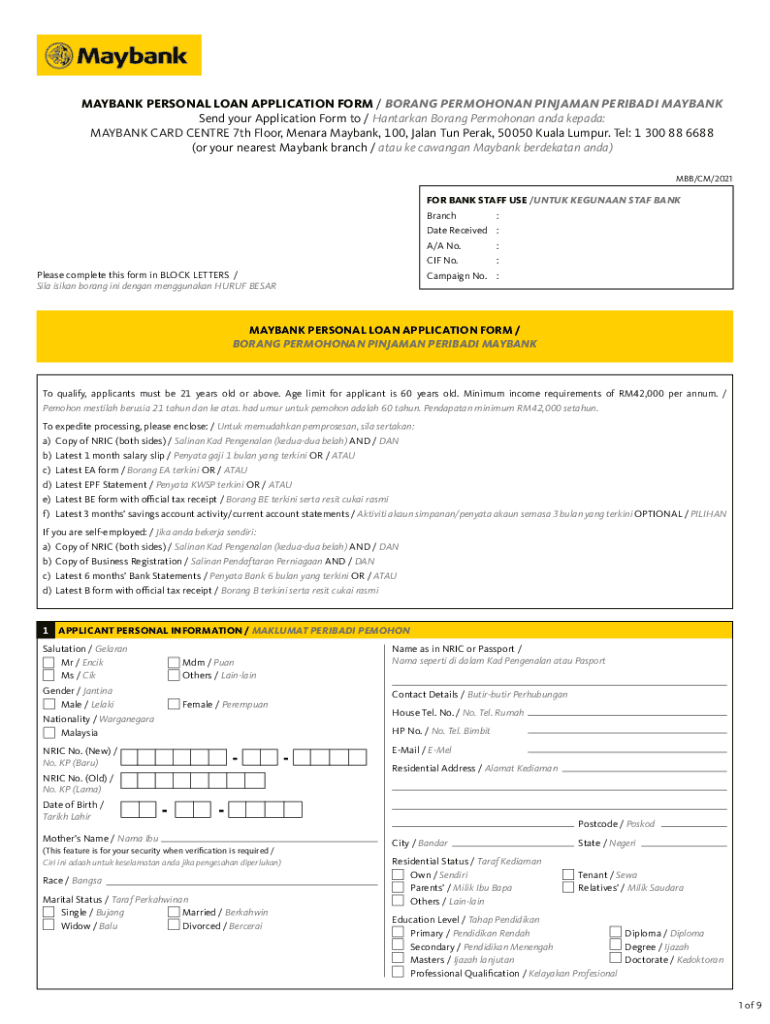

What is the Maybank personal loan application form?

The Maybank personal loan application form is a crucial document that individuals must complete to apply for a personal loan from Maybank. This form collects essential information about the applicant, including personal details, financial status, and the desired loan amount. It serves as the foundation for the bank's assessment of the applicant's eligibility for a loan and the terms that may be offered. Understanding the components of this form is vital for a successful application process.

Steps to complete the Maybank personal loan application form

Completing the Maybank personal loan application form involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, such as proof of income, identification, and any additional financial statements. Next, carefully fill out the form with your personal information, including your full name, address, and contact details. Be sure to provide accurate financial information, such as your monthly income and existing liabilities. Finally, review the form for any errors before submission to avoid delays in processing your application.

Required documents for the Maybank personal loan application

When applying for a personal loan with Maybank, certain documents are required to support your application. Commonly required documents include:

- Proof of identity, such as a government-issued ID or passport

- Proof of income, which may include recent pay stubs or tax returns

- Bank statements for the last three to six months

- Employment verification letter from your employer

Having these documents ready can streamline the application process and enhance the likelihood of approval.

Eligibility criteria for the Maybank personal loan

To qualify for a Maybank personal loan, applicants must meet specific eligibility criteria. Generally, these criteria include:

- Being at least eighteen years old

- Having a stable source of income

- Possessing a good credit history

- Meeting the minimum income requirement set by Maybank

Each applicant's situation is evaluated on a case-by-case basis, and meeting these criteria does not guarantee loan approval.

Application process and approval time for the Maybank personal loan

The application process for a Maybank personal loan typically involves submitting the completed application form along with the required documents. Once submitted, the bank reviews the application and verifies the information provided. The approval time can vary, but applicants can usually expect a decision within a few business days. Factors that may affect the approval timeline include the completeness of the application, the volume of applications being processed, and the need for additional documentation.

Legal use of the Maybank personal loan application form

The Maybank personal loan application form is legally binding once it is signed and submitted. It is essential that applicants understand the terms and conditions associated with the loan they are applying for. By signing the form, applicants agree to the bank's terms, including repayment schedules and interest rates. Ensuring that all information is accurate and truthful is critical, as providing false information can lead to legal consequences and denial of the loan.

Quick guide on how to complete borang pinjaman maybank 570071816

Complete Borang Pinjaman Maybank effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents swiftly without delays. Manage Borang Pinjaman Maybank on any device using airSlate SignNow's Android or iOS applications and enhance any document-related procedure today.

The easiest way to edit and eSign Borang Pinjaman Maybank effortlessly

- Obtain Borang Pinjaman Maybank and then click Get Form to begin.

- Employ the tools we provide to finalize your form.

- Emphasize important sections of your documents or conceal sensitive information using tools specifically designed by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and then click the Done button to save your modifications.

- Select how you wish to share your form, via email, text message (SMS), or invite link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Edit and eSign Borang Pinjaman Maybank and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct borang pinjaman maybank 570071816

Create this form in 5 minutes!

How to create an eSignature for the borang pinjaman maybank 570071816

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Maybank personal loan?

A Maybank personal loan is a financial product offered by Maybank that provides individuals with funds to cover personal expenses. This loan is tailored to meet various needs, such as home improvements, medical bills, or unexpected expenses. With flexible repayment terms, it aims to offer borrowers convenience and ease.

-

What are the eligibility criteria for a Maybank personal loan?

To qualify for a Maybank personal loan, applicants generally need to meet specific criteria, including age, income level, and employment status. Typically, you must be at least 21 years old and a Malaysian citizen or a permanent resident. It's essential to check the latest requirements on the Maybank website for detailed information.

-

What are the interest rates for a Maybank personal loan?

The interest rates for a Maybank personal loan vary based on the loan amount and the applicant's creditworthiness. Typically, these rates are competitive, making it an appealing option for borrowers. Always consult the Maybank official site or a representative for the most current rates applicable to your situation.

-

Can I use a Maybank personal loan for debt consolidation?

Yes, a Maybank personal loan can be utilized for debt consolidation, allowing you to merge multiple debts into a single loan with a potentially lower interest rate. This can simplify your repayment process and help manage your finances better. It's advisable to assess your financial situation to determine if this option suits your needs.

-

What is the maximum loan amount I can apply for with a Maybank personal loan?

The maximum loan amount for a Maybank personal loan varies based on your income and credit profile. Typically, these loans can range from a few thousand to several tens of thousands of ringgit. It's important to discuss your needs with a Maybank representative to understand what you may qualify for.

-

How long does it take to get approved for a Maybank personal loan?

Approval for a Maybank personal loan can be quite swift, often taking just a few days if all necessary documents are in order. Processing times may vary based on the completeness of your application and the current volume of requests. For the best experience, ensure all required documentation is submitted accurately.

-

What are the repayment options available for a Maybank personal loan?

Maybank offers various repayment options for its personal loans, allowing users to select terms that best fit their financial situations. Borrowers can choose between different repayment periods and monthly installment plans. This flexibility helps individuals manage their debts more effectively, ensuring timely payments.

Get more for Borang Pinjaman Maybank

- Edd forms printable

- Printable anticoagulant alert card form

- Leather inspection report form

- Genius challenge water cycle answers form

- Dr2504 100497256 form

- Industrial commission of arizona request for state legal forms

- Marriage license application shasta county form

- Exhibit b claim form sc superior court e filing

Find out other Borang Pinjaman Maybank

- Sign New York Affidavit of No Lien Online

- How To Sign Delaware Trademark License Agreement

- How To Sign Nevada Retainer for Attorney

- How To Sign Georgia Assignment of License

- Sign Arizona Assignment of Lien Simple

- How To Sign Kentucky Assignment of Lien

- How To Sign Arkansas Lease Renewal

- Sign Georgia Forbearance Agreement Now

- Sign Arkansas Lease Termination Letter Mobile

- Sign Oregon Lease Termination Letter Easy

- How To Sign Missouri Lease Renewal

- Sign Colorado Notice of Intent to Vacate Online

- How Can I Sign Florida Notice of Intent to Vacate

- How Do I Sign Michigan Notice of Intent to Vacate

- Sign Arizona Pet Addendum to Lease Agreement Later

- How To Sign Pennsylvania Notice to Quit

- Sign Connecticut Pet Addendum to Lease Agreement Now

- Sign Florida Pet Addendum to Lease Agreement Simple

- Can I Sign Hawaii Pet Addendum to Lease Agreement

- Sign Louisiana Pet Addendum to Lease Agreement Free