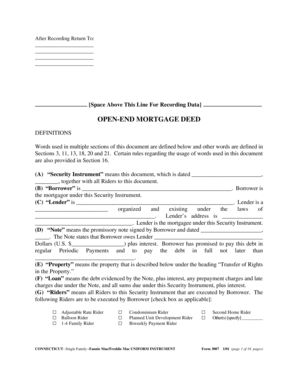

OPEN END MORTGAGE DEED Form

What is the 3007 form?

The 3007 form is a specific document used in various legal and financial transactions in the United States. It is often associated with the management and documentation of mortgages, particularly in relation to open-end mortgages. This form serves to outline the terms and conditions agreed upon by the parties involved, ensuring clarity and legal compliance.

Key elements of the 3007 form

Understanding the key elements of the 3007 form is essential for proper completion and usage. The form typically includes:

- Borrower Information: Details about the individual or entity borrowing funds.

- Lender Information: Information regarding the financial institution or individual providing the loan.

- Loan Amount: The total amount of money being borrowed.

- Interest Rate: The rate at which interest will accrue on the borrowed amount.

- Property Description: A detailed description of the property being mortgaged.

- Terms and Conditions: Specific provisions that govern the loan agreement.

Steps to complete the 3007 form

Completing the 3007 form involves several important steps to ensure accuracy and compliance:

- Gather necessary documentation, including personal identification and property details.

- Fill in the borrower and lender information accurately.

- Specify the loan amount and interest rate clearly.

- Provide a comprehensive description of the property involved.

- Review the terms and conditions section carefully to ensure all provisions are included.

- Sign and date the form where required, ensuring all parties have completed their sections.

Legal use of the 3007 form

The 3007 form must be used in accordance with applicable laws and regulations. It is crucial to ensure that all information provided is truthful and accurate, as any discrepancies could lead to legal issues. Proper filing and submission of the form are necessary to uphold the legal standing of the mortgage agreement.

Filing deadlines / Important dates

Timeliness is critical when dealing with the 3007 form. It is essential to be aware of any filing deadlines or important dates related to the mortgage process. Typically, the form should be submitted promptly following the agreement between the borrower and lender to avoid any complications or penalties.

Form submission methods

The 3007 form can be submitted through various methods, depending on the lender's requirements. Common submission methods include:

- Online Submission: Many lenders offer digital platforms for submitting the form electronically.

- Mail: The form can be printed and mailed to the appropriate lender or regulatory body.

- In-Person: Submitting the form in person may be required in certain situations, especially for notarization.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the open end mortgage deed

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 3007 form and why is it important?

The 3007 form is a crucial document used for various business transactions, particularly in the context of electronic signatures. Understanding its significance can streamline your workflow and ensure compliance with legal standards. Using airSlate SignNow, you can easily manage and eSign the 3007 form, enhancing efficiency in your operations.

-

How does airSlate SignNow simplify the process of completing the 3007 form?

airSlate SignNow offers an intuitive platform that allows users to fill out and eSign the 3007 form seamlessly. With features like drag-and-drop document upload and customizable templates, you can complete the form quickly and accurately. This not only saves time but also reduces the risk of errors.

-

What are the pricing options for using airSlate SignNow for the 3007 form?

airSlate SignNow provides flexible pricing plans tailored to meet the needs of businesses of all sizes. Whether you need basic features for occasional use or advanced functionalities for frequent transactions involving the 3007 form, there’s a plan that fits your budget. Visit our pricing page for detailed information on each plan.

-

Can I integrate airSlate SignNow with other software for managing the 3007 form?

Yes, airSlate SignNow offers robust integrations with various software applications, making it easy to manage the 3007 form alongside your existing tools. Whether you use CRM systems, cloud storage, or project management software, our integrations enhance your workflow. This ensures that you can access and eSign the 3007 form without switching between platforms.

-

What security measures does airSlate SignNow implement for the 3007 form?

Security is a top priority at airSlate SignNow, especially when handling sensitive documents like the 3007 form. We utilize advanced encryption protocols and secure cloud storage to protect your data. Additionally, our platform complies with industry standards to ensure that your eSigned documents are safe and legally binding.

-

Is it easy to track the status of the 3007 form with airSlate SignNow?

Absolutely! airSlate SignNow provides real-time tracking features that allow you to monitor the status of the 3007 form throughout the signing process. You will receive notifications when the document is viewed, signed, or completed, ensuring you stay informed every step of the way.

-

What are the benefits of using airSlate SignNow for the 3007 form?

Using airSlate SignNow for the 3007 form offers numerous benefits, including increased efficiency, reduced turnaround time, and enhanced accuracy. Our platform simplifies the signing process, allowing you to focus on your core business activities. Additionally, the ability to access documents from anywhere boosts productivity.

Get more for OPEN END MORTGAGE DEED

- Malenga wapya pdf download form

- New general mathematics ss1 pdf download form

- Jolly grammar 1 teacher book pdf download form

- Interchange 1 tests and quizzes form

- Non creamy layer certificate telangana pdf form

- Namenc form

- Download the executive registration form uwa student guild

- Imm 5484 f liste de contrle des documents form

Find out other OPEN END MORTGAGE DEED

- Electronic signature Oklahoma Education LLC Operating Agreement Fast

- How To Electronic signature Virginia Healthcare / Medical Contract

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile

- Can I Electronic signature Wisconsin Healthcare / Medical Operating Agreement

- Electronic signature Alabama High Tech Stock Certificate Fast

- Electronic signature Insurance Document California Computer

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will

- Electronic signature Insurance Document Kentucky Myself

- Electronic signature Delaware High Tech Quitclaim Deed Online

- Electronic signature Maine Insurance Quitclaim Deed Later

- Electronic signature Louisiana Insurance LLC Operating Agreement Easy

- Electronic signature West Virginia Education Contract Safe