CONSENT to DISCLOSURE of TAX RETURN INFORMATION

What is the CONSENT TO DISCLOSURE OF TAX RETURN INFORMATION

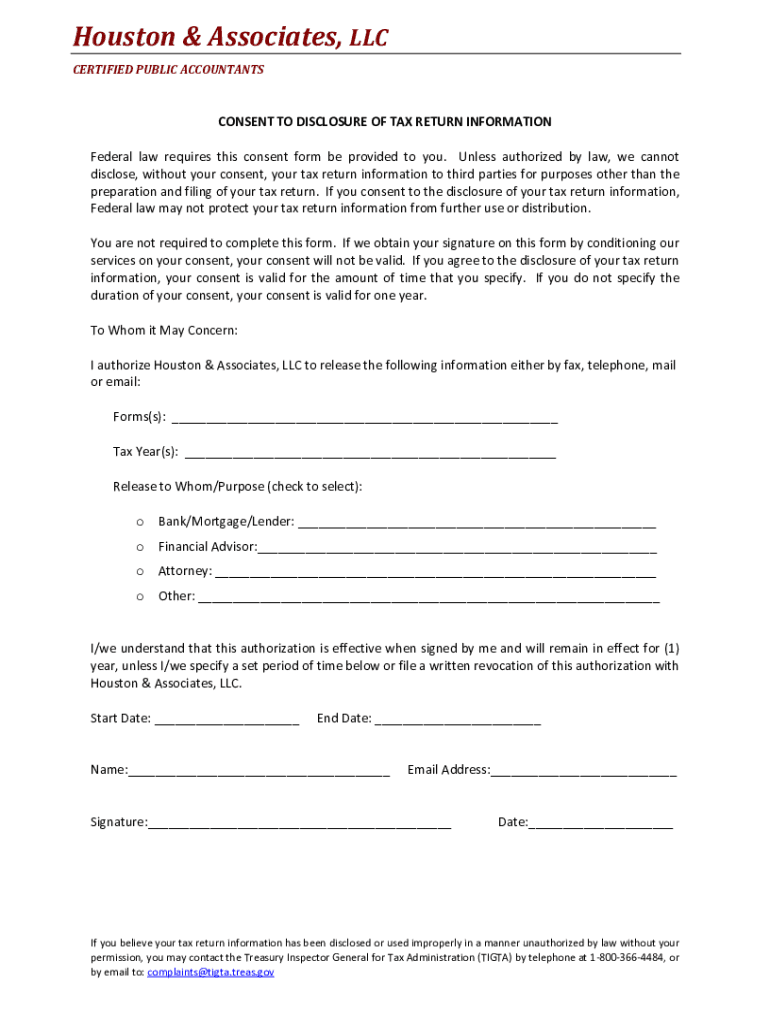

The CONSENT TO DISCLOSURE OF TAX RETURN INFORMATION is a legal document that allows taxpayers to authorize the release of their tax return information to a third party. This consent is essential for ensuring that sensitive financial data is shared only with individuals or organizations designated by the taxpayer. The form typically includes details such as the taxpayer's name, Social Security number, and the specific information to be disclosed. By signing this document, taxpayers can facilitate processes such as loan applications or financial consultations where their tax information is required.

How to use the CONSENT TO DISCLOSURE OF TAX RETURN INFORMATION

To use the CONSENT TO DISCLOSURE OF TAX RETURN INFORMATION, taxpayers should first obtain the appropriate form, which can often be downloaded from the IRS website or requested from a tax professional. After filling out the necessary details, including the recipient's information and the scope of the disclosure, the taxpayer must sign and date the form. It is crucial to ensure that all information is accurate to avoid delays or issues with the disclosure process. Once completed, the form should be submitted to the designated third party, who will then have the authority to access the specified tax information.

Steps to complete the CONSENT TO DISCLOSURE OF TAX RETURN INFORMATION

Completing the CONSENT TO DISCLOSURE OF TAX RETURN INFORMATION involves several key steps:

- Obtain the form from a reliable source, such as the IRS or a tax professional.

- Fill in your personal information, including your name and Social Security number.

- Specify the third party to whom you are granting access to your tax return information.

- Indicate the specific tax years or types of information you are consenting to disclose.

- Sign and date the form to validate your consent.

- Submit the completed form to the designated third party.

Key elements of the CONSENT TO DISCLOSURE OF TAX RETURN INFORMATION

The key elements of the CONSENT TO DISCLOSURE OF TAX RETURN INFORMATION include:

- Taxpayer Information: Full name, Social Security number, and address.

- Recipient Details: Name and address of the individual or organization receiving the information.

- Scope of Disclosure: Specific tax return information being disclosed, including years covered.

- Signature: The taxpayer's signature and date, confirming the consent.

Legal use of the CONSENT TO DISCLOSURE OF TAX RETURN INFORMATION

The legal use of the CONSENT TO DISCLOSURE OF TAX RETURN INFORMATION is governed by federal and state laws, which require that the taxpayer provides explicit consent before any tax information can be shared. This form is particularly important for compliance with privacy regulations, ensuring that sensitive information is not disclosed without the taxpayer's permission. Failure to adhere to these legal requirements can result in penalties for both the taxpayer and the third party involved.

Disclosure Requirements

Disclosure requirements for the CONSENT TO DISCLOSURE OF TAX RETURN INFORMATION mandate that taxpayers must clearly specify what information is being shared and with whom. The form must be signed by the taxpayer, and it should detail the purpose of the disclosure. Additionally, the taxpayer should retain a copy of the consent form for their records. This ensures that all parties are aware of the terms of the disclosure and that the taxpayer's rights are protected throughout the process.

Quick guide on how to complete consent to disclosure of tax return information

Complete CONSENT TO DISCLOSURE OF TAX RETURN INFORMATION effortlessly on any gadget

Digital document management has become widely accepted by businesses and individuals alike. It offers an ideal environmentally-friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly without any hold-ups. Manage CONSENT TO DISCLOSURE OF TAX RETURN INFORMATION on any device with airSlate SignNow Android or iOS applications and streamline any document-related procedure today.

The easiest way to edit and electronically sign CONSENT TO DISCLOSURE OF TAX RETURN INFORMATION with ease

- Obtain CONSENT TO DISCLOSURE OF TAX RETURN INFORMATION and click Get Form to begin.

- Utilize the tools we provide to finalize your form.

- Emphasize important sections of your documents or obscure sensitive information using specialized tools offered by airSlate SignNow.

- Generate your signature with the Sign tool, which takes only a few seconds and holds the same legal authority as a traditional ink signature.

- Review all the details and click on the Done button to save your updates.

- Select your preferred method for delivering your form, whether via email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or scattered documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign CONSENT TO DISCLOSURE OF TAX RETURN INFORMATION to ensure excellent communication at every phase of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the consent to disclosure of tax return information

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the CONSENT TO DISCLOSURE OF TAX RETURN INFORMATION?

The CONSENT TO DISCLOSURE OF TAX RETURN INFORMATION is a document that grants permission for the sharing of your tax return details with third parties. This is essential for businesses that need to verify financial information while ensuring compliance with privacy regulations.

-

How does airSlate SignNow facilitate the CONSENT TO DISCLOSURE OF TAX RETURN INFORMATION process?

AirSlate SignNow streamlines the process by allowing you to easily create, send, and eSign the CONSENT TO DISCLOSURE OF TAX RETURN INFORMATION form. Its user-friendly platform ensures that all parties can quickly complete the necessary documentation without delays.

-

Is airSlate SignNow compliant with laws regarding the CONSENT TO DISCLOSURE OF TAX RETURN INFORMATION?

Yes, airSlate SignNow is designed to comply with legal standards and regulations surrounding the CONSENT TO DISCLOSURE OF TAX RETURN INFORMATION. Our solution ensures that all eSignatures and documents are secure and legally valid.

-

What pricing options does airSlate SignNow offer for managing tax return disclosures?

AirSlate SignNow provides flexible pricing plans to accommodate various business needs while managing the CONSENT TO DISCLOSURE OF TAX RETURN INFORMATION. Each plan includes features tailored to streamline document management and eSigning at competitive rates.

-

What features does airSlate SignNow offer for the CONSENT TO DISCLOSURE OF TAX RETURN INFORMATION?

AirSlate SignNow offers a range of features such as customizable templates, secure cloud storage, and automated workflows for the CONSENT TO DISCLOSURE OF TAX RETURN INFORMATION. These features make document management efficient and help ensure compliance.

-

Can airSlate SignNow integrate with other software for tax management?

Yes, airSlate SignNow can integrate with various accounting and tax management software, enhancing the experience for handling CONSENT TO DISCLOSURE OF TAX RETURN INFORMATION. This ensures seamless data transfer and efficient document processing.

-

What benefits can businesses expect from using airSlate SignNow for tax return disclosures?

By using airSlate SignNow to manage the CONSENT TO DISCLOSURE OF TAX RETURN INFORMATION, businesses can expect increased efficiency, reduced turnaround times, and enhanced document security. This helps streamline operations while maintaining compliance.

Get more for CONSENT TO DISCLOSURE OF TAX RETURN INFORMATION

Find out other CONSENT TO DISCLOSURE OF TAX RETURN INFORMATION

- Sign Idaho Legal Living Will Online

- Sign Oklahoma Insurance Limited Power Of Attorney Now

- Sign Idaho Legal Separation Agreement Online

- Sign Illinois Legal IOU Later

- Sign Illinois Legal Cease And Desist Letter Fast

- Sign Indiana Legal Cease And Desist Letter Easy

- Can I Sign Kansas Legal LLC Operating Agreement

- Sign Kansas Legal Cease And Desist Letter Now

- Sign Pennsylvania Insurance Business Plan Template Safe

- Sign Pennsylvania Insurance Contract Safe

- How Do I Sign Louisiana Legal Cease And Desist Letter

- How Can I Sign Kentucky Legal Quitclaim Deed

- Sign Kentucky Legal Cease And Desist Letter Fast

- Sign Maryland Legal Quitclaim Deed Now

- Can I Sign Maine Legal NDA

- How To Sign Maine Legal Warranty Deed

- Sign Maine Legal Last Will And Testament Fast

- How To Sign Maine Legal Quitclaim Deed

- Sign Mississippi Legal Business Plan Template Easy

- How Do I Sign Minnesota Legal Residential Lease Agreement