Form 8962 Instructions

What is the Form 8962 Instructions

The Form 8962, also known as the Premium Tax Credit (PTC) form, is used to calculate and claim the premium tax credit for individuals and families who purchased health insurance through the Health Insurance Marketplace. The instructions for this form provide essential guidance on how to accurately complete it, ensuring compliance with IRS regulations. The form is specifically designed to help taxpayers reconcile their premium tax credit with the amount of premium tax credit they received in advance during the tax year.

How to use the Form 8962 Instructions

To effectively use the Form 8962 instructions, taxpayers should first gather all necessary documents, including Form 1095-A, which details the health coverage obtained through the Marketplace. The instructions guide users through each line of the form, explaining how to report income, household size, and other relevant information. It is crucial to follow these instructions closely to ensure that the calculations for the premium tax credit are accurate, which can significantly impact the taxpayer's overall tax liability.

Steps to complete the Form 8962 Instructions

Completing the Form 8962 involves several key steps:

- Gather necessary documents, including Form 1095-A.

- Follow the instructions to determine your household size and income.

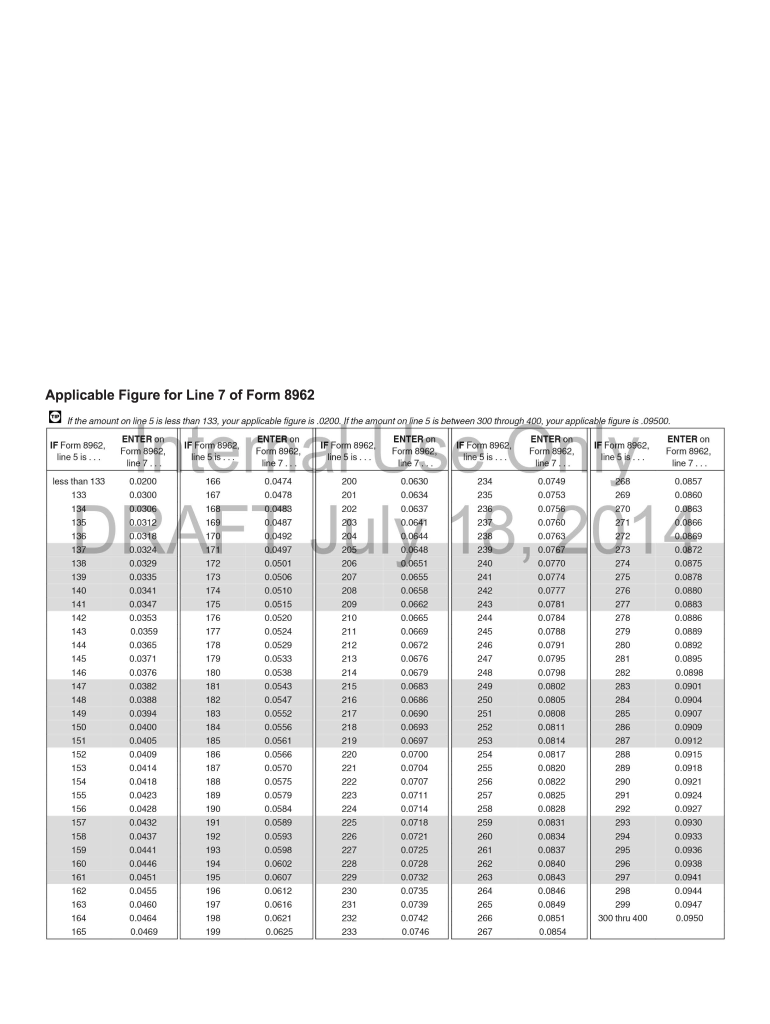

- Calculate the premium tax credit using the applicable figure for the year.

- Fill out each section of the form, ensuring that all information is accurate.

- Review the completed form for any errors before submission.

By adhering to these steps, taxpayers can ensure that their Form 8962 is completed correctly and submitted on time.

Legal use of the Form 8962 Instructions

The legal use of Form 8962 instructions is critical for ensuring that taxpayers comply with federal tax laws. The form must be filed with the IRS when claiming the premium tax credit, and accurate completion is necessary to avoid penalties. The instructions clarify the legal requirements for eligibility, including income thresholds and household composition, which are essential for determining the correct amount of credit. Understanding these legal aspects helps taxpayers navigate the complexities of tax compliance.

Eligibility Criteria

To qualify for the premium tax credit outlined in Form 8962, taxpayers must meet specific eligibility criteria:

- Must have purchased health insurance through the Health Insurance Marketplace.

- Must have a household income between one hundred and four hundred percent of the federal poverty level.

- Must not be eligible for other minimum essential coverage, such as Medicaid or Medicare.

- Must file a federal tax return for the year in which the credit is claimed.

Meeting these criteria is essential for successfully claiming the premium tax credit and ensuring compliance with IRS regulations.

Filing Deadlines / Important Dates

Filing deadlines for Form 8962 are aligned with the general tax filing deadlines. Typically, taxpayers must submit their federal tax returns by April fifteenth of the following year. If additional time is needed, taxpayers can file for an extension, but the premium tax credit must still be reconciled by the original deadline. It is important to stay informed about any changes to deadlines that may occur due to legislative updates or IRS announcements.

Quick guide on how to complete form 8962 instructions

Effortlessly Prepare Form 8962 Instructions on Any Device

Online document management has gained traction among companies and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary forms and securely keep them online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents rapidly without delays. Manage Form 8962 Instructions on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

Edit and Electronically Sign Form 8962 Instructions with Ease

- Locate Form 8962 Instructions and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize relevant sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how you want to send your form, via email, SMS, or an invitation link, or download it to your computer.

No more worrying about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from your preferred device. Modify and electronically sign Form 8962 Instructions and ensure effective communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 8962 instructions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the applicable figure 2017 for airSlate SignNow pricing?

The applicable figure 2017 for airSlate SignNow pricing indicates our commitment to providing affordable eSignature solutions. Our pricing plans are designed to meet the needs of businesses of all sizes, ensuring that you receive excellent value for your investment. By offering various tiers, we make it easier for you to find a plan that fits your budget.

-

What features does airSlate SignNow offer for managing documents?

airSlate SignNow provides a range of features tailored for document management, all rooted in the applicable figure 2017 guidelines. Key functionalities include eSigning, document templates, and real-time collaboration, which streamline the document workflow. These tools empower you to increase efficiency and reduce turnaround time for your contracts and agreements.

-

How does airSlate SignNow ensure security for signed documents?

Security is a top priority for airSlate SignNow, and our approach is guided by the applicable figure 2017 standards. We implement robust encryption, secure storage, and compliance measures to protect your sensitive information. You can trust that your documents will be secure and accessible only to authorized users.

-

Can airSlate SignNow integrate with other software solutions?

Yes, airSlate SignNow supports integrations with a variety of software applications, aligning with the applicable figure 2017 principles for seamless connectivity. You can integrate with CRM systems, cloud storage services, and project management tools to enhance your document workflow. This flexibility allows you to tailor the solution to your specific business needs.

-

What are the benefits of using airSlate SignNow for my business?

Using airSlate SignNow provides numerous benefits that align with the applicable figure 2017 objectives. It simplifies the signing process, reduces paper usage, and improves operational efficiency. By adopting our solution, you can also enhance customer satisfaction with quick and easy document transactions.

-

Is there a mobile app for airSlate SignNow?

Yes, airSlate SignNow offers a mobile app that allows you to manage eSignatures on the go, following the applicable figure 2017 framework for accessibility. This app provides users with the flexibility to send, sign, and track documents from their smartphones and tablets. Consequently, you can stay productive no matter where you are.

-

What type of customer support does airSlate SignNow provide?

airSlate SignNow offers comprehensive customer support to users, ensuring alignment with the applicable figure 2017 standard for user assistance. Our support team is available via multiple channels, including live chat, email, and phone, to help resolve any issues you may encounter. We aim to provide timely and effective solutions, enhancing your experience with our platform.

Get more for Form 8962 Instructions

Find out other Form 8962 Instructions

- eSignature Colorado Demand for Payment Letter Mobile

- eSignature Colorado Demand for Payment Letter Secure

- eSign Delaware Shareholder Agreement Template Now

- eSign Wyoming Shareholder Agreement Template Safe

- eSign Kentucky Strategic Alliance Agreement Secure

- Can I eSign Alaska Equipment Rental Agreement Template

- eSign Michigan Equipment Rental Agreement Template Later

- Help Me With eSignature Washington IOU

- eSign Indiana Home Improvement Contract Myself

- eSign North Dakota Architectural Proposal Template Online

- How To eSignature Alabama Mechanic's Lien

- Can I eSign Alabama Car Insurance Quotation Form

- eSign Florida Car Insurance Quotation Form Mobile

- eSign Louisiana Car Insurance Quotation Form Online

- Can I eSign Massachusetts Car Insurance Quotation Form

- eSign Michigan Car Insurance Quotation Form Online

- eSign Michigan Car Insurance Quotation Form Mobile

- eSignature Massachusetts Mechanic's Lien Online

- eSignature Massachusetts Mechanic's Lien Free

- eSign Ohio Car Insurance Quotation Form Mobile