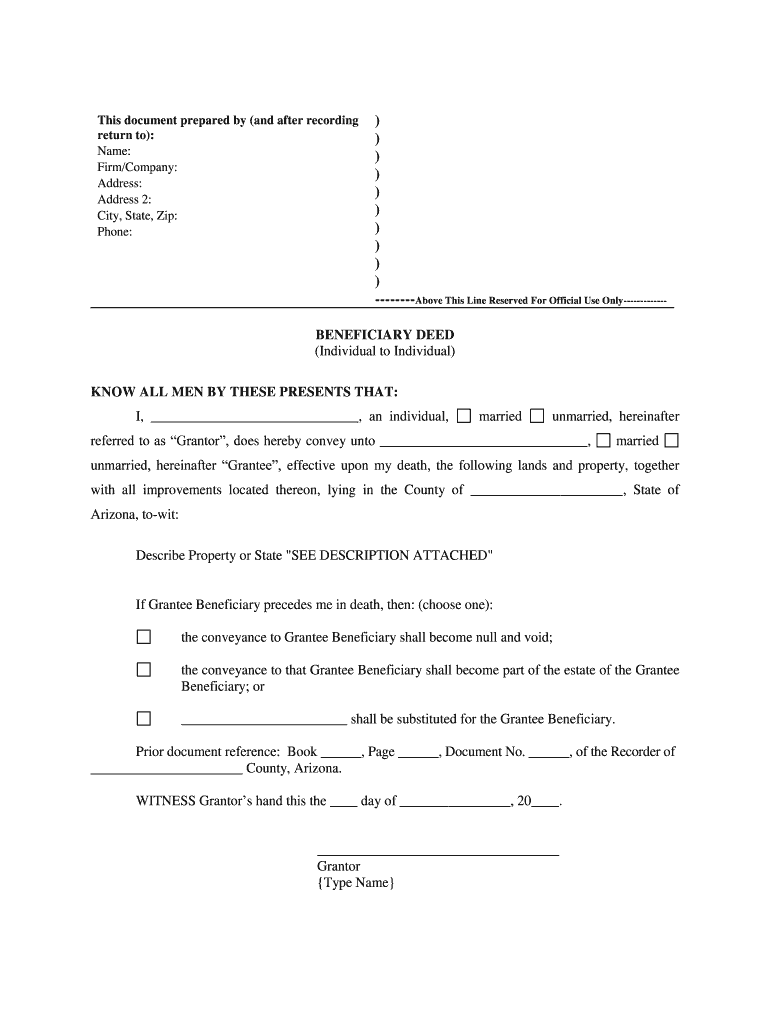

Beneficiary Deed Arizona Form

What is the quit claim deed in Arizona?

A quit claim deed in Arizona is a legal document used to transfer ownership of real property from one party to another without any guarantees regarding the title. This type of deed conveys whatever interest the grantor has in the property at the time of the transfer. It is often used among family members or in situations where the parties know each other well, as it does not provide the same level of protection as a warranty deed.

Steps to complete the quit claim deed in Arizona

Completing a quit claim deed in Arizona involves several key steps:

- Obtain the form: You can find a quit claim deed form specific to Arizona online or at a local legal stationery store.

- Fill out the form: Include the names of the grantor (the person transferring the property) and the grantee (the person receiving the property), along with a legal description of the property.

- Sign the deed: The grantor must sign the deed in front of a notary public to ensure its legality.

- Record the deed: Submit the completed and notarized deed to the county recorder’s office in the county where the property is located. This step is crucial for public record.

Legal use of the quit claim deed in Arizona

In Arizona, a quit claim deed is legally recognized and can be used for various purposes, including transferring property between family members, clearing up title issues, or transferring property into a trust. However, it is important to understand that this deed does not guarantee that the grantor holds clear title to the property, which can lead to potential disputes if there are existing liens or claims against the property.

Required documents for the quit claim deed in Arizona

To complete a quit claim deed in Arizona, you typically need the following documents:

- The quit claim deed form, filled out and signed.

- A legal description of the property, which can usually be found on the existing deed or through the county assessor's office.

- A notary public to witness the signature of the grantor.

State-specific rules for the quit claim deed in Arizona

Arizona has specific rules regarding quit claim deeds that must be followed to ensure validity:

- The deed must be signed by the grantor and notarized.

- It must include a legal description of the property being transferred.

- The deed should be recorded with the county recorder’s office to provide public notice of the transfer.

Examples of using the quit claim deed in Arizona

Common scenarios for using a quit claim deed in Arizona include:

- Transferring property between family members, such as from parents to children.

- Clearing up title issues when a property has multiple owners.

- Transferring property into a trust for estate planning purposes.

Quick guide on how to complete beneficiary deed arizona 495361277

Complete Beneficiary Deed Arizona effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can obtain the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Handle Beneficiary Deed Arizona on any device using the airSlate SignNow Android or iOS applications and streamline your document-related tasks today.

The simplest way to modify and eSign Beneficiary Deed Arizona with ease

- Find Beneficiary Deed Arizona and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize essential parts of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which only takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the information and then click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you prefer. Edit and eSign Beneficiary Deed Arizona and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the beneficiary deed arizona 495361277

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a quit claim deed in Arizona?

A quit claim deed in Arizona is a legal document that allows a property owner to transfer their interest to another entity without making any warranties about the title. This type of deed is often used between family members or in divorce settlements. It is crucial to ensure that the deed is properly executed and recorded in Arizona for it to be legally binding.

-

How can airSlate SignNow help with creating a quit claim deed in Arizona?

airSlate SignNow offers an easy-to-use platform to create, send, and eSign a quit claim deed in Arizona securely. With customizable templates and user-friendly features, you can quickly draft your deed and ensure all necessary information is included. This streamlines the process and enhances efficiency.

-

What are the costs associated with filing a quit claim deed in Arizona?

While airSlate SignNow provides an affordable solution for document management, the cost of filing a quit claim deed in Arizona may include county recording fees and any applicable taxes. It is essential to check with your local county recorder's office for the exact fees related to filing a quit claim deed in your area.

-

Are there any benefits to using an electronic solution for quit claim deeds in Arizona?

Using an electronic solution like airSlate SignNow for managing quit claim deeds in Arizona offers numerous benefits, including convenience, speed, and security. You can complete the process from anywhere, track document status in real-time, and store your documents securely. This eliminates the hassle of paperwork and mailing.

-

What features does airSlate SignNow offer for quit claim deeds in Arizona?

airSlate SignNow provides features such as customizable templates, in-app eSignature capabilities, document collaboration, and secure cloud storage. These features streamline the entire process of creating and managing your quit claim deed in Arizona, ensuring that your documents are always accessible and well-organized.

-

Can I integrate airSlate SignNow with other applications for quit claim deed processes?

Yes, airSlate SignNow allows for seamless integrations with various applications, enhancing your workflow for quit claim deed processes in Arizona. You can connect with popular tools such as Google Drive, Dropbox, and CRM systems to maximize efficiency and keep all your documents in one place. This integration capability is vital for managing documents effectively.

-

Is it necessary to signNow a quit claim deed in Arizona?

Yes, in Arizona, a quit claim deed must be signNowd to be legally valid. Notarization provides an additional layer of authenticity and ensures that the signatures involved are legitimate. It's critical to follow these legal requirements for property transfer to be recognized by authorities.

Get more for Beneficiary Deed Arizona

- Form 62 0687

- Cheerleading forms 11978449

- Sbtpg phone number form

- Safety stand down template 215803234 form

- Wi form 1943

- S 114 instructions for wisconsin sales and use tax return form st 12 and county sales and use tax schedule schedule ct

- Formpw1wisconsin nonresident income or franchise t

- Wisconsin sch cc request for a closing certificate for form

Find out other Beneficiary Deed Arizona

- eSign Wisconsin High Tech Cease And Desist Letter Fast

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile