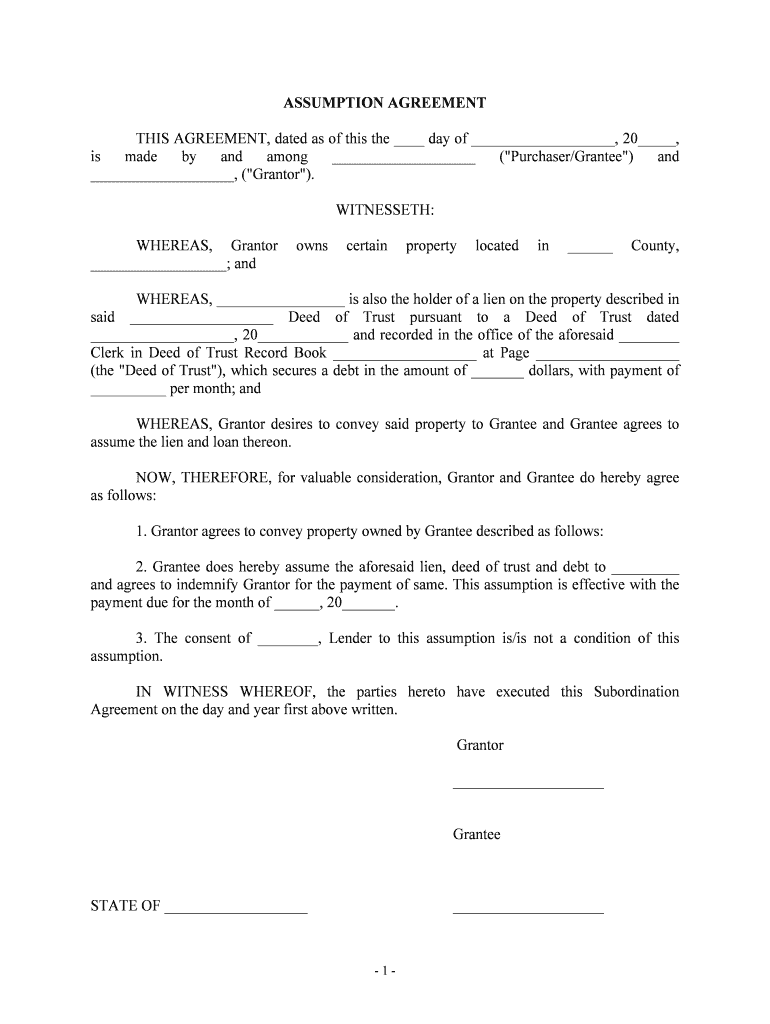

Loan Agreement Template Form

What is the loan agreement document?

A loan agreement document is a legally binding contract between a lender and a borrower that outlines the terms and conditions of a loan. This document specifies the amount borrowed, the interest rate, repayment schedule, and any collateral involved. It serves to protect the interests of both parties and ensures clarity regarding obligations and rights. The agreement can apply to various types of loans, including personal loans, auto loans, and mortgages, making it a crucial component of financial transactions.

Key elements of the loan agreement document

Understanding the key elements of a loan agreement document is essential for both lenders and borrowers. The primary components include:

- Loan amount: The total sum being borrowed.

- Interest rate: The cost of borrowing, expressed as a percentage of the loan amount.

- Repayment terms: The schedule detailing when payments are due and the duration of the loan.

- Collateral: Any assets pledged by the borrower to secure the loan.

- Default terms: Conditions under which the lender can take action if the borrower fails to meet obligations.

How to use the loan agreement document

Using a loan agreement document involves several steps to ensure its effectiveness and legality. First, both parties should review the terms carefully to ensure mutual understanding. Next, the document should be filled out completely, including all necessary details such as the loan amount and repayment schedule. Once completed, both parties must sign the document, ideally in the presence of a witness or notary to enhance its legal standing. Finally, each party should retain a copy for their records.

Steps to complete the loan agreement document

Completing a loan agreement document involves a systematic approach:

- Gather necessary information, including personal details and financial data.

- Choose a suitable loan agreement template that meets your needs.

- Fill in the required fields, ensuring accuracy in all figures and terms.

- Review the document with the other party to confirm agreement on all terms.

- Sign the document and have it witnessed or notarized if required.

- Distribute copies to all parties involved for their records.

Legal use of the loan agreement document

The legal use of a loan agreement document is governed by state and federal laws. It is important to ensure that the document complies with relevant regulations to be enforceable in court. This includes adhering to laws regarding interest rates, disclosures, and borrower rights. Additionally, electronic signatures are legally recognized under the ESIGN Act and UETA, allowing for convenient and secure signing processes. Understanding these legal frameworks helps protect both parties and ensures the agreement's validity.

Examples of using the loan agreement document

Loan agreement documents can be utilized in various scenarios, including:

- A personal loan between friends or family members.

- A formal loan from a financial institution for purchasing a vehicle.

- A mortgage agreement for buying a home.

- A business loan to finance operational costs or expansion.

Each example highlights the versatility of the loan agreement document in facilitating financial transactions while providing legal protection.

Quick guide on how to complete loan agreement template

Complete Loan Agreement Template effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly alternative to traditional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, edit, and electronically sign your documents quickly and without delays. Manage Loan Agreement Template on any platform using airSlate SignNow’s Android or iOS applications, and streamline any document-related process today.

The easiest method to modify and eSign Loan Agreement Template without exertion

- Find Loan Agreement Template and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about missing or lost files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device of your choice. Modify and eSign Loan Agreement Template and guarantee excellent communication throughout the form preparation process using airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the loan agreement template

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a loan agreement document?

A loan agreement document is a legally binding contract between a lender and a borrower outlining the terms of a loan. This document includes details such as the loan amount, interest rate, repayment schedule, and any collateral involved. Using airSlate SignNow, you can easily create and customize your loan agreement documents for seamless transactions.

-

How can airSlate SignNow help with loan agreement documents?

airSlate SignNow streamlines the process of creating, sharing, and signing loan agreement documents. With its user-friendly interface, you can quickly draft documents, collect eSignatures, and manage all your agreements in one secure platform. This simplifies the workflow and reduces the time spent on paperwork.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers competitive pricing plans suitable for businesses of all sizes. You can choose from different tiers to access features like unlimited document signing, templates, and integrations. Each plan is designed to ensure you get the most out of your investment while efficiently managing your loan agreement documents.

-

Are there any templates available for loan agreement documents?

Yes, airSlate SignNow provides several customizable templates for loan agreement documents. These templates come pre-filled with standard terms and conditions, allowing you to tailor them to fit your specific needs. This saves time and ensures your documents are professionally crafted.

-

Can I integrate airSlate SignNow with other platforms for my loan agreement documents?

Absolutely! airSlate SignNow integrates seamlessly with various third-party applications, such as CRM systems, payment processors, and cloud storage solutions. This enables you to manage your loan agreement documents alongside your other business tools, enhancing productivity and efficiency.

-

How secure are the signed loan agreement documents?

Security is a top priority at airSlate SignNow. All signed loan agreement documents are stored securely and encrypted, ensuring that your sensitive information remains protected. Furthermore, the platform complies with industry standards, providing peace of mind while you manage your documents.

-

What benefits does eSigning offer for loan agreement documents?

eSigning with airSlate SignNow speeds up the execution of loan agreement documents, allowing both parties to sign from anywhere at any time. This convenience reduces turnaround time and accelerates the loan process. Additionally, it provides a clear audit trail for better record-keeping.

Get more for Loan Agreement Template

- Eat your medicine companion guide pdf form

- Stupid fucking bird form

- Sigma gamma rho sorority inc staffcmcssnet staff cmcss form

- Dl180 form

- Genotropin smn form

- Instructions for form 940 instructions for form 940 employers annual federal unemployment futa tax return

- Credit for prior year minimum tax form 8801

- Instructions for form 2441 instructions for form 2441child and dependent care expenses

Find out other Loan Agreement Template

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word