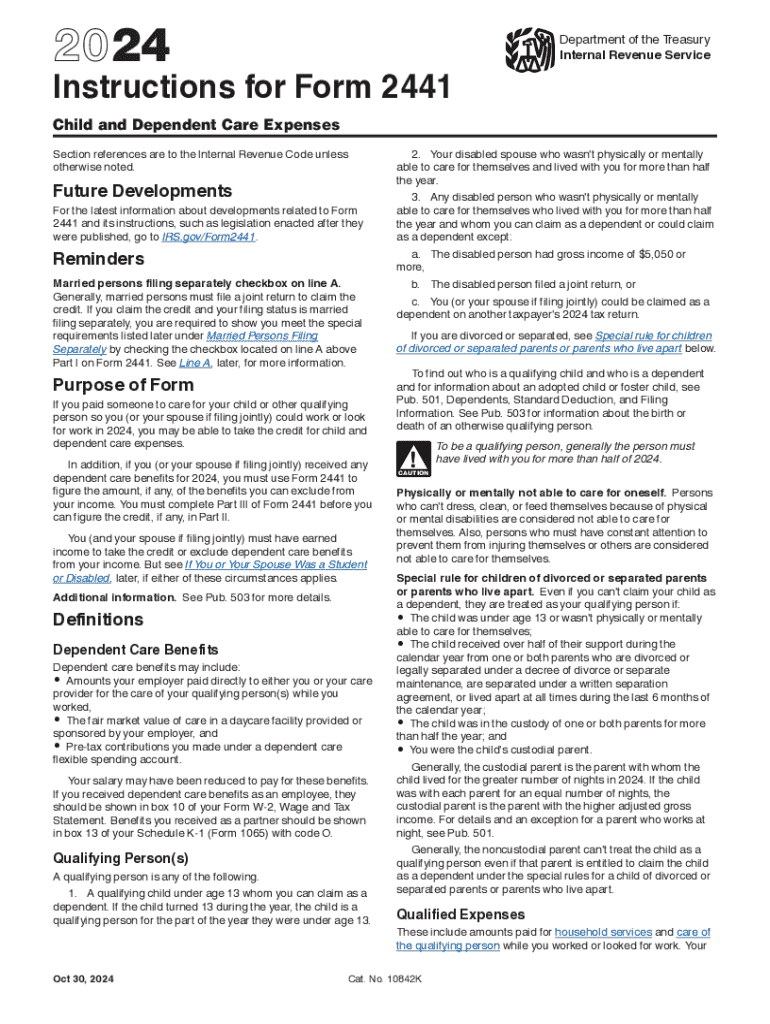

Instructions for Form 2441 Instructions for Form 2441,Child and Dependent Care Expenses 2024-2026

Understanding Form 2441

Form 2441 is a tax form used in the United States to claim the Child and Dependent Care Expenses Credit. This form allows taxpayers to report expenses incurred for the care of qualifying children or dependents while they work or look for work. The credit can help reduce the tax burden for families, making it an important aspect of tax planning for those who qualify.

The form is specifically designed for individuals who pay for care services, which can include daycare, babysitting, or other forms of care necessary for children under the age of thirteen or for dependents who are physically or mentally incapable of self-care.

Key Elements of Form 2441

When completing Form 2441, there are several key elements to consider:

- Qualifying Expenses: Only certain types of expenses can be claimed, such as payments made to care providers for services rendered.

- Eligibility Criteria: Taxpayers must meet specific criteria regarding income and the age of the child or dependent to qualify for the credit.

- Provider Information: The form requires detailed information about the care provider, including their name, address, and taxpayer identification number.

- Credit Calculation: The form includes sections for calculating the amount of credit based on the taxpayer's income and the total qualifying expenses.

Steps to Complete Form 2441

Completing Form 2441 involves several steps to ensure accuracy and compliance with IRS guidelines:

- Gather Documentation: Collect all necessary documentation, including receipts for care expenses and information about the care provider.

- Complete the Form: Fill out the form with accurate information regarding your qualifying expenses and the care provider.

- Calculate the Credit: Use the IRS guidelines to calculate the credit based on your reported expenses and income level.

- Attach to Tax Return: Submit Form 2441 along with your federal tax return, ensuring all forms are signed and dated.

IRS Guidelines for Form 2441

The IRS provides specific guidelines for completing Form 2441, which include instructions on eligibility, qualifying expenses, and how to calculate the credit. It is essential to refer to the latest IRS instructions to ensure compliance and to maximize the potential credit. Taxpayers should be aware of any updates or changes to the form or the associated tax laws that may affect their filing.

Obtaining Form 2441

Form 2441 can be obtained directly from the IRS website or through various tax preparation software. It is important to ensure that you are using the correct version of the form for the tax year you are filing. For those who prefer paper forms, they can be printed from the IRS website or requested via mail from the IRS.

Legal Use of Form 2441

Form 2441 is legally used by taxpayers to claim credits for child and dependent care expenses. Misuse of the form, such as claiming expenses that do not meet IRS criteria, can result in penalties. It is crucial for taxpayers to understand the legal implications of their claims and to maintain accurate records of all expenses related to care services.

Create this form in 5 minutes or less

Find and fill out the correct instructions for form 2441 instructions for form 2441child and dependent care expenses

Create this form in 5 minutes!

How to create an eSignature for the instructions for form 2441 instructions for form 2441child and dependent care expenses

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 2441 and why is it important?

Form 2441 is a tax form used to claim the Child and Dependent Care Expenses Credit. Understanding what is form 2441 is crucial for taxpayers who want to maximize their tax benefits related to childcare costs. This form helps in reporting expenses incurred for the care of qualifying individuals while you work or look for work.

-

How can airSlate SignNow help with form 2441?

airSlate SignNow simplifies the process of completing and submitting form 2441 by providing an easy-to-use platform for eSigning and document management. With airSlate SignNow, you can securely send and receive your tax documents, ensuring that your form 2441 is filled out accurately and submitted on time. This streamlines your tax preparation process.

-

What features does airSlate SignNow offer for managing form 2441?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking that are beneficial for managing form 2441. These features ensure that you can easily create, edit, and send your form while keeping all your documents organized. Additionally, you can collaborate with others to ensure accuracy.

-

Is there a cost associated with using airSlate SignNow for form 2441?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs, including those who need to manage form 2441. The cost is competitive and provides value through features that enhance document management and eSigning. You can choose a plan that fits your budget and requirements.

-

Can I integrate airSlate SignNow with other software for form 2441?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, making it easier to manage form 2441 alongside your other business tools. This integration allows for a more efficient workflow, enabling you to access and send your tax documents directly from your preferred platforms.

-

What are the benefits of using airSlate SignNow for form 2441?

Using airSlate SignNow for form 2441 offers numerous benefits, including enhanced security, ease of use, and time savings. You can quickly eSign and send your form without the hassle of printing and scanning. This not only speeds up the process but also reduces the risk of errors.

-

How does airSlate SignNow ensure the security of my form 2441?

airSlate SignNow prioritizes security by employing advanced encryption and compliance measures to protect your documents, including form 2441. Your sensitive information is safeguarded throughout the eSigning process, ensuring that only authorized individuals have access to your tax documents.

Get more for Instructions For Form 2441 Instructions For Form 2441,Child And Dependent Care Expenses

Find out other Instructions For Form 2441 Instructions For Form 2441,Child And Dependent Care Expenses

- How Do I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- Help Me With eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Presentation

- Help Me With eSign Hawaii Charity Presentation

- How Can I eSign Hawaii Charity Presentation

- How Do I eSign Hawaii Charity Presentation

- How Can I eSign Illinois Charity Word

- How To eSign Virginia Business Operations Presentation

- How To eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Do I eSign Hawaii Construction Form

- How Can I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Document

- Can I eSign Hawaii Construction Document

- How Do I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Form