Form 656 Ppv 2020-2026

What is the Form 656 Ppv

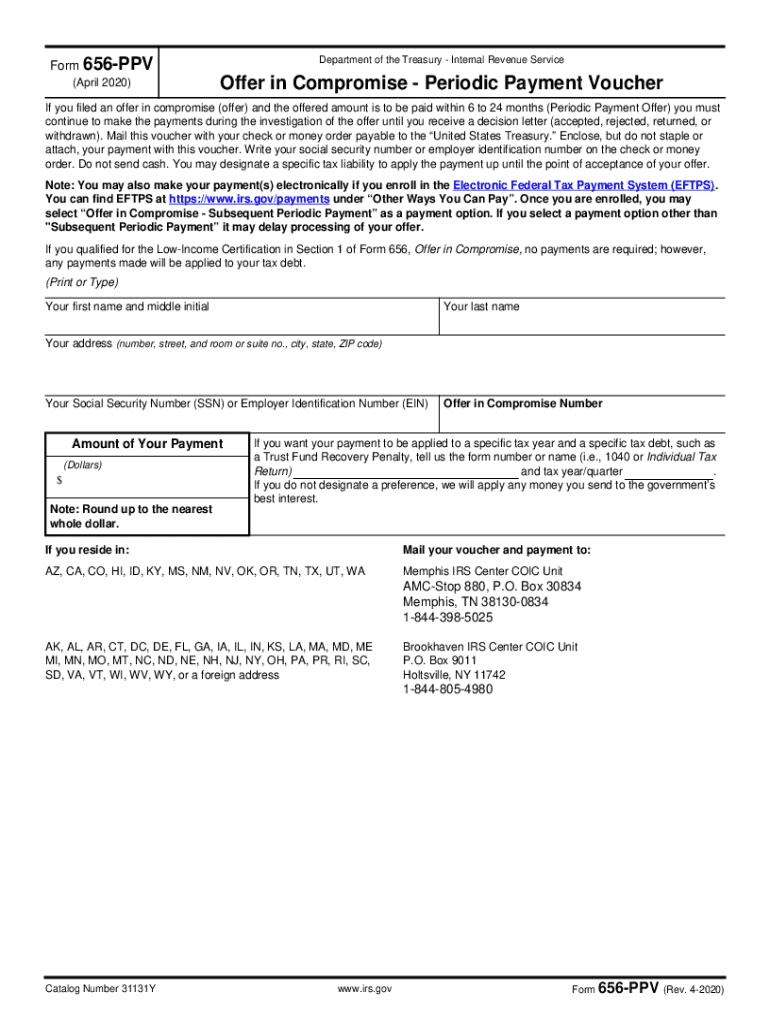

The Form 656 Ppv is a document used by taxpayers in the United States to submit an offer in compromise to the Internal Revenue Service (IRS). This form allows individuals to propose a settlement for their tax liabilities, potentially reducing the amount owed. It is particularly beneficial for those facing financial hardship, as it provides a structured way to negotiate tax debts. Understanding the purpose and implications of this form is crucial for anyone considering this option.

How to use the Form 656 Ppv

Using the Form 656 Ppv involves several steps to ensure that the submission is complete and accurate. First, gather all necessary financial information, including income, expenses, and assets. This data will help in determining a reasonable offer amount. Next, fill out the form carefully, ensuring that all sections are completed and that the information is truthful. After completing the form, review it for accuracy before submitting it to the IRS, either online or by mail. It is essential to keep a copy for your records.

Steps to complete the Form 656 Ppv

Completing the Form 656 Ppv requires attention to detail and adherence to specific guidelines. Follow these steps for a successful submission:

- Gather financial documentation, including pay stubs, bank statements, and tax returns.

- Fill out the form, providing accurate information about your financial situation.

- Calculate your offer based on your ability to pay, ensuring it meets IRS guidelines.

- Sign and date the form, confirming that all information is correct.

- Submit the form along with any required fees to the IRS.

Legal use of the Form 656 Ppv

The legal use of the Form 656 Ppv is governed by IRS regulations. When submitted correctly, this form can create a legally binding agreement between the taxpayer and the IRS. It is essential to ensure compliance with all IRS requirements to avoid potential penalties or rejection of the offer. The form must be filled out honestly, as providing false information can lead to legal consequences.

IRS Guidelines

The IRS has established specific guidelines for using the Form 656 Ppv effectively. These guidelines include eligibility criteria for submitting an offer in compromise, the necessary documentation to support the offer, and the process for reviewing and accepting offers. Familiarizing oneself with these guidelines can significantly enhance the chances of a successful outcome.

Eligibility Criteria

To qualify for submitting the Form 656 Ppv, taxpayers must meet certain eligibility criteria set by the IRS. These criteria typically include being unable to pay the full tax liability, demonstrating a genuine financial hardship, and not being in an open bankruptcy case. Understanding these requirements is crucial for determining whether to pursue an offer in compromise.

Form Submission Methods (Online / Mail / In-Person)

The Form 656 Ppv can be submitted through various methods, allowing flexibility based on individual preferences. Taxpayers can file the form online through the IRS website, which offers a streamlined process. Alternatively, the form can be mailed to the appropriate IRS address, ensuring that all required documentation is included. In-person submissions are generally not common for this form, but taxpayers can consult with IRS representatives for guidance if needed.

Quick guide on how to complete form 656 ppv

Prepare Form 656 Ppv effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly substitute to conventional printed and signed documents, enabling you to obtain the correct format and securely save it online. airSlate SignNow equips you with all the resources you require to create, modify, and electronically sign your documents quickly without delays. Manage Form 656 Ppv on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and eSign Form 656 Ppv with ease

- Find Form 656 Ppv and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet signature.

- Review all the information and click on the Done button to save your changes.

- Select your preferred method for sharing your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worry of lost or misfiled documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device of your preference. Modify and eSign Form 656 Ppv and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 656 ppv

Create this form in 5 minutes!

How to create an eSignature for the form 656 ppv

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form 656 ppv and how can it benefit my business?

The form 656 ppv is a document that facilitates the payment of tax liabilities in an organized manner. Utilizing airSlate SignNow allows businesses to streamline this process, making it easier to send, sign, and manage essential documents quickly. This can signNowly enhance operational efficiency and ensure compliance with IRS regulations.

-

How does airSlate SignNow support the completion of form 656 ppv?

airSlate SignNow offers user-friendly tools that enable users to fill out and eSign the form 656 ppv efficiently. With features like templates and automated workflows, you can reduce the manual effort involved in preparing this document. This means you can focus more on your business while ensuring the form is completed accurately.

-

Is there a cost associated with using airSlate SignNow for form 656 ppv?

Yes, airSlate SignNow offers various pricing plans tailored to meet different business needs, including options for handling documents like the form 656 ppv. By investing in this solution, businesses not only save time but also reduce the risk of errors in document processing. Pricing is competitive, making it a cost-effective choice for organizations.

-

Can I integrate airSlate SignNow with other software for processing form 656 ppv?

Absolutely! airSlate SignNow seamlessly integrates with numerous applications, allowing users to connect with CRM, accounting, and other software to manage the form 656 ppv. This interoperability enhances your workflow and ensures all related tasks are synchronized, saving you time and improving accuracy.

-

What features specifically aid in managing form 656 ppv with airSlate SignNow?

Key features like document sharing, real-time collaboration, and legally binding eSignatures are crucial for managing the form 656 ppv. These tools allow multiple stakeholders to review and sign documents swiftly. Additionally, airSlate SignNow’s tracking capabilities keep you informed about each stage of the document’s progress.

-

Is the form 656 ppv secure when using airSlate SignNow?

Yes, security is a top priority for airSlate SignNow. All documents, including the form 656 ppv, are protected with industry-standard encryption and comply with data protection regulations. This ensures that sensitive information remains confidential while you manage your documents with peace of mind.

-

What types of businesses benefit from using airSlate SignNow for form 656 ppv?

Businesses of all sizes can benefit from using airSlate SignNow for processing the form 656 ppv. Whether you're a small business, a nonprofit, or a large enterprise, the easy-to-use platform enhances productivity and document management. This versatility makes it a valuable tool across various sectors.

Get more for Form 656 Ppv

- Crummey letter sample 100078696 form

- Weekly sleep log 255753439 form

- Pharmaciafoundation form

- Proof of residency affidavit form

- District of columbia employer application and joinder form

- Guelph humber education declaration form

- Illinois department of revenue ptax 300 ha affidavit for co stephenson il form

- Montana registrationapplication for permit form

Find out other Form 656 Ppv

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later