AFFIDAVIT of EXEMPTION DOCX 2022-2026

What is the affidavit of tax exemption?

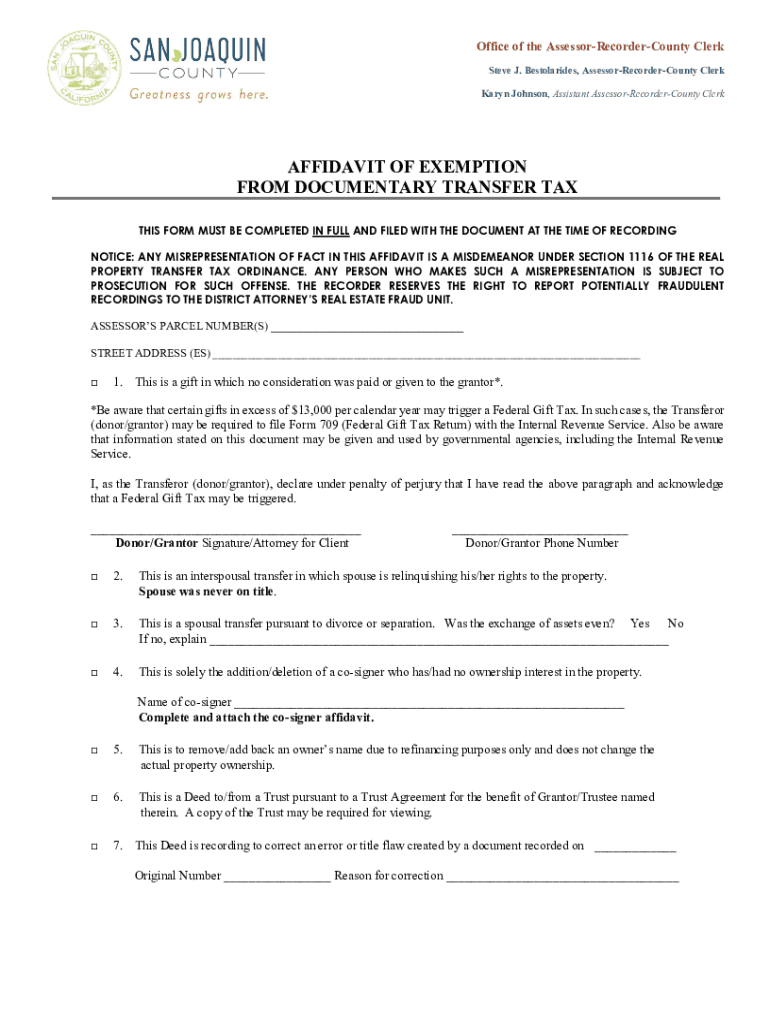

The affidavit of tax exemption is a legal document used to declare that an individual or entity qualifies for a tax exemption under specific circumstances. This form is often required by state or local governments to verify eligibility for certain tax benefits, such as property tax exemptions or sales tax exemptions. It serves as a formal declaration that the signer meets the criteria established by tax authorities, thereby allowing them to avoid paying certain taxes.

Steps to complete the affidavit of tax exemption

Completing the affidavit of tax exemption involves several important steps to ensure accuracy and compliance. Follow these guidelines:

- Gather necessary information, including your personal details, tax identification number, and any relevant documentation that supports your exemption claim.

- Carefully read the instructions provided with the form to understand the specific requirements and conditions for your exemption.

- Fill out the affidavit accurately, ensuring all fields are completed and that the information is consistent with your supporting documents.

- Sign the affidavit in the designated area, ensuring that your signature is clear and matches your official identification.

- Submit the completed affidavit to the appropriate tax authority, either online, by mail, or in person, as specified in the instructions.

Legal use of the affidavit of tax exemption

The affidavit of tax exemption holds legal significance, as it serves as a sworn statement regarding the eligibility for tax exemption. When properly executed, it can be used in legal proceedings to demonstrate compliance with tax regulations. It is important to ensure that all information provided is truthful and accurate, as providing false information may result in penalties or legal consequences. The affidavit must also comply with relevant laws and regulations, including those established by the IRS and state tax authorities.

Eligibility criteria for the affidavit of tax exemption

Eligibility for filing an affidavit of tax exemption varies based on the type of exemption being claimed. Common criteria include:

- Non-profit organizations that meet specific charitable purposes.

- Individuals or entities that qualify for specific exemptions based on income level or property use.

- Businesses that meet certain criteria for sales tax exemptions, such as resale or manufacturing.

It is essential to review the specific requirements set forth by the relevant tax authority to determine if you qualify for the exemption.

Required documents for the affidavit of tax exemption

When completing the affidavit of tax exemption, you may need to provide supporting documentation to substantiate your claim. Commonly required documents include:

- Proof of identity, such as a driver's license or state ID.

- Tax identification number (TIN) or Social Security number.

- Documentation supporting your eligibility, such as financial statements, non-profit status verification, or property deeds.

Ensure all documents are current and accurately reflect your situation to avoid delays in processing your affidavit.

Form submission methods for the affidavit of tax exemption

Submitting the affidavit of tax exemption can typically be done through various methods, depending on the guidelines provided by the tax authority. Common submission methods include:

- Online submission through the tax authority's official website, where applicable.

- Mailing the completed form to the designated address provided in the instructions.

- In-person submission at local tax offices or designated government buildings.

Review the specific submission requirements to ensure that your affidavit is processed efficiently.

Quick guide on how to complete affidavit of exemption docx

Effortlessly Prepare AFFIDAVIT OF EXEMPTION docx on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to obtain the correct format and securely keep it online. airSlate SignNow provides all the necessary tools to create, edit, and electronically sign your documents swiftly without delays. Manage AFFIDAVIT OF EXEMPTION docx on any device with airSlate SignNow's Android or iOS applications and enhance any document-oriented procedure today.

How to Edit and Electronically Sign AFFIDAVIT OF EXEMPTION docx with Ease

- Obtain AFFIDAVIT OF EXEMPTION docx and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Mark important sections of your documents or black out confidential information using tools that airSlate SignNow specifically offers for that purpose.

- Create your electronic signature with the Sign feature, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and electronically sign AFFIDAVIT OF EXEMPTION docx and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct affidavit of exemption docx

Create this form in 5 minutes!

How to create an eSignature for the affidavit of exemption docx

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an affidavit of tax exemption?

An affidavit of tax exemption is a legal document that allows a business or individual to claim exemption from certain taxes. This document is essential for various applications such as sales tax, income tax, or property tax. By using airSlate SignNow, you can easily create and eSign your affidavit of tax exemption for quick processing.

-

How can airSlate SignNow help with my affidavit of tax exemption?

airSlate SignNow enables you to streamline the process of creating and signing your affidavit of tax exemption. The platform offers user-friendly templates and tools that simplify document creation and customization. This ensures that your affidavit is professionally presented and compliant with regulations.

-

Is there a cost associated with using airSlate SignNow for my affidavit of tax exemption?

Yes, airSlate SignNow offers flexible pricing plans that cater to various business needs. You can start with a free trial to explore features, including the creation of an affidavit of tax exemption. After the trial, choose a plan that fits your requirements without compromising on functionality.

-

What features does airSlate SignNow offer for eSigning an affidavit of tax exemption?

airSlate SignNow provides a host of features for eSigning your affidavit of tax exemption, including secure signing, cloud storage, and real-time tracking. You can invite multiple signers, add fields for required information, and even integrate with popular apps for seamless workflow management. These features enhance efficiency and security in signing important documents.

-

Can I integrate airSlate SignNow with other software for managing my affidavit of tax exemption?

Absolutely! airSlate SignNow integrates smoothly with various applications, such as CRMs, accounting software, and cloud storage services. These integrations allow you to manage your documents, including your affidavit of tax exemption, in one centralized platform, improving your overall productivity and document organization.

-

Are there any benefits to using airSlate SignNow for an affidavit of tax exemption?

Using airSlate SignNow for your affidavit of tax exemption offers numerous benefits, including faster turnaround times and enhanced security. The platform's electronic signing capabilities reduce the risk of delays associated with traditional paper methods. Additionally, you can access your documents from anywhere, making it easier to manage your tax exemption needs.

-

How can I ensure my affidavit of tax exemption is legally binding?

To ensure that your affidavit of tax exemption is legally binding, utilize airSlate SignNow's advanced eSigning features that comply with electronic signature laws. Each signed document is securely stored with an audit trail, confirming the identity and consent of all signers. This compliance guarantees that your affidavit holds legal weight in your tax matters.

Get more for AFFIDAVIT OF EXEMPTION docx

Find out other AFFIDAVIT OF EXEMPTION docx

- How Can I Electronic signature Texas Electronic Contract

- How Do I Electronic signature Michigan General contract template

- Electronic signature Maine Email Contracts Later

- Electronic signature New Mexico General contract template Free

- Can I Electronic signature Rhode Island Email Contracts

- How Do I Electronic signature California Personal loan contract template

- Electronic signature Hawaii Personal loan contract template Free

- How To Electronic signature Hawaii Personal loan contract template

- Electronic signature New Hampshire Managed services contract template Computer

- Electronic signature Alabama Real estate sales contract template Easy

- Electronic signature Georgia Real estate purchase contract template Secure

- Electronic signature South Carolina Real estate sales contract template Mobile

- Can I Electronic signature Kentucky Residential lease contract

- Can I Electronic signature Nebraska Residential lease contract

- Electronic signature Utah New hire forms Now

- Electronic signature Texas Tenant contract Now

- How Do I Electronic signature Florida Home rental application

- Electronic signature Illinois Rental application Myself

- How Can I Electronic signature Georgia Rental lease form

- Electronic signature New York Rental lease form Safe