San Joaquin County Transfer Tax Affidavit 2015

What is the San Joaquin County Transfer Tax Affidavit

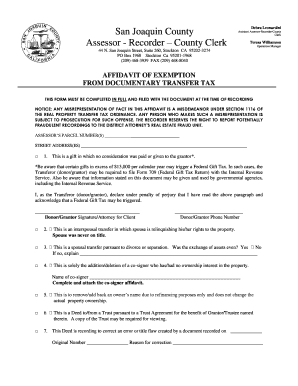

The San Joaquin County Transfer Tax Affidavit is a legal document required during the transfer of real property ownership within San Joaquin County, California. This affidavit serves to disclose the details of the transaction, including the sale price and the parties involved. It is essential for ensuring compliance with local tax regulations and helps determine the appropriate transfer tax owed to the county.

How to use the San Joaquin County Transfer Tax Affidavit

Using the San Joaquin County Transfer Tax Affidavit involves several steps. First, the seller or transferor must complete the affidavit accurately, providing all necessary information regarding the property and the transaction. Once filled out, the affidavit must be signed by all parties involved. After signing, it should be submitted to the appropriate county office, typically alongside the deed of transfer. This process ensures that the transfer tax is calculated correctly and that the transaction is officially recorded.

Steps to complete the San Joaquin County Transfer Tax Affidavit

Completing the San Joaquin County Transfer Tax Affidavit requires careful attention to detail. Follow these steps:

- Obtain the affidavit form from the county's official website or office.

- Fill in the required information, including property details, sale price, and parties involved.

- Review the document for accuracy and completeness.

- Sign the affidavit in the presence of a notary, if required.

- Submit the completed affidavit along with the deed to the county recorder's office.

Key elements of the San Joaquin County Transfer Tax Affidavit

Several key elements must be included in the San Joaquin County Transfer Tax Affidavit for it to be valid:

- Property Description: A detailed description of the property being transferred, including its address and parcel number.

- Sale Price: The total sale price agreed upon by the buyer and seller.

- Parties Involved: Names and contact information of the buyer and seller.

- Signatures: Signatures of all parties involved in the transaction.

Legal use of the San Joaquin County Transfer Tax Affidavit

The San Joaquin County Transfer Tax Affidavit is legally binding when completed and submitted according to local regulations. It serves as proof of the transaction and is essential for the proper assessment of transfer taxes. Failure to submit this affidavit can result in penalties or delays in the property transfer process. Therefore, it is crucial to ensure that all information is accurate and that the affidavit is submitted in a timely manner.

Form Submission Methods

The San Joaquin County Transfer Tax Affidavit can be submitted in several ways:

- Online: Some counties may offer electronic submission options through their official websites.

- Mail: The completed affidavit can be mailed to the county recorder's office.

- In-Person: Individuals can also submit the affidavit in person at the county recorder's office during business hours.

Quick guide on how to complete san joaquin county transfer tax affidavit

Complete San Joaquin County Transfer Tax Affidavit effortlessly on any device

Web-based document management has become favored among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents swiftly without delays. Manage San Joaquin County Transfer Tax Affidavit on any device using airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

How to edit and eSign San Joaquin County Transfer Tax Affidavit effortlessly

- Find San Joaquin County Transfer Tax Affidavit and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight important sections of your documents or redact sensitive information with the tools that airSlate SignNow specifically offers for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or mistakes that require reprinting new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Edit and eSign San Joaquin County Transfer Tax Affidavit and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct san joaquin county transfer tax affidavit

Create this form in 5 minutes!

How to create an eSignature for the san joaquin county transfer tax affidavit

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a San Joaquin County transfer tax affidavit?

A San Joaquin County transfer tax affidavit is a legal document required when property ownership is transferred within San Joaquin County. This affidavit declares the transfer and provides the necessary information to determine any applicable transfer taxes based on the property's value.

-

How can airSlate SignNow simplify the process of completing a San Joaquin County transfer tax affidavit?

airSlate SignNow provides a user-friendly platform that allows you to easily prepare, send, and eSign the San Joaquin County transfer tax affidavit. Our software streamlines the documentation process, ensuring that you have all the necessary fields completed accurately and efficiently.

-

Are there any fees associated with filing a San Joaquin County transfer tax affidavit?

Yes, there may be fees associated with the processing and filing of the San Joaquin County transfer tax affidavit. These fees can vary based on the property's value and the local regulations, so it's advisable to check with your local county office for the most accurate information.

-

What benefits does airSlate SignNow offer for managing transfer tax affidavits?

Using airSlate SignNow to manage your San Joaquin County transfer tax affidavit comes with several benefits, including reduced paperwork, enhanced security, and the ability to track document status in real-time. Our platform also eliminates the hassle of printing and manually signing documents.

-

Can I integrate airSlate SignNow with other software for my San Joaquin County transfer tax affidavit?

Absolutely! airSlate SignNow can be seamlessly integrated with various other software applications, such as CRM systems and document management tools. This integration allows you to manage the San Joaquin County transfer tax affidavit alongside other business processes, enhancing efficiency.

-

Is there customer support available for assistance with the San Joaquin County transfer tax affidavit?

Yes, airSlate SignNow offers comprehensive customer support for users who may have questions regarding the San Joaquin County transfer tax affidavit. Our support team is available to assist you through live chat, email, and phone, ensuring that you have the help needed during the signing process.

-

How does airSlate SignNow ensure the security of my San Joaquin County transfer tax affidavit?

airSlate SignNow prioritizes your security by implementing advanced encryption and security protocols. When you create and store your San Joaquin County transfer tax affidavit, you can trust that your sensitive information is protected against unauthorized access.

Get more for San Joaquin County Transfer Tax Affidavit

- Niceic complaints form

- Iowa dhs child care forms

- Rta form

- Form dir 2

- Poder y declaraci n de representaci n departamento de hacienda gobierno form

- English version seicliosta iarratas pleanla planning application checklist t an fhoirm seo le fil i gcl mr chomh maith this form

- Ccr certification form

- Ccr certification form oha drinking water services

Find out other San Joaquin County Transfer Tax Affidavit

- How To Sign Ohio Car Dealer Arbitration Agreement

- How To Sign Oregon Car Dealer Limited Power Of Attorney

- How To Sign Pennsylvania Car Dealer Quitclaim Deed

- How Can I Sign Pennsylvania Car Dealer Quitclaim Deed

- Sign Rhode Island Car Dealer Agreement Safe

- Sign South Dakota Car Dealer Limited Power Of Attorney Now

- Sign Wisconsin Car Dealer Quitclaim Deed Myself

- Sign Wisconsin Car Dealer Quitclaim Deed Free

- Sign Virginia Car Dealer POA Safe

- Sign Wisconsin Car Dealer Quitclaim Deed Fast

- How To Sign Wisconsin Car Dealer Rental Lease Agreement

- How To Sign Wisconsin Car Dealer Quitclaim Deed

- How Do I Sign Wisconsin Car Dealer Quitclaim Deed

- Sign Wyoming Car Dealer Purchase Order Template Mobile

- Sign Arizona Charity Business Plan Template Easy

- Can I Sign Georgia Charity Warranty Deed

- How To Sign Iowa Charity LLC Operating Agreement

- Sign Kentucky Charity Quitclaim Deed Myself

- Sign Michigan Charity Rental Application Later

- How To Sign Minnesota Charity Purchase Order Template