TRANSFER on DEATH DEED GRANTERS, , as Owners 2019-2026

Understanding the Kansas Transfer on Death Deed Grantors

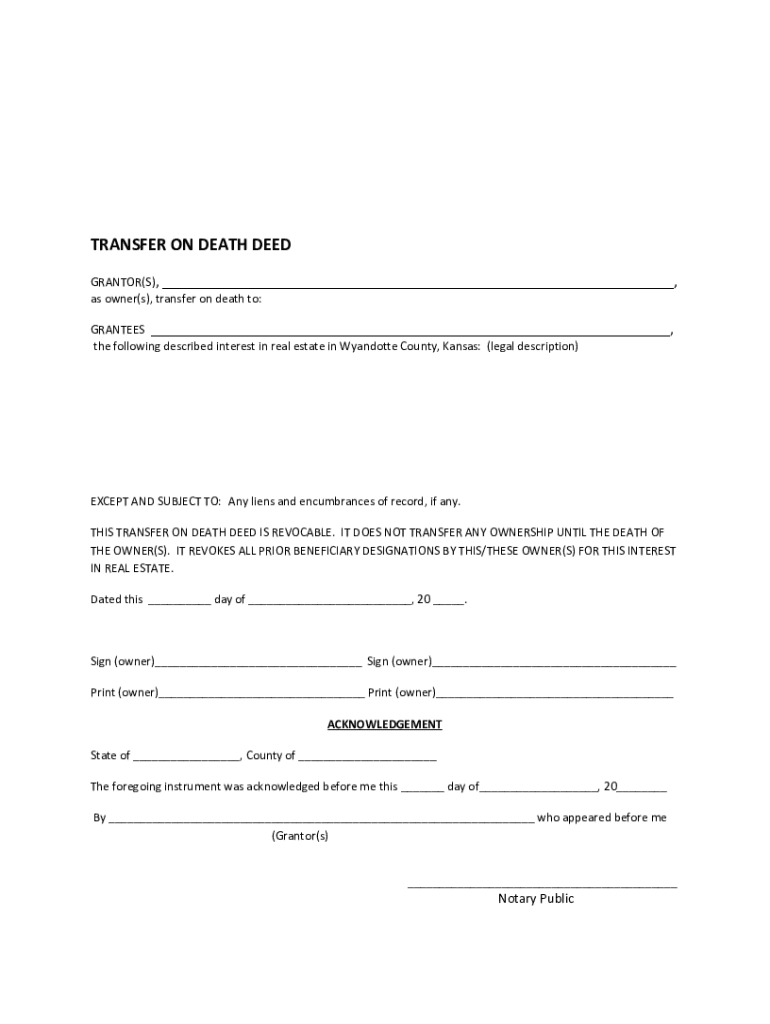

The Kansas transfer on death deed allows property owners to designate beneficiaries who will receive the property upon the owner's death. This legal document is beneficial for individuals who wish to bypass the probate process, ensuring a smoother transition of property ownership. The grantors, or property owners, retain full control of the property during their lifetime, with the transfer occurring automatically upon their passing. It is important for grantors to understand their rights and responsibilities, as well as the implications of this deed on their estate planning.

Steps to Complete the Kansas Transfer on Death Deed

Completing the Kansas transfer on death deed involves several key steps to ensure its validity and effectiveness. First, the grantor must fill out the form accurately, including details about the property and the designated beneficiaries. Next, the form must be signed in the presence of a notary public to validate the signatures. After notarization, the deed should be recorded with the appropriate county office to ensure it is legally recognized. It is advisable to keep a copy of the recorded deed for personal records and future reference.

Legal Use of the Kansas Transfer on Death Deed

The Kansas transfer on death deed is legally binding when executed in compliance with state laws. This means that the document must meet specific requirements, including proper identification of the grantor and beneficiaries, accurate property description, and notarization. Understanding the legal framework surrounding this deed is crucial for ensuring that the transfer is honored upon the grantor's death. Additionally, consulting with a legal professional can provide clarity on how this deed fits into an overall estate plan.

State-Specific Rules for the Kansas Transfer on Death Deed

Each state has its own regulations regarding transfer on death deeds. In Kansas, the law outlines specific provisions that must be followed for the deed to be valid. For instance, the deed must explicitly state that it is a transfer on death deed and must include the names of the beneficiaries. Furthermore, Kansas law allows for multiple beneficiaries and provides guidelines on how the property will be divided if one of the beneficiaries predeceases the grantor. Familiarizing oneself with these state-specific rules is essential for effective estate planning.

Required Documents for the Kansas Transfer on Death Deed

To complete the Kansas transfer on death deed, certain documents are necessary. The primary document is the transfer on death deed form itself, which must be filled out completely. Additionally, the grantor may need to provide proof of identity, such as a driver's license or state ID, to the notary public during the signing process. It is also advisable to have a copy of the property deed available to ensure accurate information is included in the transfer on death deed.

Examples of Using the Kansas Transfer on Death Deed

Utilizing the Kansas transfer on death deed can simplify the transfer of property for various scenarios. For instance, a homeowner may wish to designate their children as beneficiaries to ensure that the family home passes directly to them without going through probate. Alternatively, a property owner might use this deed to transfer a vacation home to a sibling or friend, ensuring that the property remains within the family or among close associates. These examples illustrate the versatility and effectiveness of the transfer on death deed in estate planning.

Quick guide on how to complete transfer on death deed granters as owners

Prepare TRANSFER ON DEATH DEED GRANTERS, , As Owners effortlessly on any device

Web-based document management has become increasingly favored by companies and individuals. It serves as a perfect eco-friendly alternative to conventional printed and signed materials, since you can easily locate the right form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents quickly without delays. Manage TRANSFER ON DEATH DEED GRANTERS, , As Owners on any device using airSlate SignNow apps for Android or iOS and enhance any document-centric process today.

The simplest method to edit and electronically sign TRANSFER ON DEATH DEED GRANTERS, , As Owners without hassle

- Locate TRANSFER ON DEATH DEED GRANTERS, , As Owners and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize signNow sections of the documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your electronic signature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the details and then click on the Done button to save your changes.

- Choose your preferred method for sending your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new document versions. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choosing. Modify and electronically sign TRANSFER ON DEATH DEED GRANTERS, , As Owners and ensure clear communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct transfer on death deed granters as owners

Create this form in 5 minutes!

How to create an eSignature for the transfer on death deed granters as owners

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Kansas transfer death deed form?

A Kansas transfer death deed form is a legal document that allows a property owner to transfer their real estate to a beneficiary upon their death. This form can help avoid probate, making the transfer process more efficient. Understanding this form is essential for Kansas residents who want to manage their estate planning effectively.

-

How do I complete a Kansas transfer death deed form?

To complete a Kansas transfer death deed form, you must fill out the required information, including the names of the property owner and beneficiary and a legal description of the property. After filling it out, the form typically needs to be signNowd and filed with the local county register of deeds. Utilizing airSlate SignNow can simplify this process by allowing eSignature capabilities.

-

Is there a fee for using the Kansas transfer death deed form?

While there is no fee associated with the Kansas transfer death deed form itself, filing the document may incur a recording fee charged by the local county office. Additionally, using airSlate SignNow for document preparation and e-signature services may involve a subscription cost. However, it is generally a cost-effective solution compared to traditional methods.

-

What are the benefits of using a Kansas transfer death deed form?

The primary benefit of using a Kansas transfer death deed form is that it allows for direct transfer of property to beneficiaries without going through probate. This can save time and legal expenses, ensuring that your wishes are fulfilled promptly. It simplifies estate planning and provides peace of mind for both property owners and their beneficiaries.

-

Can I revoke a Kansas transfer death deed form?

Yes, a Kansas transfer death deed form can be revoked or changed at any time prior to the death of the property owner. To do this, you must complete a new form or an official revocation statement and follow the same filing procedures. Consulting with an estate planning attorney may help manage these changes effectively.

-

What integrations does airSlate SignNow offer for the Kansas transfer death deed form?

airSlate SignNow integrates with various cloud storage solutions and productivity tools, making it easier to manage and store your Kansas transfer death deed form and related documents. These integrations allow seamless access to your files, enabling quick retrieval and organization. This enhances the overall efficiency of your document workflow.

-

How can I ensure my Kansas transfer death deed form is legally valid?

To ensure your Kansas transfer death deed form is legally valid, it must be properly completed, signNowd, and recorded with the appropriate county office. It’s also advisable to follow any specific state requirements to avoid potential disputes. Using airSlate SignNow can help facilitate proper execution and storage of your documents.

Get more for TRANSFER ON DEATH DEED GRANTERS, , As Owners

- Dime cheeklist form

- Neurotoxin consent form

- Nuon overstapkorting form

- Okdhslive form

- Dsregister title a vehicle in new york state department of motor vehicles instructions for mv 82 vehicle registration title form

- Study leave application form cam pgmc ac

- Swimming pool rules and regulations v20120519 cleaneddocx campusvillage form

- Gie dental lab work authorization form

Find out other TRANSFER ON DEATH DEED GRANTERS, , As Owners

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later