720 Excise Tax Form 2017-2026

What is the 2017 Excise Tax Form?

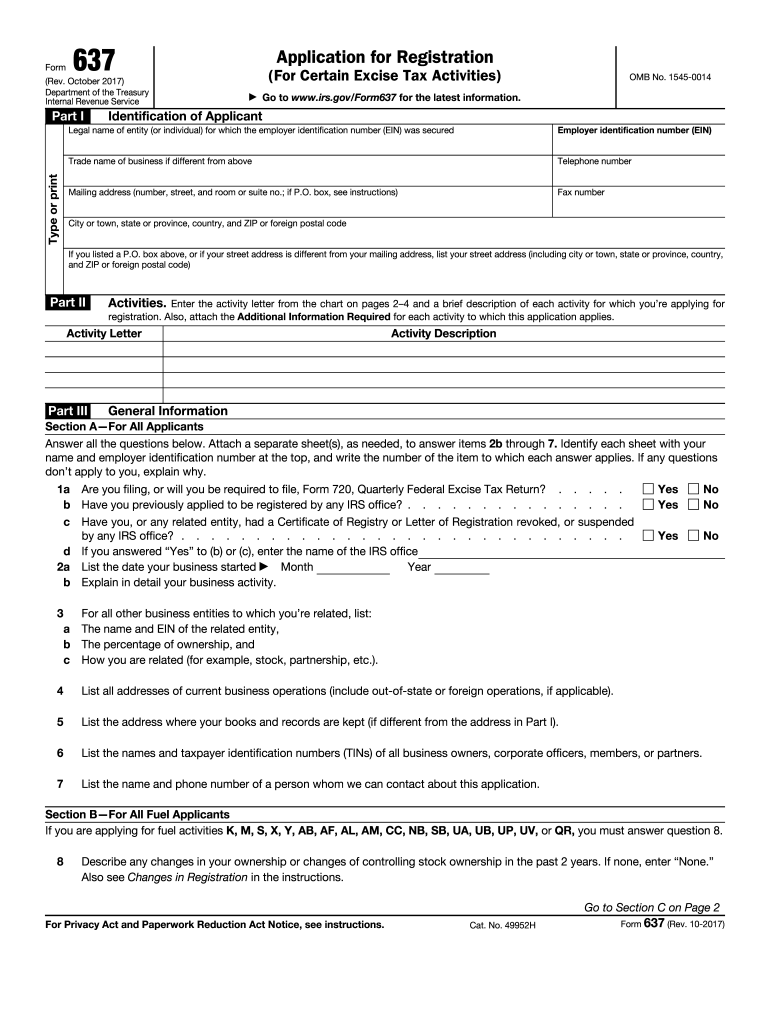

The 2017 637 form, also known as the 2017 Excise Tax Form, is a document used by businesses to report and pay excise taxes to the Internal Revenue Service (IRS). This form is essential for various activities, including the manufacturing and sale of certain goods, as well as specific services that incur federal excise taxes. Understanding the purpose of this form is crucial for compliance with federal tax regulations.

Steps to Complete the 2017 Excise Tax Form

Completing the 2017 637 form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary information, including your business details and the specific excise taxes applicable to your activities. Next, carefully fill out each section of the form, paying close attention to the required fields. It is important to review the form for any errors or omissions before submission. Finally, ensure that you submit the form by the appropriate deadline to avoid penalties.

Filing Deadlines / Important Dates

Filing deadlines for the 2017 637 form are critical for maintaining compliance with IRS regulations. Generally, the form must be submitted quarterly, with specific due dates depending on the reporting period. For example, the first quarter typically requires submission by April 30, while subsequent quarters follow a similar schedule. It is essential to stay informed about these dates to avoid late fees and potential penalties.

Form Submission Methods (Online / Mail / In-Person)

The 2017 637 form can be submitted through various methods, including online filing, mail, or in-person delivery. Online submission is often the most efficient option, allowing for quicker processing times. If you choose to file by mail, ensure that you send the form to the correct IRS address and consider using a trackable mailing service. In-person submissions may be suitable for urgent filings, but it is advisable to check the local IRS office hours and requirements before visiting.

Key Elements of the 2017 Excise Tax Form

Understanding the key elements of the 2017 637 form is vital for accurate completion. The form typically includes sections for reporting business information, detailing the types of excise taxes owed, and providing calculations for total tax liability. Additionally, it may require information about any credits or adjustments that apply to your tax situation. Familiarity with these elements can help streamline the filing process and ensure compliance with IRS regulations.

IRS Guidelines

The IRS provides specific guidelines for completing the 2017 637 form, which are crucial for ensuring accurate reporting. These guidelines outline the necessary information to include, the calculations required for tax liability, and the proper submission methods. It is important to review these guidelines thoroughly before filling out the form to avoid common mistakes that could lead to delays or penalties.

Quick guide on how to complete 637 tax 2017 2019 form

Uncover the simplest method to complete and endorse your 720 Excise Tax Form

Are you still spending time preparing your official documents on paper instead of doing it digitally? airSlate SignNow offers a superior way to finalize and endorse your 720 Excise Tax Form and associated forms for public services. Our intelligent electronic signature solution equips you with all the tools necessary to manage documents swiftly and in compliance with formal standards - comprehensive PDF editing, organizing, securing, endorsing, and sharing capabilities all accessible within an intuitive interface.

Only a few steps are needed to fill out and endorse your 720 Excise Tax Form:

- Upload the fillable template to the editor using the Get Form button.

- Review the information you need to provide in your 720 Excise Tax Form.

- Move between the fields with the Next button to ensure nothing is overlooked.

- Utilize Text, Checkbox, and Cross tools to fill in the blanks with your information.

- Modify the content with Text boxes or Images from the toolbar above.

- Emphasize what is signNow or Obscure sections that are no longer relevant.

- Click on Sign to generate a legally binding electronic signature using your preferred method.

- Add the Date next to your signature and finalize your task by clicking the Done button.

Store your completed 720 Excise Tax Form in the Documents folder of your account, download it, or export it to your chosen cloud storage. Our solution also provides flexible file sharing options. There’s no requirement to print your forms when sending them to the relevant public office - you can do it via email, fax, or by requesting a USPS “snail mail” delivery from your account. Experience it today!

Create this form in 5 minutes or less

FAQs

-

What if your taxes for 2017 was filed last year 2018 when filling out taxes this year 2019 and you didn't file the 2017 taxes, but waiting to do them with your 2019 taxes?

Looks like you want to wait for next year to file for 2018 & 2019 at the same time. In that case, 2018 will have to be mailed and 2019 only can be electronically filed. If you have refund coming to you on the 2018, no problem, refund check will take around 2 months. If you owe instead, late filing penalties will apply. If you have not yet filed for 2018, you can still file electronically till October 15.

-

How do you fill out tax forms?

I strongly recommend purchasing a tax program, Turbo tax, H&R block etc.These programs will ask you questions and they will fill out the forms for you.You just print it out and mail it in. (with a check, if you owe anything)I used to use an accountant but these programs found more deductions.

-

How do I fill a W-9 Tax Form out?

Download a blank Form W-9To get started, download the latest Form W-9 from the IRS website at https://www.irs.gov/pub/irs-pdf/.... Check the date in the top left corner of the form as it is updated occasionally by the IRS. The current revision should read (Rev. December 2014). Click anywhere on the form and a menu appears at the top that will allow you to either print or save the document. If the browser you are using doesn’t allow you to type directly into the W-9 then save the form to your desktop and reopen using signNow Reader.General purposeThe general purpose of Form W-9 is to provide your correct taxpayer identification number (TIN) to an individual or entity (typically a company) that is required to submit an “information return” to the IRS to report an amount paid to you, or other reportable amount.U.S. personForm W-9 should only be completed by what the IRS calls a “U.S. person”. Some examples of U.S. persons include an individual who is a U.S. citizen or a U.S. resident alien. Partnerships, corporations, companies, or associations created or organized in the United States or under the laws of the United States are also U.S. persons.If you are not a U.S. person you should not use this form. You will likely need to provide Form W-8.Enter your informationLine 1 – Name: This line should match the name on your income tax return.Line 2 – Business name: This line is optional and would include your business name, trade name, DBA name, or disregarded entity name if you have any of these. You only need to complete this line if your name here is different from the name on line 1. See our related blog, What is a disregarded entity?Line 3 – Federal tax classification: Check ONE box for your U.S. federal tax classification. This should be the tax classification of the person or entity name that is entered on line 1. See our related blog, What is the difference between an individual and a sole proprietor?Limited Liability Company (LLC). If the name on line 1 is an LLC treated as a partnership for U.S. federal tax purposes, check the “Limited liability company” box and enter “P” in the space provided. If the LLC has filed Form 8832 or 2553 to be taxed as a corporation, check the “Limited liability company” box and in the space provided enter “C” for C corporation or “S” for S corporation. If it is a single-member LLC that is a disregarded entity, do not check the “Limited liability company” box; instead check the first box in line 3 “Individual/sole proprietor or single-member LLC.” See our related blog, What tax classification should an LLC select?Other (see instructions) – This line should be used for classifications that are not listed such as nonprofits, governmental entities, etc.Line 4 – Exemptions: If you are exempt from backup withholding enter your exempt payee code in the first space. If you are exempt from FATCA reporting enter your exemption from FATCA reporting code in the second space. Generally, individuals (including sole proprietors) are not exempt from backup withholding. See the “Specific Instructions” for line 4 shown with Form W-9 for more detailed information on exemptions.Line 5 – Address: Enter your address (number, street, and apartment or suite number). This is where the requester of the Form W-9 will mail your information returns.Line 6 – City, state and ZIP: Enter your city, state and ZIP code.Line 7 – Account numbers: This is an optional field to list your account number(s) with the company requesting your W-9 such as a bank, brokerage or vendor. We recommend that you do not list any account numbers as you may have to provide additional W-9 forms for accounts you do not include.Requester’s name and address: This is an optional section you can use to record the requester’s name and address you sent your W-9 to.Part I – Taxpayer Identification Number (TIN): Enter in your taxpayer identification number here. This is typically a social security number for an individual or sole proprietor and an employer identification number for a company. See our blog, What is a TIN number?Part II – Certification: Sign and date your form.For additional information visit w9manager.com.

-

How do I fill out an income tax form?

The Indian Income-Tax department has made the process of filing of income tax returns simplified and easy to understand.However, that is applicable only in case where you don’t have incomes under different heads. Let’s say, you are earning salary from a company in India, the company deducts TDS from your salary. In such a scenario, it’s very easy to file the return.Contrary to this is the scenario, where you have income from business and you need to see what all expenses you can claim as deduction while calculating the net taxable income.You can always signNow out to a tax consultant for detailed review of your tax return.

Create this form in 5 minutes!

How to create an eSignature for the 637 tax 2017 2019 form

How to create an electronic signature for the 637 Tax 2017 2019 Form in the online mode

How to generate an eSignature for your 637 Tax 2017 2019 Form in Google Chrome

How to create an eSignature for putting it on the 637 Tax 2017 2019 Form in Gmail

How to generate an electronic signature for the 637 Tax 2017 2019 Form right from your mobile device

How to make an electronic signature for the 637 Tax 2017 2019 Form on iOS

How to create an eSignature for the 637 Tax 2017 2019 Form on Android OS

People also ask

-

What is the 2017 637 form?

The 2017 637 form is a crucial document used by businesses for reporting and compliance purposes. This form allows entities to signNow that they meet the necessary requirements for tax exemptions. Filling out the 2017 637 form correctly ensures smoother operations and avoids potential legal issues.

-

How can airSlate SignNow help with the 2017 637 form?

airSlate SignNow offers a simple and efficient way to fill out and eSign the 2017 637 form. Our platform allows users to easily upload documents, fill them out electronically, and ensure they are signed and dated correctly. This streamlines your compliance process related to the 2017 637 form.

-

Is airSlate SignNow cost-effective for managing the 2017 637 form?

Yes, airSlate SignNow provides a cost-effective solution for managing the 2017 637 form. With a range of pricing plans, you can choose one that fits your budget and needs. Investing in our service can save you both time and money while ensuring that your documents are handled efficiently.

-

What features does airSlate SignNow offer for the 2017 637 form?

Our platform includes various features tailored for the 2017 637 form, such as template creation, real-time collaboration, and secure eSigning. Users can also track the progress of their documents and receive notifications when they are completed. These features enhance productivity and ensure compliance.

-

Can I integrate airSlate SignNow with other applications for handling the 2017 637 form?

Absolutely! airSlate SignNow allows seamless integration with a variety of applications, making it easy to manage the 2017 637 form alongside your other business tools. Integrations with platforms like Google Drive and Dropbox streamline document management, enhancing your overall workflow.

-

What are the benefits of using airSlate SignNow for the 2017 637 form?

Using airSlate SignNow for the 2017 637 form provides numerous benefits, including increased efficiency, reduced errors, and enhanced security. Our platform ensures that your documents are safely stored and easily accessible. Additionally, eSigning simplifies the process and accelerates turnaround time.

-

How do I get started with airSlate SignNow for the 2017 637 form?

Getting started with airSlate SignNow is easy! Simply visit our website, sign up for an account, and begin utilizing our tools to manage the 2017 637 form. You can access templates and guidance to help you through the process, making it user-friendly for everyone.

Get more for 720 Excise Tax Form

- Student rental application riner rentals form

- Test form 1b answer key

- Utah state polst form

- B r eckels bol 83728149 form

- 1 2b energy changes in materials worksheet form

- Homestead or property tax refund for homeowners forms and

- Non disclosure and non circumvention agreement template form

- Non disclosure and non compete agreement template form

Find out other 720 Excise Tax Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document