Homestead or Property Tax Refund for Homeowners Forms and

What is the Homestead Or Property Tax Refund For Homeowners Forms And

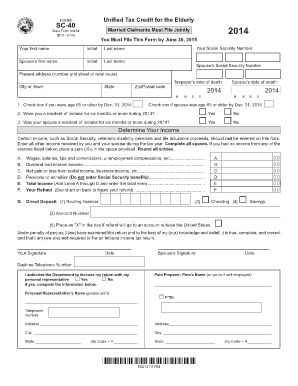

The Homestead Or Property Tax Refund For Homeowners Forms And refers to a set of documents designed to assist homeowners in claiming tax refunds or exemptions on their property taxes. These forms vary by state but generally aim to provide financial relief to homeowners by reducing their taxable property value or refunding a portion of their property taxes. The eligibility criteria often include factors such as income level, age, and disability status, making it essential for homeowners to understand their specific state's requirements.

Steps to complete the Homestead Or Property Tax Refund For Homeowners Forms And

Completing the Homestead Or Property Tax Refund For Homeowners Forms And involves several key steps to ensure accurate submission and compliance with state regulations:

- Gather Required Information: Collect necessary documentation, including proof of residency, income statements, and previous tax returns.

- Obtain the Correct Form: Identify the specific form required by your state, as these can differ significantly.

- Fill Out the Form: Carefully complete the form, ensuring all information is accurate and up-to-date.

- Review for Accuracy: Double-check all entries for errors or omissions to avoid delays in processing.

- Submit the Form: Follow your state's submission guidelines, which may include online, mail, or in-person options.

Eligibility Criteria

Eligibility for the Homestead Or Property Tax Refund For Homeowners Forms And typically hinges on several factors that may vary by state. Common criteria include:

- Residency: Homeowners must reside in the property for which they are claiming the refund.

- Income Limits: Many states impose income thresholds that applicants must not exceed to qualify for the refund.

- Age or Disability: Some programs offer additional benefits for senior citizens or individuals with disabilities.

Understanding these criteria is crucial for homeowners to determine their eligibility and maximize their potential refunds.

How to obtain the Homestead Or Property Tax Refund For Homeowners Forms And

Obtaining the Homestead Or Property Tax Refund For Homeowners Forms And can be accomplished through various channels:

- State Tax Office Website: Most states provide downloadable forms directly on their tax office websites.

- Local Government Offices: Homeowners can visit local tax assessor or revenue offices to request physical copies of the forms.

- Online Resources: Various online platforms may offer guidance and access to the necessary forms.

It is advisable to ensure that you are using the most current version of the form to avoid any issues during the submission process.

Form Submission Methods (Online / Mail / In-Person)

Homeowners have multiple options for submitting the Homestead Or Property Tax Refund For Homeowners Forms And, depending on state regulations:

- Online Submission: Many states offer electronic filing options, allowing homeowners to submit their forms via secure online portals.

- Mail: Homeowners can send completed forms through postal mail, ensuring they follow any specific mailing instructions provided by their state.

- In-Person Submission: For those who prefer face-to-face interactions, visiting local tax offices for submission is often an option.

Choosing the right submission method can help streamline the process and ensure timely processing of the forms.

Quick guide on how to complete homestead or property tax refund for homeowners forms and

Finalize Homestead Or Property Tax Refund For Homeowners Forms And effortlessly on any device

Managing documents online has gained popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it on the web. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly and without delays. Handle Homestead Or Property Tax Refund For Homeowners Forms And on any device using airSlate SignNow apps for Android or iOS and simplify any document-oriented process today.

The easiest way to modify and eSign Homestead Or Property Tax Refund For Homeowners Forms And without hassle

- Find Homestead Or Property Tax Refund For Homeowners Forms And and click on Obtain Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of the documents or redact sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Generate your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Finished button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

No more concerns about missing or lost documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your preference. Modify and eSign Homestead Or Property Tax Refund For Homeowners Forms And and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the homestead or property tax refund for homeowners forms and

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the benefits of using airSlate SignNow for Homestead Or Property Tax Refund For Homeowners Forms And?

Using airSlate SignNow for Homestead Or Property Tax Refund For Homeowners Forms And streamlines your document signing process. It reduces paperwork, saves time, and ensures that your forms are securely signed and stored. This efficiency maximizes your ability to manage tax refund requests effectively.

-

How does airSlate SignNow ensure the security of my Homestead Or Property Tax Refund For Homeowners Forms And?

airSlate SignNow uses industry-standard encryption and secure access protocols to protect your Homestead Or Property Tax Refund For Homeowners Forms And. We prioritize data security, ensuring that all documents are stored safely and accessed only by authorized users. Your sensitive information remains confidential throughout the process.

-

Can I customize my Homestead Or Property Tax Refund For Homeowners Forms And using airSlate SignNow?

Yes, airSlate SignNow allows you to customize your Homestead Or Property Tax Refund For Homeowners Forms And to fit your specific needs. You can add text fields, checkboxes, and signature lines to tailor each form. This flexibility ensures that your forms meet local requirements and reflect your branding.

-

What integrations are available with airSlate SignNow for Homestead Or Property Tax Refund For Homeowners Forms And?

airSlate SignNow integrates with various platforms including Google Drive, Dropbox, and CRM systems to enhance your workflow for Homestead Or Property Tax Refund For Homeowners Forms And. These integrations allow for seamless document management and ensure you can access all your paperwork in one place. Simplifying the process has never been easier.

-

Is there a free trial available for airSlate SignNow to handle Homestead Or Property Tax Refund For Homeowners Forms And?

Yes, airSlate SignNow offers a free trial that allows you to explore its features for managing Homestead Or Property Tax Refund For Homeowners Forms And. During the trial, you can test all functionalities and see how it streamlines your document signing process. This is a great opportunity to assess whether it meets your needs before committing.

-

What pricing plans does airSlate SignNow offer for Homestead Or Property Tax Refund For Homeowners Forms And?

airSlate SignNow offers several pricing plans tailored to different business needs for Homestead Or Property Tax Refund For Homeowners Forms And. Whether you're an individual, small business, or large enterprise, there's a plan that fits your requirements and budget. Additionally, all plans provide access to the same secure and efficient signing capabilities.

-

How can I get support when using airSlate SignNow for Homestead Or Property Tax Refund For Homeowners Forms And?

airSlate SignNow offers comprehensive support for users managing Homestead Or Property Tax Refund For Homeowners Forms And. You can access live chat, email support, and a detailed knowledge base to help answer any questions or problems you encounter. Our dedicated team is available to ensure you can maximize your experience with our product.

Get more for Homestead Or Property Tax Refund For Homeowners Forms And

Find out other Homestead Or Property Tax Refund For Homeowners Forms And

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile

- eSign Oklahoma Sports Rental Application Simple

- eSign Oklahoma Sports Rental Application Easy

- eSign Missouri Courts Lease Agreement Template Mobile

- Help Me With eSign Nevada Police Living Will

- eSign New York Courts Business Plan Template Later

- Can I eSign North Carolina Courts Limited Power Of Attorney

- eSign North Dakota Courts Quitclaim Deed Safe

- How To eSign Rhode Island Sports Quitclaim Deed

- Help Me With eSign Oregon Courts LLC Operating Agreement

- eSign North Dakota Police Rental Lease Agreement Now

- eSign Tennessee Courts Living Will Simple

- eSign Utah Courts Last Will And Testament Free

- eSign Ohio Police LLC Operating Agreement Mobile

- eSign Virginia Courts Business Plan Template Secure

- How To eSign West Virginia Courts Confidentiality Agreement