HEALTH SAVINGS ACCOUNT TRANSFERROLLOVER REQUEST Form

What is the HEALTH SAVINGS ACCOUNT TRANSFERROLLOVER REQUEST

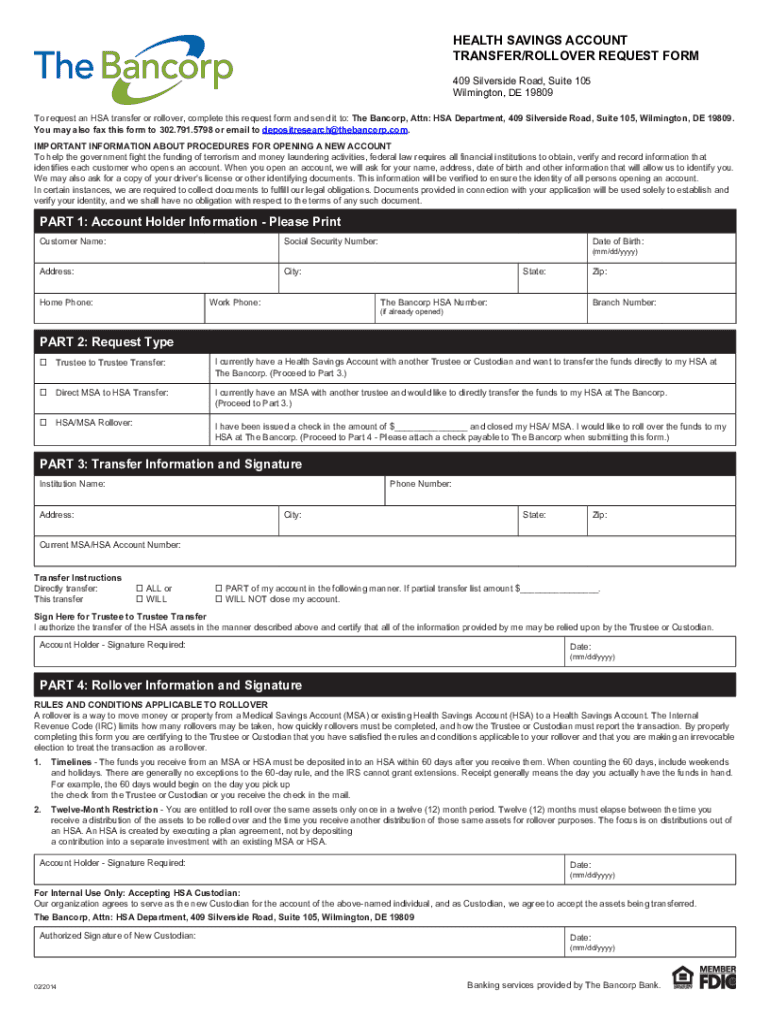

The health savings account transfer/rollover request is a formal document used to initiate the transfer of funds from one health savings account (HSA) to another. This process allows individuals to consolidate their HSAs or move their funds to a different financial institution that may offer better interest rates or investment options. The request form ensures that the transfer is executed smoothly and complies with IRS regulations governing HSAs.

Steps to complete the HEALTH SAVINGS ACCOUNT TRANSFERROLLOVER REQUEST

Completing the health savings account transfer/rollover request involves several key steps:

- Gather necessary information, including your current HSA account details and the receiving institution's information.

- Fill out the transfer/rollover request form accurately, ensuring all required fields are completed.

- Review the form for any errors or missing information to avoid delays.

- Sign and date the form to authorize the transfer.

- Submit the completed form to your current HSA provider, either online or via mail, as per their submission guidelines.

Legal use of the HEALTH SAVINGS ACCOUNT TRANSFERROLLOVER REQUEST

The health savings account transfer/rollover request is legally binding when executed properly. It must comply with the Electronic Signatures in Global and National Commerce Act (ESIGN) and the Uniform Electronic Transactions Act (UETA). These laws ensure that electronic signatures and documents are recognized as valid and enforceable. It is essential to use a reliable e-signature platform that meets these legal requirements to ensure the integrity of the transfer process.

Required Documents

To complete the health savings account transfer/rollover request, you typically need to provide the following documents:

- Your current HSA account statement.

- The completed transfer/rollover request form.

- Identification documents, if required by the receiving institution.

- Any additional forms specified by your current HSA provider.

Form Submission Methods (Online / Mail / In-Person)

The health savings account transfer/rollover request can generally be submitted through various methods, depending on the policies of the financial institutions involved:

- Online: Many providers offer an online submission option through their secure portals.

- Mail: You can send the completed form via postal service to your current HSA provider.

- In-Person: Some institutions may allow you to submit the form in person at a local branch.

IRS Guidelines

The Internal Revenue Service (IRS) provides specific guidelines regarding health savings accounts, including rules on transfers and rollovers. According to IRS regulations, individuals can transfer funds between HSAs without tax penalties, provided the transfer is executed correctly. It is crucial to adhere to these guidelines to maintain the tax-advantaged status of your HSA funds.

Quick guide on how to complete health savings account transferrollover request

Prepare HEALTH SAVINGS ACCOUNT TRANSFERROLLOVER REQUEST effortlessly on any device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Handle HEALTH SAVINGS ACCOUNT TRANSFERROLLOVER REQUEST on any device using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to modify and eSign HEALTH SAVINGS ACCOUNT TRANSFERROLLOVER REQUEST with ease

- Find HEALTH SAVINGS ACCOUNT TRANSFERROLLOVER REQUEST and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight pertinent sections of your documents or conceal sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Affix your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to share your form, via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management requirements in just a few clicks from any device of your choice. Modify and eSign HEALTH SAVINGS ACCOUNT TRANSFERROLLOVER REQUEST and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the health savings account transferrollover request

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a HEALTH SAVINGS ACCOUNT TRANSFER ROLLOVER REQUEST?

A HEALTH SAVINGS ACCOUNT TRANSFER ROLLOVER REQUEST is the process by which you transfer funds from one HSA to another. This ensures that your savings continue to grow tax-free while providing you with flexible access to your healthcare funds. airSlate SignNow simplifies this process with user-friendly features.

-

How does airSlate SignNow help with HEALTH SAVINGS ACCOUNT TRANSFER ROLLOVER REQUESTs?

airSlate SignNow offers a streamlined platform for managing your HEALTH SAVINGS ACCOUNT TRANSFER ROLLOVER REQUESTs. You can easily eSign necessary documents, ensuring that your requests are processed quickly and efficiently. This reduces the hassle typically associated with HSA transfers.

-

Are there any fees associated with processing a HEALTH SAVINGS ACCOUNT TRANSFER ROLLOVER REQUEST through airSlate SignNow?

While airSlate SignNow itself has a cost-effective pricing structure, additional fees may depend on your HSA provider. It’s recommended to check with your HSA custodian about their specific fees related to a HEALTH SAVINGS ACCOUNT TRANSFER ROLLOVER REQUEST. Using airSlate SignNow can minimize administrative costs associated with the process.

-

What features does airSlate SignNow offer for HEALTH SAVINGS ACCOUNT TRANSFER ROLLOVER REQUESTs?

airSlate SignNow provides features such as document templates, real-time tracking, and secure eSigning options tailored for HEALTH SAVINGS ACCOUNT TRANSFER ROLLOVER REQUESTs. These tools make it easy to manage your documents and ensure compliance. Additionally, our platform supports document sharing and collaboration among parties involved.

-

How secure is the process of submitting a HEALTH SAVINGS ACCOUNT TRANSFER ROLLOVER REQUEST with airSlate SignNow?

Security is a top priority at airSlate SignNow. All HEALTH SAVINGS ACCOUNT TRANSFER ROLLOVER REQUESTs are protected with robust encryption methods and secure data storage. This ensures that your sensitive information is kept safe throughout the document management process.

-

Can I integrate airSlate SignNow with other accounting software for managing HEALTH SAVINGS ACCOUNT TRANSFER ROLLOVER REQUESTs?

Yes, airSlate SignNow offers seamless integrations with various accounting and financial software. This allows you to manage your HEALTH SAVINGS ACCOUNT TRANSFER ROLLOVER REQUESTs alongside your other financial operations. Integrations ensure that you have all necessary tools in one platform for better efficiency.

-

What are the benefits of using airSlate SignNow for my HEALTH SAVINGS ACCOUNT TRANSFER ROLLOVER REQUESTs?

Using airSlate SignNow for your HEALTH SAVINGS ACCOUNT TRANSFER ROLLOVER REQUESTs provides multiple benefits including convenience, cost savings, and time efficiency. You can complete the process from anywhere, reduce paper usage, and accelerate the entire transfer timeline. It’s a straightforward solution for managing your healthcare savings.

Get more for HEALTH SAVINGS ACCOUNT TRANSFERROLLOVER REQUEST

Find out other HEALTH SAVINGS ACCOUNT TRANSFERROLLOVER REQUEST

- Can I eSignature Washington Engineering Proposal Template

- eSignature California Proforma Invoice Template Simple

- eSignature Georgia Proforma Invoice Template Myself

- eSignature Mississippi Proforma Invoice Template Safe

- eSignature Missouri Proforma Invoice Template Free

- Can I eSignature Mississippi Proforma Invoice Template

- eSignature Missouri Proforma Invoice Template Simple

- eSignature Missouri Proforma Invoice Template Safe

- eSignature New Hampshire Proforma Invoice Template Mobile

- eSignature North Carolina Proforma Invoice Template Easy

- Electronic signature Connecticut Award Nomination Form Fast

- eSignature South Dakota Apartment lease agreement template Free

- eSignature Maine Business purchase agreement Simple

- eSignature Arizona Generic lease agreement Free

- eSignature Illinois House rental agreement Free

- How To eSignature Indiana House rental agreement

- Can I eSignature Minnesota House rental lease agreement

- eSignature Missouri Landlord lease agreement Fast

- eSignature Utah Landlord lease agreement Simple

- eSignature West Virginia Landlord lease agreement Easy