SUNZ Insurance Company Loss History Affidavit Form

What is the SUNZ Insurance Company Loss History Affidavit

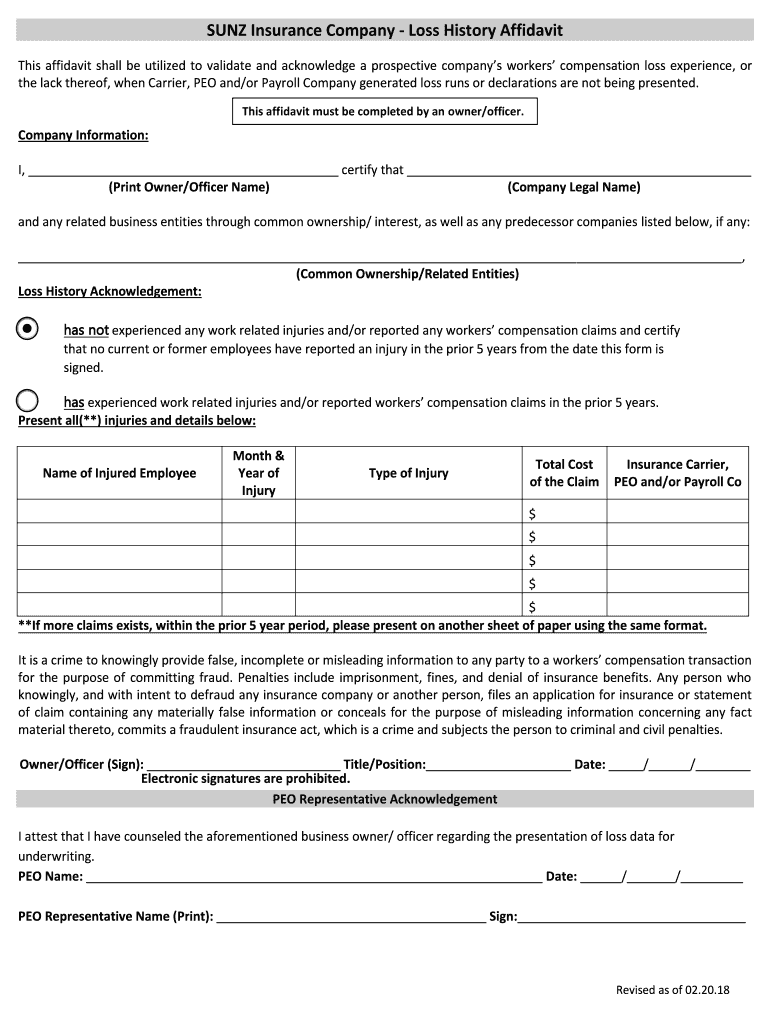

The SUNZ Insurance Company Loss History Affidavit is a formal document used to disclose an individual's or business's history of insurance claims. This affidavit is crucial for insurance underwriting processes, providing insurers with a clear picture of past claims, which can influence policy decisions and premium rates. It typically includes details such as the type of claims made, the dates of those claims, and the amounts involved. Understanding this document is essential for both policyholders and insurers to ensure transparency and informed decision-making.

How to obtain the SUNZ Insurance Company Loss History Affidavit

Obtaining the SUNZ Insurance Company Loss History Affidavit involves a straightforward process. First, you can visit the official SUNZ Insurance Company website or contact their customer service for guidance. Often, the affidavit can be requested directly through an online portal, where you may need to provide personal identification and relevant policy information. Ensure that you have all necessary details at hand to expedite the process. In some cases, you may also be required to submit a written request or complete a specific form to receive the affidavit.

Steps to complete the SUNZ Insurance Company Loss History Affidavit

Completing the SUNZ Insurance Company Loss History Affidavit requires careful attention to detail. Here are the essential steps:

- Gather all relevant information regarding past insurance claims, including dates, types, and amounts.

- Access the affidavit form through the SUNZ Insurance Company website or the provided link.

- Fill in your personal information, ensuring accuracy to avoid delays.

- Detail your loss history by listing each claim in the required format.

- Review the completed affidavit for any errors or omissions.

- Submit the affidavit electronically or as directed, ensuring compliance with any submission guidelines.

Legal use of the SUNZ Insurance Company Loss History Affidavit

The legal use of the SUNZ Insurance Company Loss History Affidavit is significant in the context of insurance agreements. This document serves as a legally binding declaration of your loss history, which insurers rely on to assess risk and determine coverage options. Misrepresentation or failure to disclose accurate information in the affidavit can lead to legal consequences, including denial of claims or cancellation of policies. Therefore, it is vital to ensure that all information provided is truthful and comprehensive.

Key elements of the SUNZ Insurance Company Loss History Affidavit

Several key elements make up the SUNZ Insurance Company Loss History Affidavit. These include:

- Personal Information: Name, address, and contact details of the individual or business.

- Claim History: A detailed account of all past claims, including dates, types of claims, and amounts paid.

- Signature: A declaration that the information provided is accurate, accompanied by the date of signing.

- Witness or Notary Section: In some cases, a witness or notary may be required to validate the affidavit.

Examples of using the SUNZ Insurance Company Loss History Affidavit

The SUNZ Insurance Company Loss History Affidavit is commonly used in various scenarios. For instance, when applying for a new insurance policy, insurers may request this affidavit to evaluate the applicant's risk profile. Additionally, businesses seeking to renew their insurance coverage may need to submit an updated affidavit reflecting any new claims. This document can also be useful during audits or legal proceedings where proof of loss history is required. Ensuring that this affidavit is complete and accurate can significantly impact insurance decisions and outcomes.

Quick guide on how to complete sunz insurance company loss history affidavit

Complete SUNZ Insurance Company Loss History Affidavit effortlessly on any device

Web-based document administration has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides all the resources you require to create, edit, and eSign your documents quickly without delays. Manage SUNZ Insurance Company Loss History Affidavit across any platform using airSlate SignNow’s Android or iOS applications and enhance any document-centric workflow today.

How to edit and eSign SUNZ Insurance Company Loss History Affidavit effortlessly

- Find SUNZ Insurance Company Loss History Affidavit and click on Get Form to begin.

- Use the provided tools to fill out your document.

- Highlight important sections of your documents or obscure sensitive information with the tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal significance as a conventional wet ink signature.

- Review the information and then click the Done button to save your edits.

- Select your preferred method to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, frustrating form searches, or errors that necessitate reprinting new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your device of choice. Edit and eSign SUNZ Insurance Company Loss History Affidavit and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sunz insurance company loss history affidavit

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a loss history affidavit?

A loss history affidavit is a crucial document that outlines a property's insurance claims history. It provides details about past losses and claims made, which can impact future insurance coverage and rates. Understanding this affidavit is essential for both property owners and insurers.

-

How does airSlate SignNow simplify the creation of a loss history affidavit?

airSlate SignNow streamlines the process of creating a loss history affidavit by providing templates and easy-to-use tools for document preparation. With eSignature capabilities, users can efficiently gather necessary signatures and finalize the affidavit electronically. This signNowly reduces the time and effort involved in traditional paperwork.

-

Is there a cost to use airSlate SignNow for preparing a loss history affidavit?

Yes, airSlate SignNow offers various pricing plans to suit different needs. The cost depends on the features and the number of users required to prepare documents like the loss history affidavit. Consider checking our pricing page for details on plans that work best for your business.

-

What features does airSlate SignNow provide for managing a loss history affidavit?

With airSlate SignNow, users enjoy features such as document templates, electronic signatures, and a secure cloud storage system for their loss history affidavit. Additionally, our platform supports workflow automation to streamline document processing. These features ensure that users can manage their affidavits efficiently and securely.

-

Can I integrate airSlate SignNow with other software for my loss history affidavit?

Absolutely! airSlate SignNow offers seamless integrations with numerous applications, including popular CRM and document management systems. This allows users to easily import data and manage their loss history affidavit alongside other essential business documents without any hassle.

-

What types of businesses benefit from using a loss history affidavit?

Various businesses, including real estate companies, insurance agencies, and property management firms, find value in using a loss history affidavit. It helps them establish trust with clients and insurers by providing transparency regarding a property's claim history. This can lead to better insurance terms and a smoother transaction process.

-

How long does it take to complete a loss history affidavit with airSlate SignNow?

The time to complete a loss history affidavit using airSlate SignNow can range from a few minutes to an hour, depending on the complexity of the document and data required. Our platform's user-friendly interface and template options help speed up the process signNowly. Users can also gather signatures seamlessly, reducing delays.

Get more for SUNZ Insurance Company Loss History Affidavit

- Chapter 5 test form a

- Delta ceramcoat to folk art conversion chart form

- Pay or quit notice georgia form

- Princess mobility questionnaire form

- How to become icbc approved translator form

- Printable sample job application form

- Ohio form it 1040 instructions esmart tax

- Commercial kitchen rental agreement template form

Find out other SUNZ Insurance Company Loss History Affidavit

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP

- eSign Missouri Legal Living Will Computer

- eSign Connecticut Non-Profit Job Description Template Now

- eSign Montana Legal Bill Of Lading Free

- How Can I eSign Hawaii Non-Profit Cease And Desist Letter

- Can I eSign Florida Non-Profit Residential Lease Agreement

- eSign Idaho Non-Profit Business Plan Template Free

- eSign Indiana Non-Profit Business Plan Template Fast

- How To eSign Kansas Non-Profit Business Plan Template

- eSign Indiana Non-Profit Cease And Desist Letter Free

- eSign Louisiana Non-Profit Quitclaim Deed Safe

- How Can I eSign Maryland Non-Profit Credit Memo

- eSign Maryland Non-Profit Separation Agreement Computer

- eSign Legal PDF New Jersey Free

- eSign Non-Profit Document Michigan Safe

- eSign New Mexico Legal Living Will Now

- eSign Minnesota Non-Profit Confidentiality Agreement Fast