2 CFR Part 200 Subpart F Audit Requirements 2022-2026

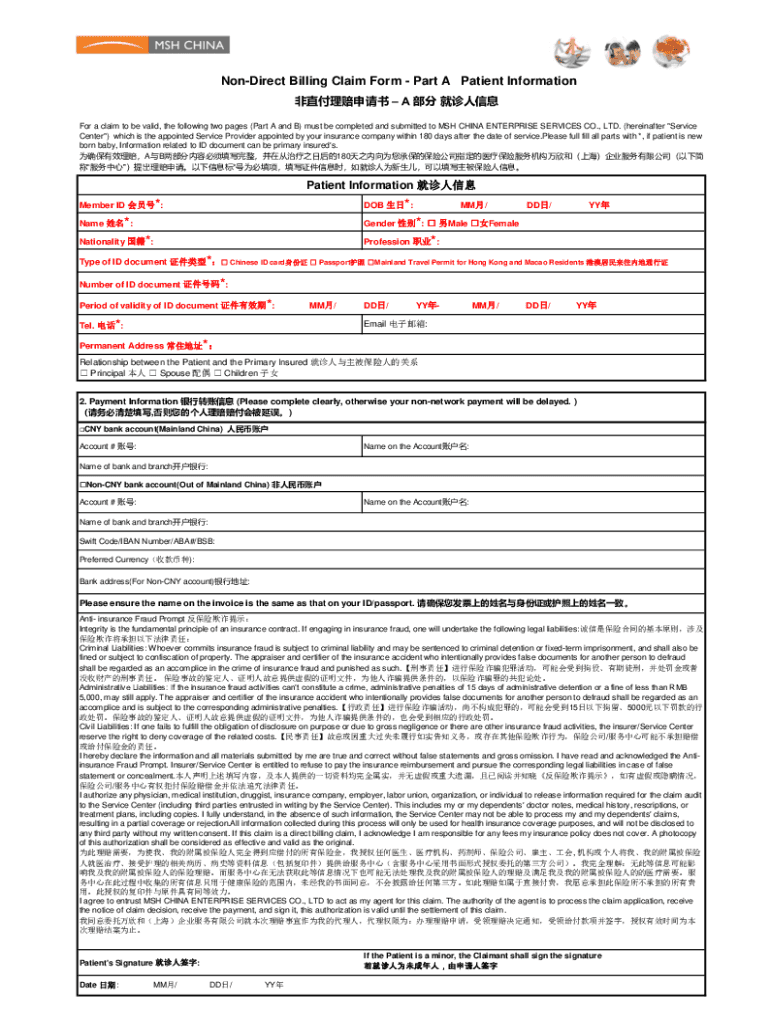

Understanding the msh claim form

The msh claim form is essential for individuals seeking reimbursement for eligible expenses under the MSH program. This form captures necessary details about the claimant, the nature of the expenses, and supporting documentation required for processing. Understanding how to accurately complete this form ensures that claims are submitted correctly and efficiently, minimizing delays in reimbursement.

Steps to complete the msh reimbursement form

Completing the msh reimbursement form involves several key steps:

- Gather all necessary documentation, including receipts and invoices related to the expenses incurred.

- Fill out personal information accurately, including your name, address, and contact details.

- Detail each expense, including the date, amount, and a brief description of the service or product.

- Review the completed form for accuracy and completeness before submission.

- Submit the form electronically or via mail, depending on the guidelines provided by the MSH program.

Required documents for the msh claim form

To ensure a smooth reimbursement process, specific documents must accompany the msh claim form. These typically include:

- Original receipts or invoices for each expense.

- A copy of the msh claim form, fully completed.

- Any additional documentation requested by the MSH program, such as proof of eligibility.

Legal use of the msh claim form

The msh claim form must be completed in compliance with applicable laws and regulations. This includes ensuring that all information provided is accurate and truthful. Misrepresentation or submission of fraudulent claims can lead to penalties, including denial of reimbursement and potential legal action. It is advisable to familiarize yourself with the specific legal requirements associated with the MSH program to avoid complications.

Form submission methods

The msh claim form can be submitted through various methods, depending on the guidelines set forth by the MSH program. Common submission methods include:

- Online submission through a secure portal.

- Mailing a physical copy of the form and supporting documents to the designated address.

- In-person submission at designated locations, if applicable.

Penalties for non-compliance

Failure to comply with the requirements associated with the msh claim form can result in significant penalties. These may include:

- Denial of the claim, resulting in no reimbursement for submitted expenses.

- Legal repercussions for fraudulent claims, which may include fines or other legal actions.

- Increased scrutiny on future claims, potentially leading to further complications.

Quick guide on how to complete 2 cfr part 200 subpart f audit requirements

Complete 2 CFR Part 200 Subpart F Audit Requirements effortlessly on any device

Digital document management has become favored by organizations and individuals alike. It offers an excellent environmentally friendly substitute for conventional printed and signed documents, allowing you to access the accurate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly and efficiently. Manage 2 CFR Part 200 Subpart F Audit Requirements on any platform with the airSlate SignNow Android or iOS applications, and streamline any document-related task today.

How to modify and eSign 2 CFR Part 200 Subpart F Audit Requirements with ease

- Obtain 2 CFR Part 200 Subpart F Audit Requirements and click on Get Form to initiate the process.

- Utilize the tools we offer to complete your form.

- Highlight important sections of your documents or obscure sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Create your signature with the Sign tool, which takes only seconds and has the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you wish to deliver your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, laborious form searches, or mistakes that require printing new copies. airSlate SignNow addresses all your document management needs within just a few clicks from your preferred device. Modify and eSign 2 CFR Part 200 Subpart F Audit Requirements while ensuring excellent communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2 cfr part 200 subpart f audit requirements

Create this form in 5 minutes!

How to create an eSignature for the 2 cfr part 200 subpart f audit requirements

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to 652834262?

airSlate SignNow is an eSignature platform that enables businesses to send and eSign documents seamlessly. The reference '652834262' highlights our unique service offering, providing an easy-to-use, cost-effective solution for all your document signing needs.

-

How does the pricing for airSlate SignNow work in relation to 652834262?

Our pricing model is designed to provide great value while accommodating various business needs. By utilizing the airSlate SignNow service associated with '652834262', you can choose from different plans that offer scalable features and competitive rates.

-

What features does airSlate SignNow offer connected with 652834262?

With airSlate SignNow, you can access a wide range of features, including document templates, real-time collaboration, and secure cloud storage. The capabilities under '652834262' allow you to streamline your signing process effectively.

-

What are the benefits of using airSlate SignNow for 652834262?

Choosing airSlate SignNow enhances your document workflow efficiency, reduces turnaround times, and improves overall productivity. The solutions tied to '652834262' ensure you can manage your documents effortlessly.

-

Can airSlate SignNow integrate with other software solutions related to 652834262?

Yes, airSlate SignNow offers a wide range of integrations with popular software platforms. By leveraging the integration capabilities of '652834262', you can enhance your workflow by connecting relevant applications.

-

Is airSlate SignNow suitable for small businesses using the identifier 652834262?

Absolutely! airSlate SignNow is tailored for businesses of all sizes, making it an ideal choice for small businesses associated with '652834262'. Its user-friendly interface and affordable pricing help small enterprises stay competitive.

-

How secure is airSlate SignNow when handling documents related to 652834262?

Security is our top priority at airSlate SignNow. We ensure that all documents processed under '652834262' are safeguarded with encryption and comply with industry standards to protect sensitive information.

Get more for 2 CFR Part 200 Subpart F Audit Requirements

Find out other 2 CFR Part 200 Subpart F Audit Requirements

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement