ChoiceLend Loan Application Form Home Loan Experts

What is the ChoiceLend Loan Application Form?

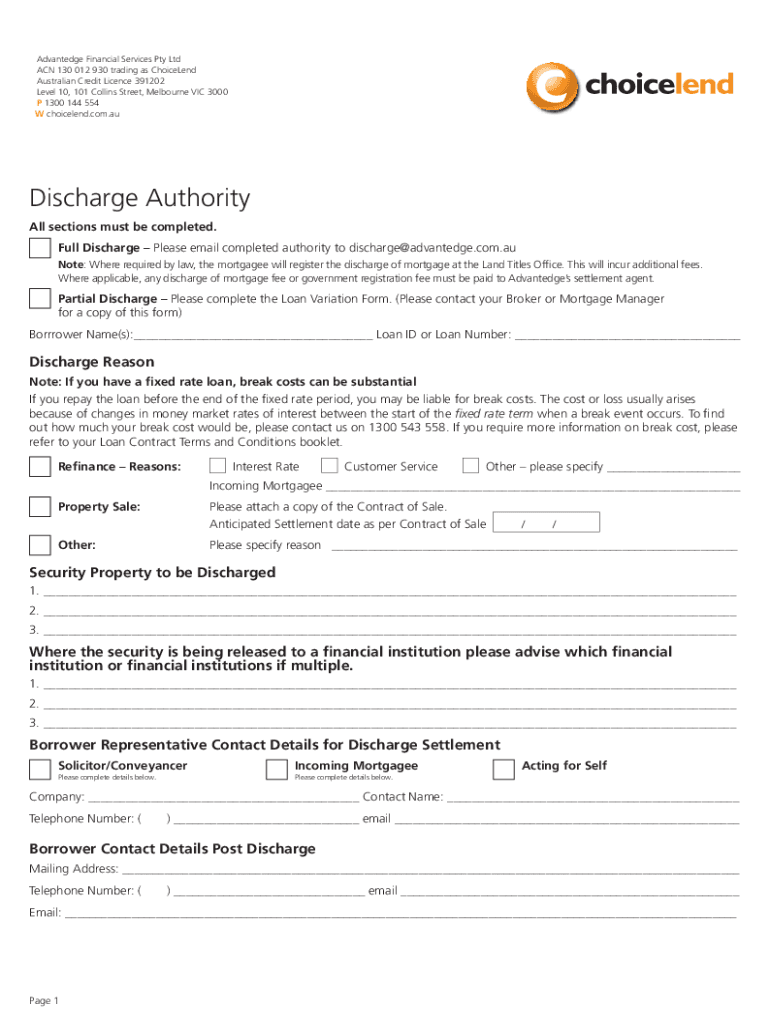

The ChoiceLend Loan Application Form is a crucial document for individuals seeking home loans through the ChoiceLend platform. This form collects essential information about the applicant's financial status, employment history, and property details. It serves as the foundation for the loan approval process, allowing lenders to assess the borrower's eligibility and determine loan terms. Completing this form accurately is vital to ensure a smooth application process.

Steps to Complete the ChoiceLend Loan Application Form

Filling out the ChoiceLend Loan Application Form involves several key steps:

- Gather necessary documentation, including income statements, tax returns, and identification.

- Access the form through the ChoiceLend platform, ensuring you have a reliable internet connection.

- Fill in personal information, such as your name, address, and Social Security number.

- Provide financial details, including income, debts, and assets.

- Review the information for accuracy before submission.

Taking these steps helps ensure that your application is complete and increases the likelihood of approval.

Legal Use of the ChoiceLend Loan Application Form

The ChoiceLend Loan Application Form is legally binding once signed, whether electronically or in paper format. To ensure its validity, it must comply with relevant laws, such as the Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA). These laws establish that electronic signatures carry the same weight as traditional handwritten signatures, provided certain conditions are met. Using a secure platform like signNow enhances the legal standing of your submissions.

Key Elements of the ChoiceLend Loan Application Form

The ChoiceLend Loan Application Form comprises several key elements that are essential for processing your loan request:

- Personal Information: Includes the applicant's name, contact details, and Social Security number.

- Employment Information: Details about current and previous employment, including job title and duration.

- Financial Information: Income sources, monthly expenses, and outstanding debts.

- Property Information: Details about the property being financed, including its address and estimated value.

Providing accurate and complete information in these sections is critical for a successful application.

How to Obtain the ChoiceLend Loan Application Form

The ChoiceLend Loan Application Form can be easily obtained through the ChoiceLend website. Users can access the form directly from the homepage or the loan application section. It is available in a digital format, allowing for easy completion and submission. For those who prefer a paper version, it may also be available for download or request through customer service. Ensuring you have the latest version of the form is important for compliance and accuracy.

Form Submission Methods

Submitting the ChoiceLend Loan Application Form can be done through various methods, depending on your preference:

- Online Submission: The most efficient method, allowing for immediate processing and confirmation.

- Mail: Applicants can print the completed form and send it to the designated address, though this may result in longer processing times.

- In-Person: Some applicants may choose to submit the form directly at a ChoiceLend office, where assistance is available if needed.

Choosing the right submission method can impact the speed and efficiency of your loan application process.

Quick guide on how to complete choicelend loan application form home loan experts

Effortlessly Prepare ChoiceLend Loan Application Form Home Loan Experts on Any Device

Managing documents online has gained traction among companies and individuals alike. It serves as a perfect eco-conscious alternative to traditional printed and signed documents since you can access the appropriate format and securely save it online. airSlate SignNow equips you with all the necessary tools to swiftly create, modify, and electronically sign your documents without delays. Handle ChoiceLend Loan Application Form Home Loan Experts on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to Modify and eSign ChoiceLend Loan Application Form Home Loan Experts with Ease

- Obtain ChoiceLend Loan Application Form Home Loan Experts and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Select important sections of your documents or obscure sensitive information with tools specifically offered by airSlate SignNow.

- Create your signature using the Sign feature, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method to share your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign ChoiceLend Loan Application Form Home Loan Experts to ensure outstanding communication throughout any phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the choicelend loan application form home loan experts

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is discharge authority in the context of document signing?

Discharge authority refers to the legal power granted to an individual to sign documents on behalf of another party. With airSlate SignNow, you can easily manage discharge authority, ensuring that the right individuals have the ability to eSign critical documents and agreements securely.

-

How can I set up discharge authority using airSlate SignNow?

Setting up discharge authority with airSlate SignNow is straightforward. You simply need to define the roles within your organization and designate who holds discharge authority for specific document types. Our user-friendly interface guides you through the process step-by-step.

-

Are there any costs associated with using the discharge authority feature?

The discharge authority feature is included in the airSlate SignNow pricing plans, making it a cost-effective solution for businesses. We offer various pricing tiers based on your needs, ensuring that you can efficiently manage discharge authority without breaking your budget.

-

What benefits does discharge authority provide to my organization?

Having clear discharge authority helps streamline document workflows and reduces the risk of unauthorized signings. By utilizing airSlate SignNow, your organization can enhance accountability, speed up processes, and ensure compliance with legal requirements tied to the discharge authority.

-

Can I customize discharge authority roles and permissions in airSlate SignNow?

Yes, airSlate SignNow allows for extensive customization of discharge authority roles and permissions. You can set specific access levels for each user, enabling them to execute documents or oversee the signing process, ensuring that your document management aligns with your organizational policies.

-

What integrations does airSlate SignNow offer for managing discharge authority?

airSlate SignNow seamlessly integrates with various platforms and applications, empowering you to manage discharge authority effectively. Integrations with CRM systems and cloud storage services enable you to centralize document management and enhance collaboration across teams.

-

Is airSlate SignNow compliant with legal standards related to discharge authority?

Yes, airSlate SignNow is designed to meet legal standards required for discharge authority and eSigning. We ensure that our platform adheres to the regulations such as ESIGN and UETA, providing you with a trustworthy solution for handling legally binding documents.

Get more for ChoiceLend Loan Application Form Home Loan Experts

Find out other ChoiceLend Loan Application Form Home Loan Experts

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document