DHS 3043 Earned Income Tax Credit Temporary Assistance for Needy Families TANF Earned Income Tax Credit TANF Form

What is the DHS 3043 Earned Income Tax Credit Temporary Assistance for Needy Families TANF?

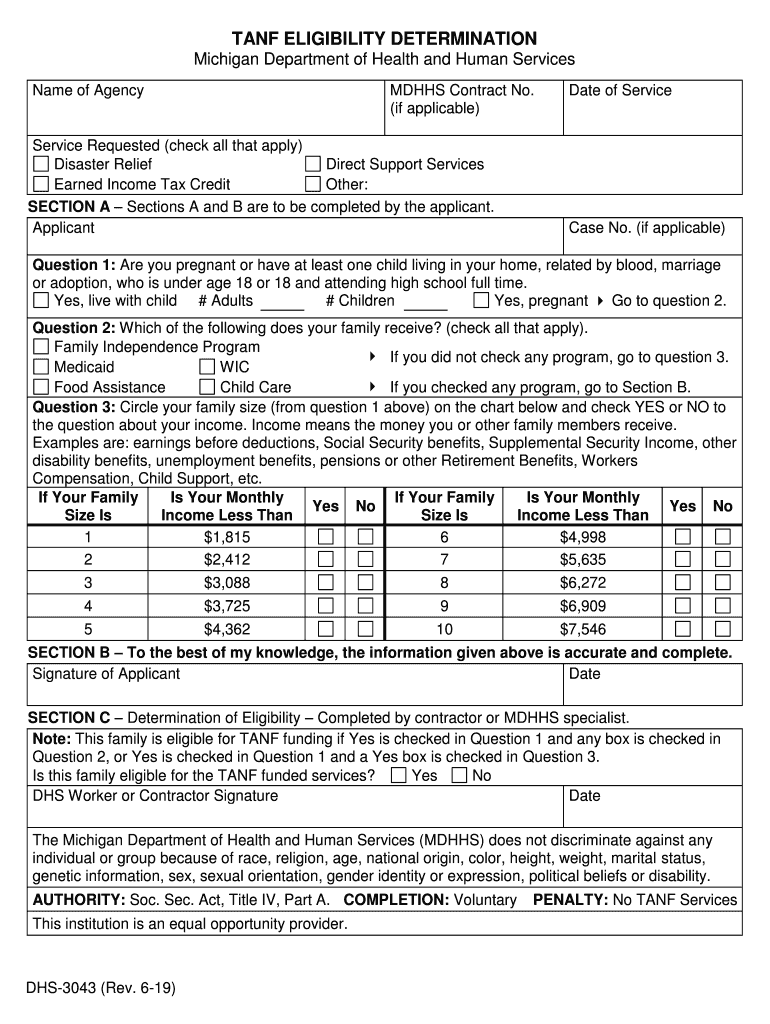

The DHS 3043 form is a crucial document for individuals seeking financial assistance through the Earned Income Tax Credit (EITC) under the Temporary Assistance for Needy Families (TANF) program. This form serves as a means to apply for benefits designed to support low-income families, helping them achieve financial stability. The EITC is a significant tax benefit that reduces the amount of tax owed and may result in a refund, making it an essential resource for eligible families.

Steps to Complete the DHS 3043 Earned Income Tax Credit Temporary Assistance for Needy Families TANF

Completing the DHS 3043 form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary information, including personal identification details, income documentation, and family size. Follow these steps:

- Fill out your personal information, including name, address, and Social Security number.

- Provide details about your income, including wages, self-employment earnings, and any other sources of income.

- Indicate the number of qualifying children in your household, as this impacts eligibility and benefit amounts.

- Review the form for accuracy and completeness before submission.

Once completed, the form can be submitted through the designated channels, ensuring you meet any deadlines associated with the application process.

Legal Use of the DHS 3043 Earned Income Tax Credit Temporary Assistance for Needy Families TANF

The DHS 3043 form is legally binding when completed and submitted according to the relevant regulations. To ensure its legal validity, it must be filled out accurately and signed by the applicant. Compliance with federal and state laws regarding the EITC and TANF programs is essential. The use of electronic signatures is permitted, provided that the signing process adheres to the guidelines set forth by the ESIGN Act and UETA. This legal framework ensures that electronic documents hold the same weight as traditional paper forms.

How to Obtain the DHS 3043 Earned Income Tax Credit Temporary Assistance for Needy Families TANF

The DHS 3043 form can be obtained through various channels. Applicants can access the form online through state government websites or local Department of Human Services offices. Additionally, community organizations and tax assistance programs may provide copies of the form and offer guidance on completing it. It is advisable to ensure you are using the most current version of the form to avoid any issues during the application process.

Eligibility Criteria for the DHS 3043 Earned Income Tax Credit Temporary Assistance for Needy Families TANF

Eligibility for the benefits associated with the DHS 3043 form is determined by several factors. Applicants must meet specific income thresholds, which vary based on family size and state regulations. Other criteria include:

- Being a resident of the state where you are applying.

- Having qualifying children under the age of 19 or dependent students.

- Meeting work requirements, which may include having earned income from employment or self-employment.

It is essential for applicants to review the eligibility requirements thoroughly to ensure they qualify before submitting the form.

Key Elements of the DHS 3043 Earned Income Tax Credit Temporary Assistance for Needy Families TANF

The DHS 3043 form encompasses several key elements that are critical for applicants to understand. These include:

- Personal Information: Basic details about the applicant and household members.

- Income Details: Comprehensive reporting of all income sources to determine eligibility.

- Family Composition: Information regarding dependents and their ages, which affects benefit calculations.

- Signature: A declaration of the truthfulness of the information provided, which is legally binding.

Understanding these elements is vital for a successful application process and ensuring that all necessary information is accurately reported.

Quick guide on how to complete dhs 3043 earned income tax credit temporary assistance for needy families tanf earned income tax credit tanf

Easily Prepare DHS 3043 Earned Income Tax Credit Temporary Assistance For Needy Families TANF Earned Income Tax Credit TANF on Any Device

The management of online documents has gained traction among companies and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed paperwork, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly without delays. Manage DHS 3043 Earned Income Tax Credit Temporary Assistance For Needy Families TANF Earned Income Tax Credit TANF on any platform using the airSlate SignNow apps for Android or iOS and enhance any document-centric process today.

How to Modify and Electronically Sign DHS 3043 Earned Income Tax Credit Temporary Assistance For Needy Families TANF Earned Income Tax Credit TANF Effortlessly

- Obtain DHS 3043 Earned Income Tax Credit Temporary Assistance For Needy Families TANF Earned Income Tax Credit TANF and select Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your electronic signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review all the details and press the Done button to save your changes.

- Select your preferred method to deliver your form, whether by email, SMS, invitation link, or download it to your PC.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign DHS 3043 Earned Income Tax Credit Temporary Assistance For Needy Families TANF Earned Income Tax Credit TANF while ensuring effective communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the dhs 3043 earned income tax credit temporary assistance for needy families tanf earned income tax credit tanf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the dhs form 3043 and why is it important?

The dhs form 3043 is a critical form for businesses needing to comply with specific Department of Homeland Security requirements. It ensures that organizations maintain proper records and processes. Understanding this form is essential for streamlined operations and compliance with regulations.

-

How can airSlate SignNow help with the dhs form 3043?

airSlate SignNow simplifies the process of filling out and submitting the dhs form 3043 by providing a user-friendly platform for e-signatures and document management. With our tool, you can easily customize, send, and securely sign the form without hassle. This not only saves time but also enhances accuracy.

-

What are the pricing options for airSlate SignNow when dealing with the dhs form 3043?

airSlate SignNow offers a variety of pricing plans that can fit the needs of any business looking to manage the dhs form 3043 effectively. Our plans are designed to provide excellent value and flexibility, starting from a basic free version to premium features for larger organizations. Customers can choose based on their document signing needs.

-

Are there any integrations available that work with the dhs form 3043?

Yes, airSlate SignNow seamlessly integrates with various applications, enhancing the efficiency of managing the dhs form 3043. You can connect it with popular apps such as Google Drive, Salesforce, and Dropbox, allowing for easy document access and management. This makes your workflow smoother and more efficient.

-

What features does airSlate SignNow offer for completing the dhs form 3043?

With airSlate SignNow, you get a comprehensive set of features tailored for completing the dhs form 3043, including customizable templates, real-time collaboration, and secure e-signature capabilities. These features ensure that the form is completed accurately and swiftly, reducing potential delays in your processes.

-

Can I track the status of the dhs form 3043 with airSlate SignNow?

Absolutely! airSlate SignNow provides tracking features that allow you to monitor the status of your dhs form 3043 in real-time. You'll receive notifications when recipients view or sign the document, keeping you informed and allowing for timely follow-ups.

-

Is the dhs form 3043 secure with airSlate SignNow?

Yes, security is a top priority at airSlate SignNow. We utilize advanced encryption technology to ensure that your dhs form 3043 and any associated documents are protected throughout the signing process. You can have peace of mind knowing your sensitive information is safe.

Get more for DHS 3043 Earned Income Tax Credit Temporary Assistance For Needy Families TANF Earned Income Tax Credit TANF

Find out other DHS 3043 Earned Income Tax Credit Temporary Assistance For Needy Families TANF Earned Income Tax Credit TANF

- eSign South Carolina Non-Profit Business Plan Template Simple

- How Can I eSign South Dakota Non-Profit LLC Operating Agreement

- eSign Oregon Legal Cease And Desist Letter Free

- eSign Oregon Legal Credit Memo Now

- eSign Oregon Legal Limited Power Of Attorney Now

- eSign Utah Non-Profit LLC Operating Agreement Safe

- eSign Utah Non-Profit Rental Lease Agreement Mobile

- How To eSign Rhode Island Legal Lease Agreement

- How Do I eSign Rhode Island Legal Residential Lease Agreement

- How Can I eSign Wisconsin Non-Profit Stock Certificate

- How Do I eSign Wyoming Non-Profit Quitclaim Deed

- eSign Hawaii Orthodontists Last Will And Testament Fast

- eSign South Dakota Legal Letter Of Intent Free

- eSign Alaska Plumbing Memorandum Of Understanding Safe

- eSign Kansas Orthodontists Contract Online

- eSign Utah Legal Last Will And Testament Secure

- Help Me With eSign California Plumbing Business Associate Agreement

- eSign California Plumbing POA Mobile

- eSign Kentucky Orthodontists Living Will Mobile

- eSign Florida Plumbing Business Plan Template Now