Form 14446 CN S Rev 10 Virtual VITATCE Taxpayer Consent Chinese Simplified Version Irs 2016

What is the Form 14446 CN S Rev 10 Virtual VITATCE Taxpayer Consent Chinese Simplified Version IRS

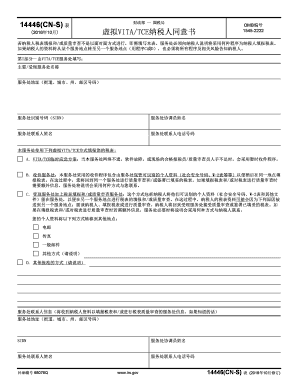

The Form 14446 CN S Rev 10 is a specific IRS document designed for virtual taxpayer consent in the Chinese Simplified language. It facilitates the process for taxpayers who need to provide consent for the Virtual VITATCE program, which aids in the verification of taxpayer identities and ensures compliance with IRS regulations. This form is essential for non-English speaking taxpayers to understand their rights and obligations in the tax filing process.

How to use the Form 14446 CN S Rev 10 Virtual VITATCE Taxpayer Consent Chinese Simplified Version IRS

Using the Form 14446 CN S Rev 10 involves several straightforward steps. First, ensure you have the correct version of the form, as updates may occur. Next, carefully read the instructions provided in the Chinese Simplified version to understand the requirements. Fill out the form accurately, providing all necessary information, and ensure that you sign it electronically. This form can be submitted online, making the process efficient and accessible for users.

Steps to complete the Form 14446 CN S Rev 10 Virtual VITATCE Taxpayer Consent Chinese Simplified Version IRS

Completing the Form 14446 CN S Rev 10 requires attention to detail. Follow these steps:

- Download the form from the IRS website or obtain it through authorized channels.

- Read the instructions carefully to understand what information is required.

- Fill in your personal details, including your name, address, and taxpayer identification number.

- Review the consent section and ensure you understand what you are consenting to.

- Sign the form electronically, ensuring your signature is valid under IRS regulations.

- Submit the completed form through the designated online portal or as instructed.

Legal use of the Form 14446 CN S Rev 10 Virtual VITATCE Taxpayer Consent Chinese Simplified Version IRS

The legal use of the Form 14446 CN S Rev 10 is grounded in compliance with IRS guidelines. When completed accurately and submitted through the appropriate channels, this form is recognized as a legally binding document. It is crucial that all information provided is truthful and complete, as inaccuracies can lead to penalties or delays in processing. Understanding the legal implications of this form helps taxpayers navigate their obligations effectively.

Key elements of the Form 14446 CN S Rev 10 Virtual VITATCE Taxpayer Consent Chinese Simplified Version IRS

Several key elements make up the Form 14446 CN S Rev 10. These include:

- Taxpayer Information: Personal details such as name, address, and taxpayer identification number.

- Consent Statement: A clear declaration of what the taxpayer is consenting to regarding their information.

- Signature Section: An area for the taxpayer to provide their electronic signature, confirming the authenticity of the submission.

- Instructions: Guidance in Chinese Simplified to assist taxpayers in completing the form accurately.

How to obtain the Form 14446 CN S Rev 10 Virtual VITATCE Taxpayer Consent Chinese Simplified Version IRS

The Form 14446 CN S Rev 10 can be obtained directly from the IRS website or through authorized tax professionals. It is important to ensure that you are using the most current version of the form to comply with IRS requirements. Additionally, local tax assistance centers may provide copies of the form in Chinese Simplified, making it easier for non-English speakers to access the necessary documents for tax compliance.

Quick guide on how to complete form 14446 cn s rev 10 virtual vitatce taxpayer consent chinese simplified version irs

Effortlessly Prepare Form 14446 CN S Rev 10 Virtual VITATCE Taxpayer Consent Chinese Simplified Version Irs on Any Device

Digital document management has become increasingly popular among businesses and individuals alike. It serves as an excellent eco-friendly alternative to conventional printed and signed paperwork, allowing you to access the correct form and securely keep it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents quickly without delays. Manage Form 14446 CN S Rev 10 Virtual VITATCE Taxpayer Consent Chinese Simplified Version Irs on any device using airSlate SignNow's Android or iOS applications and enhance any document-based task today.

Steps to Modify and eSign Form 14446 CN S Rev 10 Virtual VITATCE Taxpayer Consent Chinese Simplified Version Irs with Ease

- Locate Form 14446 CN S Rev 10 Virtual VITATCE Taxpayer Consent Chinese Simplified Version Irs and click on Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize important sections of your documents or conceal sensitive information using tools specifically designed by airSlate SignNow for this purpose.

- Create your signature with the Sign feature, which takes seconds and has the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the hassle of lost or misfiled documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you select. Edit and eSign Form 14446 CN S Rev 10 Virtual VITATCE Taxpayer Consent Chinese Simplified Version Irs while ensuring excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 14446 cn s rev 10 virtual vitatce taxpayer consent chinese simplified version irs

Create this form in 5 minutes!

How to create an eSignature for the form 14446 cn s rev 10 virtual vitatce taxpayer consent chinese simplified version irs

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 14446 CN S Rev 10 Virtual VITATCE Taxpayer Consent Chinese Simplified Version Irs?

The Form 14446 CN S Rev 10 Virtual VITATCE Taxpayer Consent Chinese Simplified Version Irs is an official IRS document that allows taxpayers to provide consent for virtual tax assistance in a simplified Chinese format. This form is essential for ensuring compliance and effective communication with Chinese-speaking taxpayers.

-

How can I access the Form 14446 CN S Rev 10 Virtual VITATCE Taxpayer Consent Chinese Simplified Version Irs?

You can easily access the Form 14446 CN S Rev 10 Virtual VITATCE Taxpayer Consent Chinese Simplified Version Irs through our user-friendly platform at airSlate SignNow. Our service enables you to find, fill out, and electronically sign the form with ease, ensuring a smooth experience.

-

What features does airSlate SignNow offer for processing Form 14446 CN S Rev 10?

airSlate SignNow offers several features to streamline the processing of the Form 14446 CN S Rev 10 Virtual VITATCE Taxpayer Consent Chinese Simplified Version Irs, including customizable templates, user-friendly navigation, and secure eSignature capabilities. Our platform ensures that you meet IRS requirements effectively and efficiently.

-

Is there a cost associated with using airSlate SignNow for Form 14446 CN S Rev 10?

Yes, there is a cost associated with using airSlate SignNow for the Form 14446 CN S Rev 10 Virtual VITATCE Taxpayer Consent Chinese Simplified Version Irs. We offer various pricing plans that cater to different needs, providing a cost-effective solution for businesses seeking to manage documents and eSignatures securely.

-

What are the benefits of using airSlate SignNow for the Form 14446 CN S Rev 10?

By using airSlate SignNow for the Form 14446 CN S Rev 10 Virtual VITATCE Taxpayer Consent Chinese Simplified Version Irs, you can enjoy benefits such as increased efficiency, time savings, and enhanced compliance. Our platform simplifies document management and eSigning, allowing for a smoother tax assistance process for Chinese-speaking clients.

-

Can airSlate SignNow integrate with other software for handling Form 14446 CN S Rev 10?

Yes, airSlate SignNow offers integration capabilities with multiple software applications, helping users to manage their documentation for the Form 14446 CN S Rev 10 Virtual VITATCE Taxpayer Consent Chinese Simplified Version Irs seamlessly. Integrations with CRM systems, cloud storage services, and other tools enhance productivity and facilitate a cohesive workflow.

-

How does airSlate SignNow ensure the security of my Form 14446 CN S Rev 10 submissions?

airSlate SignNow prioritizes the security of your documents, including the Form 14446 CN S Rev 10 Virtual VITATCE Taxpayer Consent Chinese Simplified Version Irs, by employing advanced encryption protocols and adhering to industry standards. Our platform provides secure storage, ensuring that your sensitive information remains protected during the eSigning process.

Get more for Form 14446 CN S Rev 10 Virtual VITATCE Taxpayer Consent Chinese Simplified Version Irs

- Planilla de ivu municipal de guaynabo form

- Universal direct deposit form

- Yazoo kees zkh61252 parts form

- Dl 410 fo renewal by mail eligibility form drivers licenses org

- Tamuc 1098 t form

- Past year papers form

- Cr 126 application for extension of time to file briefcriminal case judicial council forms

- Cook employment contract template 787751089 form

Find out other Form 14446 CN S Rev 10 Virtual VITATCE Taxpayer Consent Chinese Simplified Version Irs

- Can I Electronic signature Ohio Consumer Credit Application

- eSignature Georgia Junior Employment Offer Letter Later

- Electronic signature Utah Outsourcing Services Contract Online

- How To Electronic signature Wisconsin Debit Memo

- Electronic signature Delaware Junior Employment Offer Letter Later

- Electronic signature Texas Time Off Policy Later

- Electronic signature Texas Time Off Policy Free

- eSignature Delaware Time Off Policy Online

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy