Dgs Mileage Log Form

What is the Dgs Mileage Log

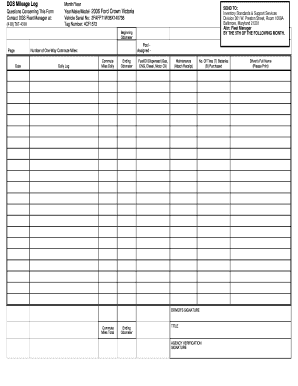

The Dgs Mileage Log is a specialized document used to track and report mileage for business purposes. This form is essential for individuals and businesses that need to document travel expenses for tax deductions or reimbursements. It typically includes details such as the date of travel, the starting and ending locations, the purpose of the trip, and the total miles driven. Accurate record-keeping is crucial for compliance with IRS regulations and for maximizing potential tax benefits.

How to use the Dgs Mileage Log

Using the Dgs Mileage Log involves a straightforward process. Start by recording each trip as it occurs, noting the date, starting point, destination, and purpose. It is beneficial to maintain this log regularly to ensure accuracy. At the end of the reporting period, compile the entries to summarize total mileage for business-related trips. This summary can then be used for tax filings or reimbursement requests. Utilizing digital tools can streamline this process, making it easier to manage and submit your mileage records.

Steps to complete the Dgs Mileage Log

Completing the Dgs Mileage Log involves several key steps:

- Gather necessary information: Collect details about each trip, including dates, locations, and purposes.

- Record mileage: Log the starting and ending odometer readings to calculate total miles driven.

- Document the purpose: Clearly state the reason for each trip to support your claims for deductions or reimbursements.

- Review entries: Ensure all information is accurate and complete before finalizing the log.

- Submit the log: Use the completed mileage log for tax filings or to request reimbursements from your employer.

Legal use of the Dgs Mileage Log

The Dgs Mileage Log serves a legal purpose when it comes to tax deductions and reimbursements. To be considered valid, the log must accurately reflect business-related travel and comply with IRS guidelines. This includes maintaining detailed records and ensuring that the information is truthful and complete. In the event of an audit, having a well-documented mileage log can provide necessary evidence to support your claims and protect against penalties.

IRS Guidelines

The IRS has specific guidelines regarding the use of mileage logs for tax purposes. For example, taxpayers must differentiate between personal and business mileage, as only the latter is eligible for deductions. The IRS also requires that mileage logs be contemporaneous, meaning they should be recorded at the time of travel. Keeping a detailed log can help ensure compliance with these regulations and facilitate accurate reporting on tax returns.

Examples of using the Dgs Mileage Log

There are various scenarios in which the Dgs Mileage Log can be utilized effectively. For instance, a self-employed individual may use the log to track travel between client meetings, while an employee may document trips made for work-related errands. Additionally, businesses can use the log to monitor travel expenses for employees, ensuring that reimbursements align with IRS regulations. These examples highlight the versatility and importance of maintaining an accurate mileage log for both personal and business use.

Quick guide on how to complete dgs mileage log

Easily prepare Dgs Mileage Log on any device

Digital document management has gained signNow traction among companies and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed papers, as you can obtain the necessary form and securely keep it online. airSlate SignNow provides all the tools required to create, modify, and eSign your documents swiftly without delays. Manage Dgs Mileage Log on any device using airSlate SignNow Android or iOS applications and enhance any document-related task today.

How to modify and eSign Dgs Mileage Log effortlessly

- Locate Dgs Mileage Log and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or obscure sensitive data with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes just a few seconds and carries the same legal validity as a conventional ink signature.

- Review all the details and click the Done button to save your modifications.

- Select your preferred delivery method for your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced papers, exhausting form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you choose. Modify and eSign Dgs Mileage Log to ensure outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the dgs mileage log

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a DGS mileage log?

A DGS mileage log is an essential tool for tracking business mileage, ensuring compliance with tax regulations, and simplifying expense reporting. It allows users to accurately record distances traveled for business purposes, making it easier to claim deductions. With airSlate SignNow, users can create and manage their DGS mileage log efficiently.

-

How does airSlate SignNow help with maintaining a DGS mileage log?

airSlate SignNow provides a streamlined platform for creating and managing your DGS mileage log. Users can easily record mileage entries, categorize trips, and generate reports for tax purposes. Our solution simplifies the tracking process, saving users time and reducing errors.

-

Is there a cost associated with using the DGS mileage log feature in airSlate SignNow?

Yes, the DGS mileage log feature is part of the airSlate SignNow pricing plans. We offer flexible pricing options that cater to businesses of all sizes. By choosing airSlate SignNow, you'll have access to a cost-effective solution that encompasses all necessary features for managing your mileage logs.

-

Can I integrate DGS mileage log with other accounting software?

Absolutely! airSlate SignNow allows for seamless integration with popular accounting software and tools. This means your DGS mileage log can be easily synchronized with your existing financial systems, making tracking expenses more efficient and accurate.

-

What are the benefits of using airSlate SignNow for my DGS mileage log?

Using airSlate SignNow for your DGS mileage log streamlines the entire process of mileage tracking and reporting. It helps ensure accuracy, reduces the risk of losing important data, and makes it easy to retrieve information during tax season. Additionally, our user-friendly interface is designed to enhance productivity.

-

Can I access my DGS mileage log from mobile devices?

Yes, airSlate SignNow is fully optimized for mobile use. This allows you to access and update your DGS mileage log on the go, ensuring you never miss an entry. Whether you're out on business or working remotely, your mileage tracking is always at your fingertips.

-

How secure is my DGS mileage log data with airSlate SignNow?

Security is a top priority for airSlate SignNow. Your DGS mileage log data is protected with advanced encryption and complies with industry standards to ensure privacy and confidentiality. You can trust that your business mileage records are safe and secure.

Get more for Dgs Mileage Log

Find out other Dgs Mileage Log

- eSignature Hawaii Real Estate Operating Agreement Online

- eSignature Idaho Real Estate Cease And Desist Letter Online

- eSignature Idaho Real Estate Cease And Desist Letter Simple

- eSignature Wyoming Plumbing Quitclaim Deed Myself

- eSignature Colorado Sports Living Will Mobile

- eSignature Iowa Real Estate Moving Checklist Simple

- eSignature Iowa Real Estate Quitclaim Deed Easy

- eSignature Real Estate Form Louisiana Simple

- eSignature Louisiana Real Estate LLC Operating Agreement Myself

- Can I eSignature Louisiana Real Estate Quitclaim Deed

- eSignature Hawaii Sports Living Will Safe

- eSignature Hawaii Sports LLC Operating Agreement Myself

- eSignature Maryland Real Estate Quitclaim Deed Secure

- eSignature Idaho Sports Rental Application Secure

- Help Me With eSignature Massachusetts Real Estate Quitclaim Deed

- eSignature Police Document Florida Easy

- eSignature Police Document Florida Safe

- How Can I eSignature Delaware Police Living Will

- eSignature Michigan Real Estate LLC Operating Agreement Mobile

- eSignature Georgia Police Last Will And Testament Simple